Smart Asset Allocation Strategies for a Secure Future

Your Modern “Nest Egg” – Where’s the Secret?

The old saying “Little by little, a little becomes a lot” emphasizes the power of consistent saving. Today, however, stashing cash under the mattress is outdated. Instead, a smart asset allocation strategy is the guiding principle for those seeking to preserve and grow their wealth. But what exactly is a “good asset allocation strategy”? And how can you build one that works for you? Let’s explore with XE TẢI HÀ NỘI!

F.E.T.P Asset Allocation: Four Golden Words for Every Household

F.E.T.P – More Than Just an Acronym, It’s Your Guide

F.E.T.P stands for the four key elements of an effective asset allocation policy: Flexible, Efficient, Transparent, and Personalized.

- Flexible: Markets fluctuate constantly, requiring your strategy to adapt to these changes.

- Efficient: Every investment decision should aim to maximize returns and minimize risk.

- Transparent: Understand where your money is going, what it’s invested in, and how it’s performing.

- Personalized: There’s no one-size-fits-all solution. The best asset allocation strategy is tailored to each individual, based on their risk tolerance, financial goals, and life stage.

Flexible asset allocation

Flexible asset allocation

Decoding Asset Allocation – Which Options Are Right for You?

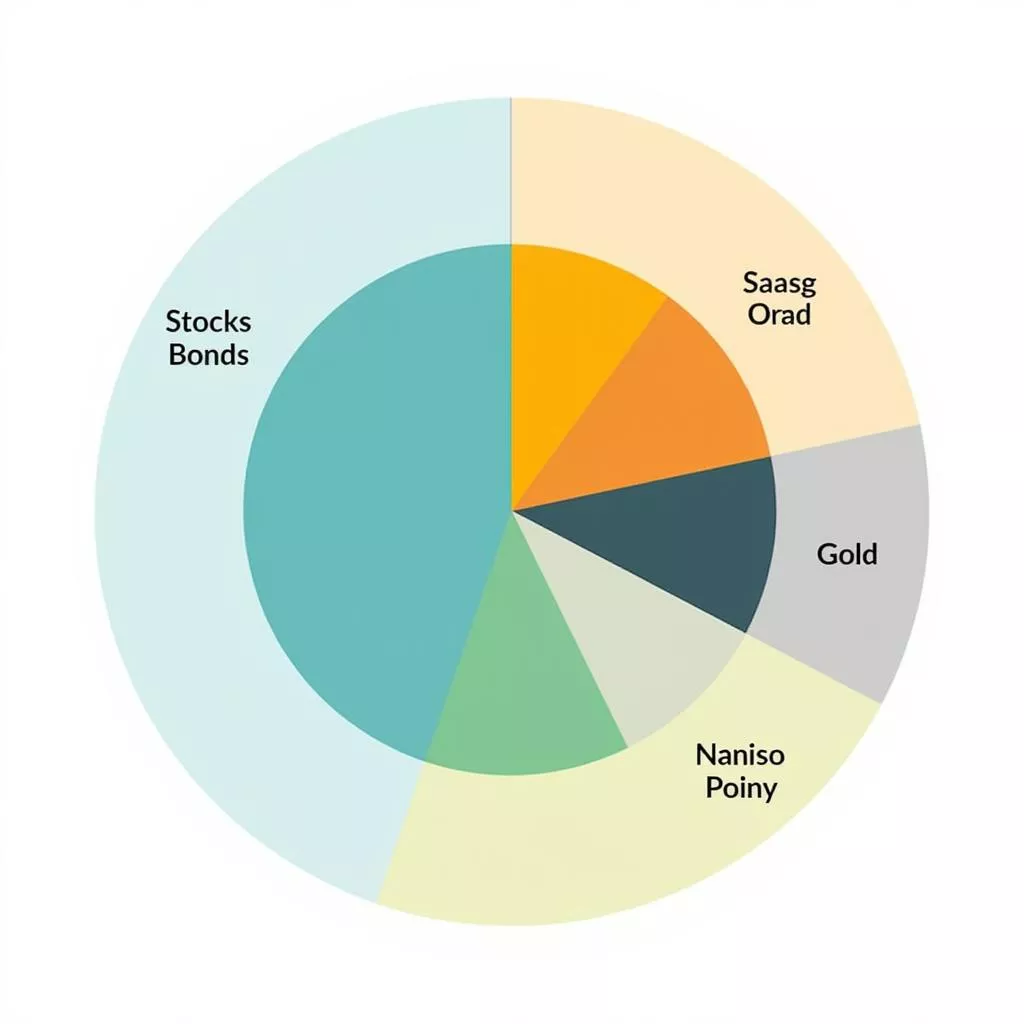

With countless investment channels available, which pieces fit your financial puzzle?

- Savings: The foundation of any financial plan, savings provide a safety net for emergencies.

- Real Estate: A classic investment, real estate often appreciates in value over time.

- Stocks: A potentially high-growth investment, but with higher risk.

- Gold: A traditional safe haven asset that can protect against inflation.

Explore other options like bonds, mutual funds, and foreign currencies.

Building an Effective Asset Allocation Plan: Where to Begin?

1. Define Your Financial Goals: Buying a house, a car, funding your child’s education, or securing retirement income?

2. Assess Your Risk Tolerance: Do you prefer security or are you willing to accept higher risk for potentially higher returns?

3. Research Investment Channels: Understand the pros, cons, potential returns, and risks of each option.

4. Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different channels to mitigate risk.

5. Monitor and Adjust Regularly: Markets change, so regularly review and adjust your portfolio to align with your circumstances and goals.

Diversified investment portfolio

Diversified investment portfolio

Important Considerations for Asset Allocation:

- There’s no universal formula.

- Be flexible and adjust your strategy over time.

- Consult financial professionals for informed decisions.

XE TẢI HÀ NỘI – Your Partner in Building Financial Strength

Building a sound asset allocation strategy is a long-term journey that requires persistence and effort. XE TẢI HÀ NỘI hopes this article has provided valuable insights into the F.E.T.P approach.

Contact us today for personalized advice and support!

Phone: 0968239999

Email: [email protected]

Address: No. TT36 – CN9 Road, Tu Liem Industrial Zone, Phuong Canh Ward, Nam Tu Liem District, Hanoi.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.