Imported Used Car Taxes in Hanoi: A Comprehensive Guide

Importing a used car involves understanding the applicable taxes. This guide provides a detailed overview of imported used car taxes in Hanoi, helping you budget accurately and avoid potential issues.

Types of Taxes on Imported Used Cars

Several taxes apply when importing a used car, primarily including import duty, special consumption tax, and value-added tax (VAT). Each tax is calculated differently and has its own rate. Understanding each is crucial for calculating the total import cost.

Import Duty

Import duty is calculated based on the car’s customs value, which includes the purchase price, shipping, insurance, and other related costs. The import duty rate depends on the car’s origin and engine displacement.

Special Consumption Tax (SCT)

SCT applies to luxury goods, including cars. This tax is calculated based on the car’s engine displacement. Larger engines incur higher SCT.

Value Added Tax (VAT)

VAT is calculated on the car’s total value after adding import duty and SCT. The current VAT rate is 10%.

Types of taxes on imported used cars

Types of taxes on imported used cars

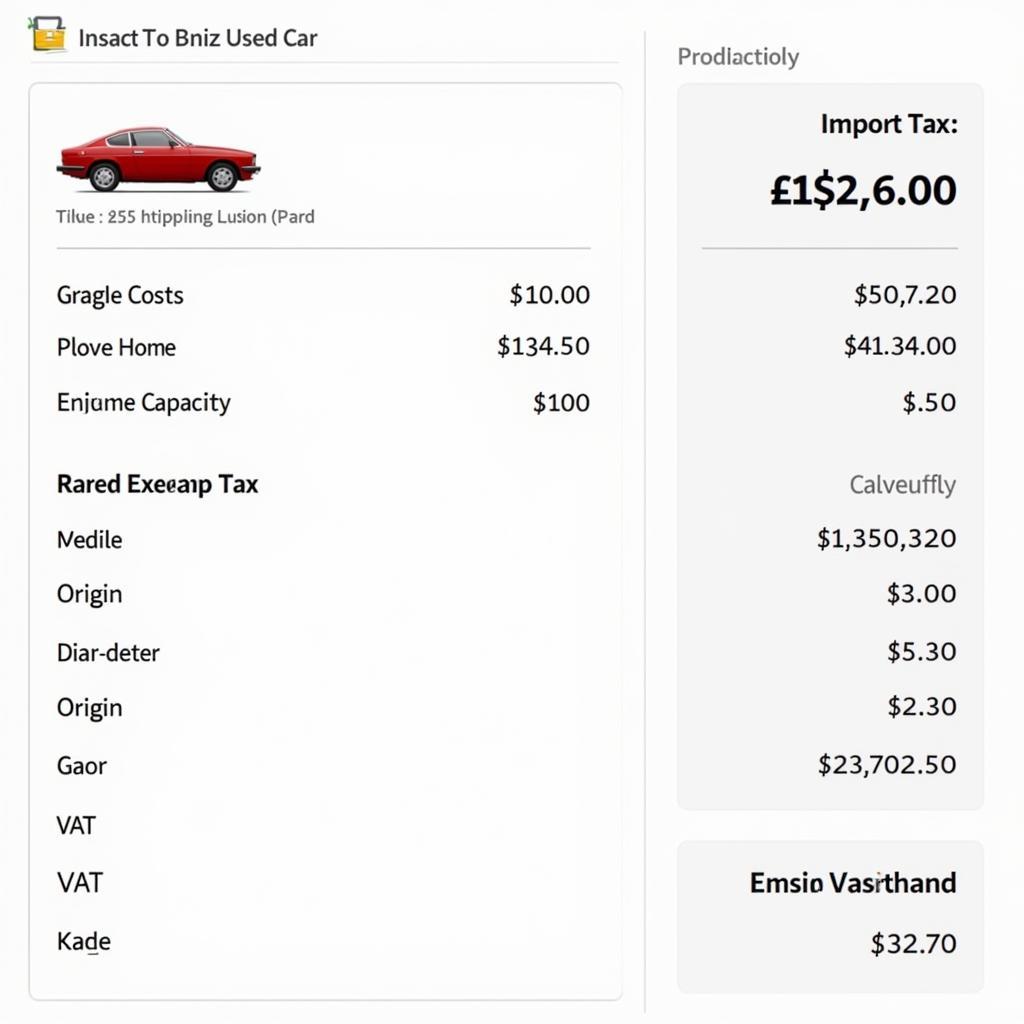

Calculating Taxes on Imported Used Cars

Calculating these taxes can be complex, requiring you to determine the car’s customs value, engine displacement, origin, and other factors. Then, apply the corresponding tax formulas for each tax type. How to calculate taxes on imported used cars provides more details.

Example

Consider importing a used car with a purchase price of $10,000, shipping and insurance costs of $1,000, a 2.0L engine, and originating from Japan. With these parameters, you can calculate the applicable taxes.

Example of calculating taxes on an imported used car

Example of calculating taxes on an imported used car

Important Considerations When Importing a Used Car

When importing a used car, consider several key factors. Thoroughly research the legal regulations regarding used car imports. Choose a reputable importer to avoid risks. Inspect the car’s condition before purchasing. Calculating car import taxes provides further information on the necessary steps. You can also learn more about import taxes on used cars.

Nguyen Van A – Automotive Consultant: “Understanding the regulations regarding imported used car taxes is crucial. This helps you avoid unwanted issues and ensures your rights are protected.”

Conclusion

Imported used car taxes are complex but essential. Understanding these regulations helps you make informed decisions when purchasing a car. This guide aims to provide helpful information on this topic.

Considerations when importing a used car

Considerations when importing a used car

FAQ

- How is import duty calculated for used cars?

- What is the special consumption tax rate for used cars?

- What is the VAT rate for imported used cars?

- What documents are required for importing a used car?

- Are there any tax incentives for importing used cars?

- How do I calculate the total cost of importing a used car?

- Which reputable used car importers should I consider?

Common Questions and Scenarios

Many customers have questions about determining the year of manufacture for applying the correct tax rate. Other common questions relate to proving the car’s origin.

Related Articles and Resources

Learn more about car AC condensers or cars for sale in Ha Tinh on our website.

Contact Us for Assistance

Phone: 0968239999, Email: [email protected] or visit us at: TT36 – CN9 Road, Tu Liem Industrial Park, Phuong Canh Ward, Nam Tu Liem District, Hanoi. We have a 24/7 customer support team.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.