Global Exchange Rate Policy in 2008 and Its Impact

The global exchange rate policy in 2008 was significantly influenced by the global financial crisis, creating major fluctuations in the currency market and profoundly impacting the world economy. This crisis exposed weaknesses in the global financial system and forced countries to adjust their exchange rate policies to respond to the volatile situation.

The 2008 Financial Crisis and Exchange Rate Policy Shifts

The collapse of Lehman Brothers in September 2008 triggered a widespread global financial crisis. Central banks around the world faced the difficult task of stabilizing financial markets and stimulating economic growth. Exchange rate policy became a crucial tool for achieving this goal. Many countries adopted quantitative easing policies, injecting money into the economy and lowering interest rates to alleviate pressure on the financial system.

Impact of the 2008 financial crisis on global exchange rate policies

Impact of the 2008 financial crisis on global exchange rate policies

Some countries chose to directly intervene in the foreign exchange market to stabilize exchange rates. For example, China maintained the Renminbi’s peg to the US dollar to support exports. However, this policy also sparked controversy over currency manipulation.

Impact of the 2008 Global Exchange Rate Policy

The 2008 global exchange rate policy had a significant impact on international trade, investment flows, and global economic growth. The adoption of different exchange rate policies by various countries created currency competition, affecting trade balances. Investment flows were also affected by exchange rate fluctuations, forcing investors to carefully consider their decisions.

Impact of the 2008 exchange rate policy on the global economy

Impact of the 2008 exchange rate policy on the global economy

How Does Exchange Rate Policy Affect International Trade?

Fluctuations in exchange rates can alter the prices of imported and exported goods, impacting the competitiveness of businesses.

Is Austerity the Solution?

Austerity measures in English were adopted by many countries after the crisis, but their effectiveness remains debatable.

What Role Do Macroeconomic Formulas and Fiscal Policy Play?

Macroeconomic formulas and fiscal policy help policymakers better understand the relationship between macroeconomic variables and make informed decisions.

Conclusion

The global exchange rate policy in 2008 was a crucial part of the effort to respond to the global financial crisis. While these policies helped stabilize financial markets in the short term, they also created long-term consequences for the world economy. Finding an optimal exchange rate policy remains a major challenge for countries in an increasingly complex global economic landscape.

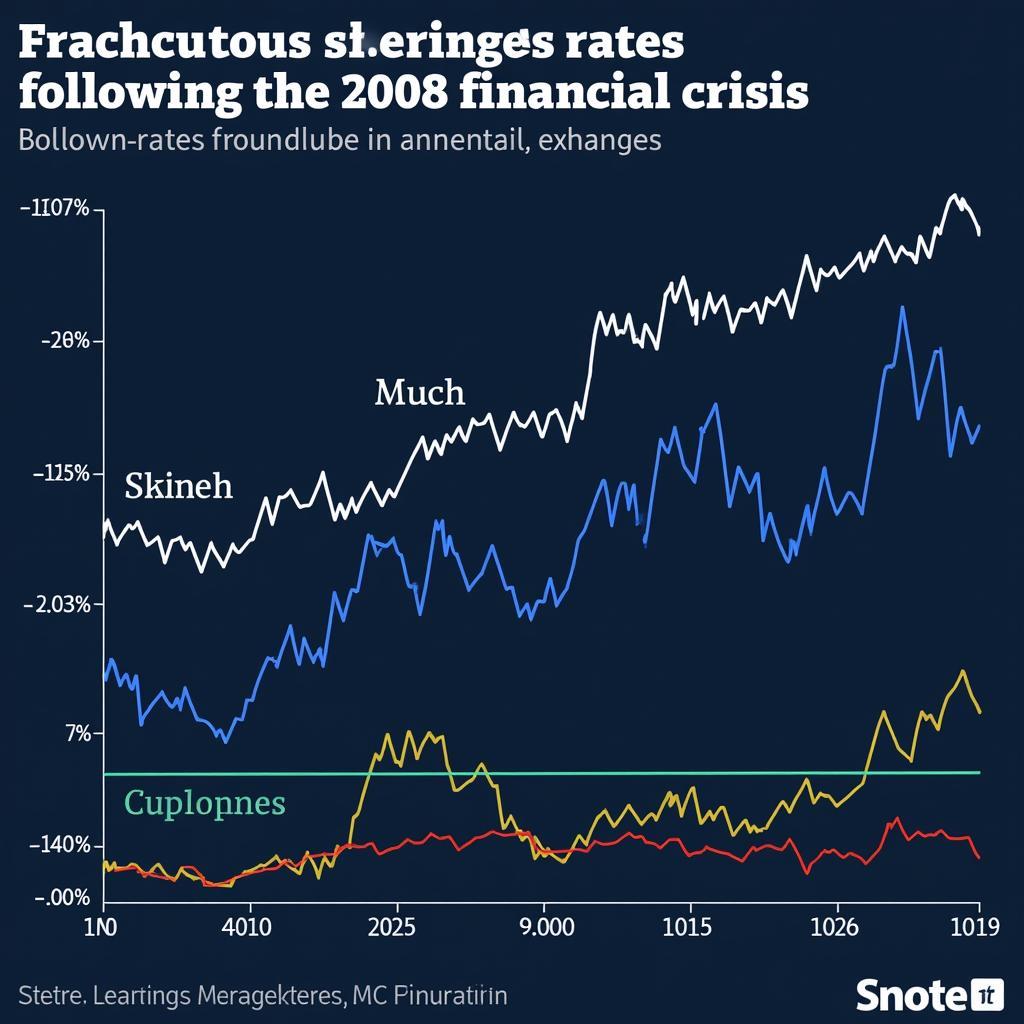

Exchange rate fluctuations after the 2008 financial crisis

Exchange rate fluctuations after the 2008 financial crisis

FAQ

- What was the main cause of the 2008 financial crisis?

- What is quantitative easing?

- How does exchange rate policy affect inflation?

- Why did China maintain the Renminbi’s peg to the US dollar?

- What lessons were learned from the 2008 financial crisis?

- How do exchange rates affect tourism?

- How can exchange rate policy affect foreign investment?

For assistance, please contact us by phone: 0968239999, Email: [email protected] or visit our address: No. TT36 – CN9 Road, Tu Liem Industrial Park, Phuong Canh Ward, Nam Tu Liem District, Hanoi. We have a 24/7 customer service team.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.