Affordable Motorcycle Insurance in Hanoi: Finding the Right Fit

Looking for affordable motorcycle insurance in Hanoi without compromising on coverage? This guide will help you understand different insurance types, tips for choosing the right plan, and reputable providers in the city.

Common Types of Motorcycle Insurance

Currently, there are two main types of motorcycle insurance in Vietnam: mandatory and voluntary.

- Compulsory Third Party Liability (TPL) Insurance: Required for all motorcycles on the road. This insurance covers bodily injury and property damage to third parties caused by the insured motorcycle.

- Voluntary Physical Damage Insurance: Covers damage to the insured motorcycle itself in cases of accidents, collisions, fire, natural disasters, and theft.

Tips for Choosing Affordable Motorcycle Insurance in Hanoi

To find affordable motorcycle insurance in Hanoi that meets your needs, consider these tips:

- Compare prices from reputable insurers: Different companies offer varying premiums and benefits. Thorough comparison helps you find the best fit for your budget.

- Consider buying insurance online: Online purchases often come with lower premiums due to reduced operational costs.

- Take advantage of promotions: Insurance companies frequently offer discounts and promotions for new or loyal customers.

- Choose a plan that fits your needs: Avoid purchasing overly comprehensive plans with unnecessary benefits that lead to higher premiums.

- Pay attention to exclusion clauses: Understand the circumstances under which the insurance will not provide coverage to avoid disputes later.

Reputable Motorcycle Insurance Providers in Hanoi

Here are some reputable motorcycle insurance providers in Hanoi:

- Bao Viet Insurance: One of the oldest and most trusted insurance companies in Vietnam.

- PTI Insurance: Offers a variety of motorcycle insurance plans with competitive premiums.

- Liberty Insurance: Known for its dedicated and professional customer service.

Cheap Motorcycle Insurance – Is It Worth It?

Many people focus solely on finding the cheapest insurance without considering other crucial factors:

- Reputation of the insurer: Choosing a reputable company ensures your rights are protected in case of an incident.

- Coverage scope: Does the insurance plan adequately meet your protection needs?

- Service quality: Are customer support and claims processing efficient and professional?

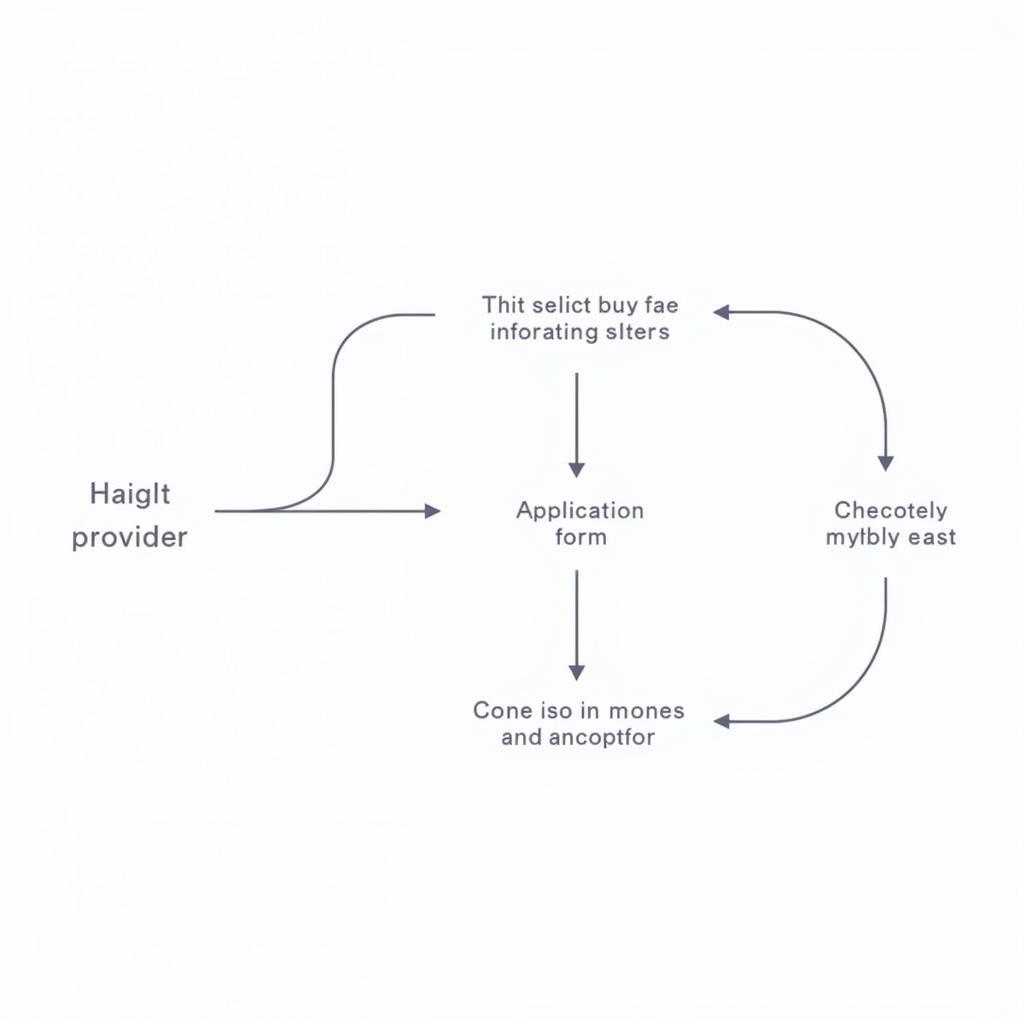

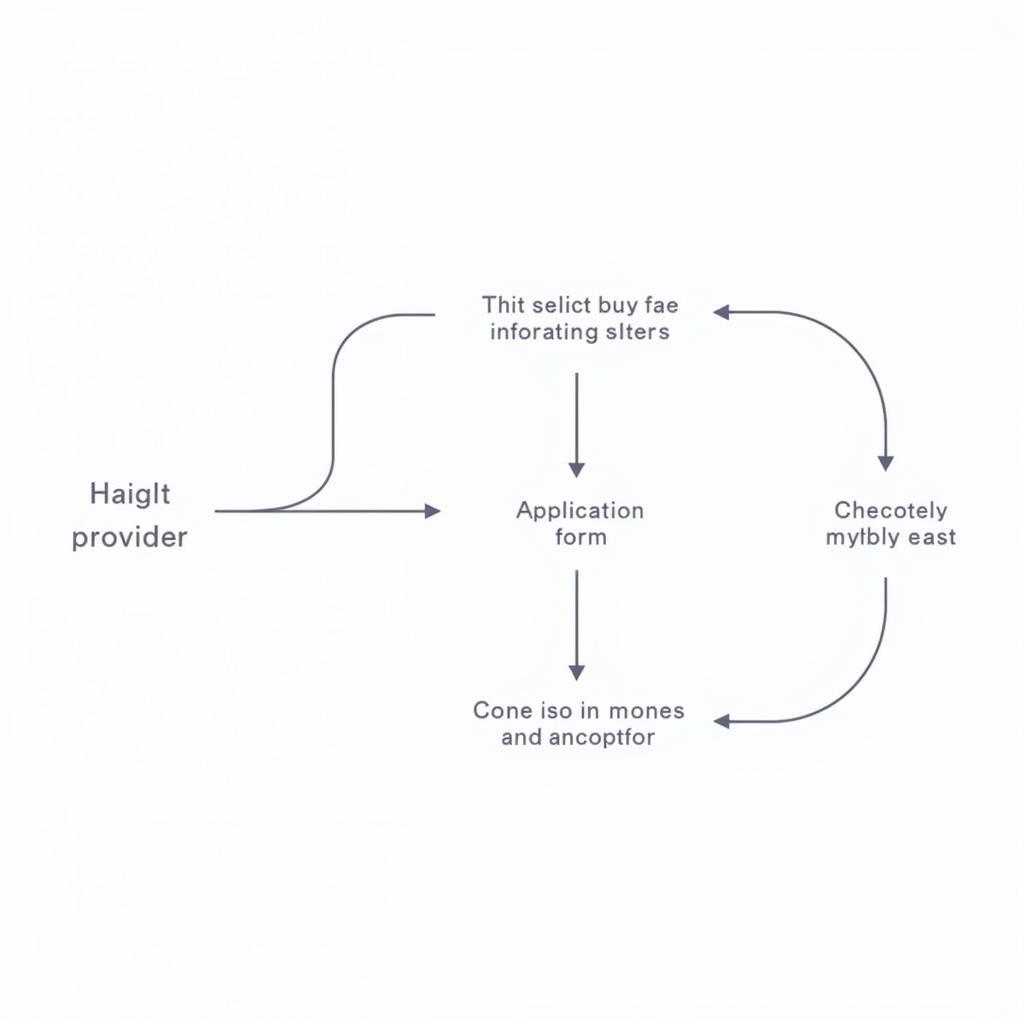

Online Motorcycle Insurance Purchase Process

Online Motorcycle Insurance Purchase Process

According to Nguyen Van A, a motorcycle insurance expert: “Choosing motorcycle insurance shouldn’t solely focus on price. Prioritize factors like reputation, coverage, and service quality to ensure your rights are protected.”

Conclusion

Finding affordable motorcycle insurance in Hanoi is essential. However, carefully consider factors like company reputation, coverage scope, and service quality to choose the best plan for your needs.

Frequently Asked Questions

-

Is motorcycle insurance mandatory in Vietnam?

- TPL insurance is mandatory; physical damage insurance is voluntary.

-

How do I buy motorcycle insurance online?

- Visit the insurer’s website, select a plan, fill in your information, make an online payment, and receive your electronic certificate.

-

When should I notify the insurance company?

- Immediately after an incident (within 24-48 hours).

-

How long is motorcycle insurance valid?

- Typically one year.

-

Can I change or cancel my motorcycle insurance after purchase?

- It’s possible, depending on the terms and conditions of each insurance company.

Want to learn more about the Mercedes E180? Visit our Mercedes E180 review for detailed information.

We also provide information on other vehicles, such as:

Need Assistance?

Contact us now:

- Phone: 0968239999

- Email: [email protected]

- Address: No. TT36 – CN9 Road, Tu Liem Industrial Zone, Phuong Canh Ward, Nam Tu Liem District, Hanoi.

XE TẢI HÀ NỘI – Our 24/7 customer support team is always ready to assist you!

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.