State Bank’s Credit Policies and Their Impact on the Truck Industry in Hanoi

The State Bank of Vietnam’s credit policies play a crucial role in regulating the economy, directly impacting various sectors, including transportation, particularly the truck market. Access to loans for truck purchases is significantly affected by decisions regarding interest rates, credit limits, and other lending conditions.

Impact of Credit Policies on the Truck Market

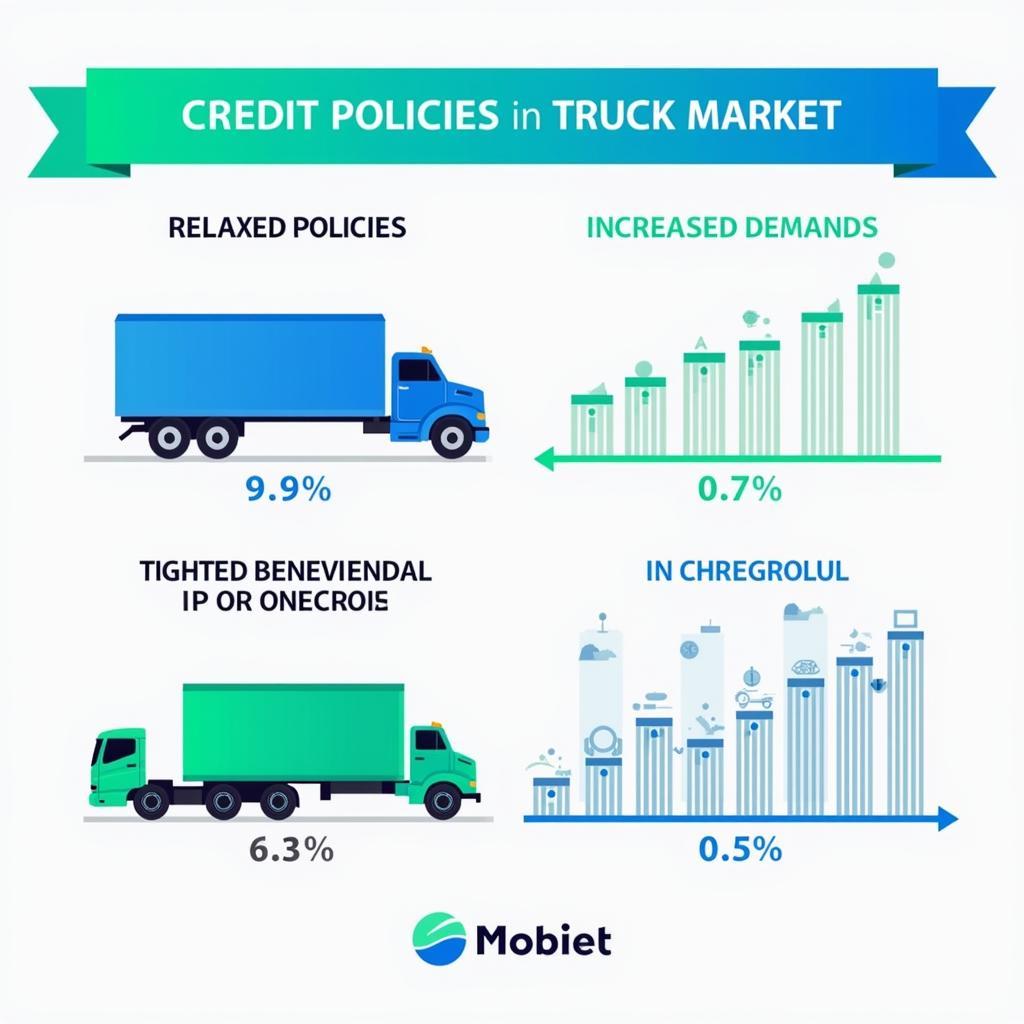

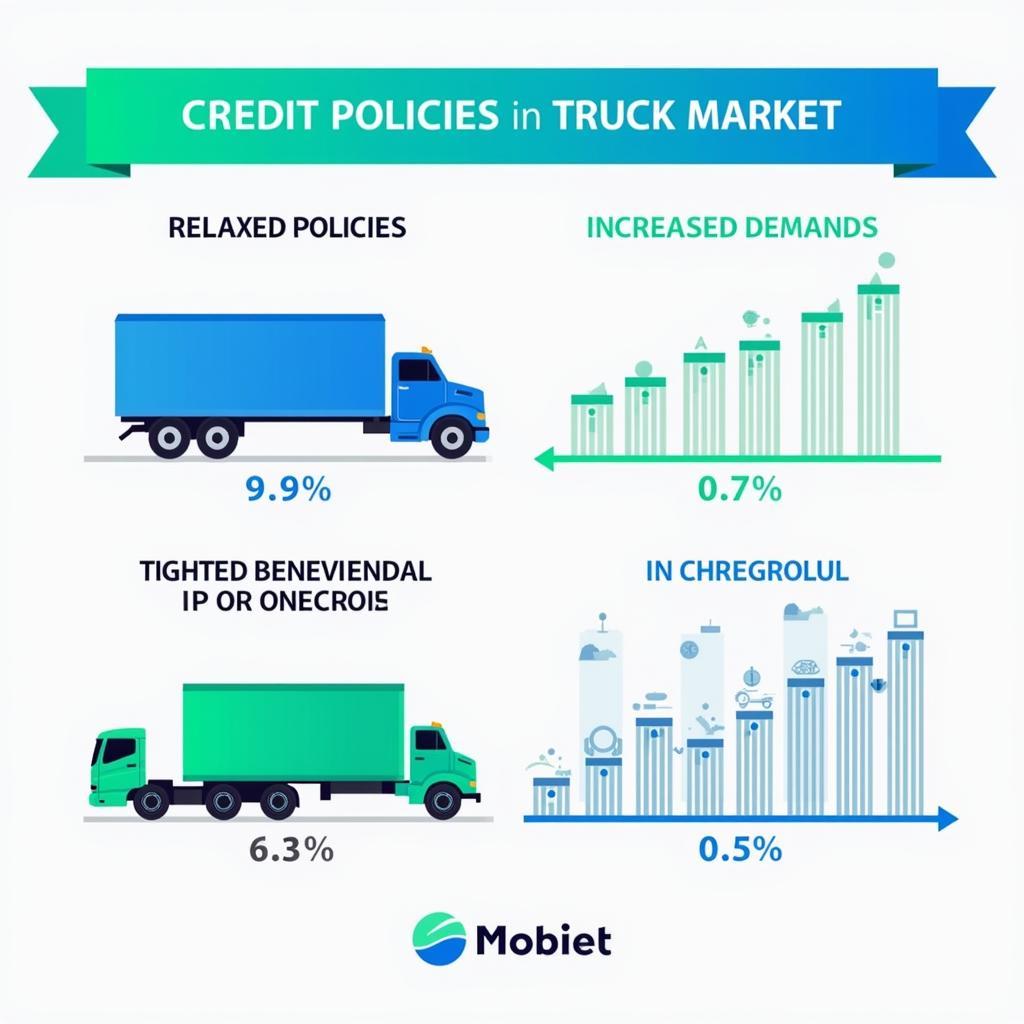

Credit policies influence the truck market in several ways. When the State Bank loosens credit policies, lending interest rates decrease, encouraging businesses and individuals to invest in trucks, thus boosting demand. Conversely, when credit policies tighten, interest rates rise, making borrowing more challenging, leading to a decline in truck demand and impacting truck dealers’ sales. Credit policies also affect the accessibility of capital for transportation companies, influencing their business operations and expansion investments.

Impact of credit policies on the truck market

Impact of credit policies on the truck market

Truck Loan Interest Rates and Lending Conditions

Truck loan interest rates are a crucial factor for buyers to consider. High-interest rates increase investment costs, while low-interest rates alleviate the financial burden. Besides interest rates, lending conditions such as loan terms, loan-to-value ratios, and application procedures also influence purchasing decisions. Understanding current credit policies and comparing loan packages from different banks helps customers choose the most suitable option.

State Bank Support Policies for the Transportation Industry

In addition to general credit policies, the State Bank may implement specific support policies for the transportation sector, such as preferential credit packages, reduced interest rates for truck loans, and capital support for transportation companies to upgrade vehicles and enhance service quality. These policies aim to promote the development of the transportation industry, contributing to economic growth. The Decree 134/135 program may provide further information on these support policies. Other policies like economic buffers can also indirectly impact access to loans.

Importance of Understanding Credit Policies

Staying informed about the State Bank’s credit policies is crucial for businesses and individuals operating in the transportation industry. This knowledge enables them to make informed truck investment decisions, optimize costs, and enhance competitiveness. You can also refer to Nuoc Long Hau Policy for a better understanding of other support policies.

Conclusion

The State Bank’s credit policies significantly impact the truck market. Understanding and closely monitoring these policies enables businesses and individuals in the transportation industry to make effective business decisions. Credit policies can affect the purchase of 1-ton, 2-ton, 3.5-ton, and 8-ton trucks. Learn more about the Anti-Corruption and Bribery Policy to ensure transparent business operations. The Le So Economic Policy offers a historical perspective on economic policies.

FAQ

- What are credit policies?

- How do interest rates affect truck purchases?

- How can I access preferential loan packages?

- What are the conditions for truck loans?

- How does the State Bank support the transportation industry?

- What do I need to prepare to apply for a truck loan?

- How do credit policies change over time?

Common Customer Questions

Customers often inquire about truck loan interest rates, application procedures, processing times, and promotional programs.

Suggested Related Content

You can learn more about box trucks, light trucks, and vans on our website.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.