Vietnam Car Import Taxes: A Buyer’s Guide

“Love the truck, love the road,” a common saying among Hanoi truck drivers, seems to never get old. But besides their passion for their “second wives,” these men also grapple with a “headache-inducing” problem: car import taxes.

Decoding the Import Tax Puzzle

When it comes to car import taxes, many people compare it to a “maze” with a multitude of overlapping taxes and fees. For example, a friend of mine, who drives a 2-ton truck, said he wanted to “upgrade” to an 8-ton truck to be more “impressive,” but a glance at the price list left him stunned because of the taxes.

So, what types of taxes are included in car import taxes?

- Import Duty: This is a tax levied on imported goods, calculated based on the vehicle’s value and the tax rate. Currently, the import duty on completely built-up cars from ASEAN to Vietnam is 0%, creating favorable conditions for consumers to access affordable car models.

- Special Consumption Tax: Applied to passenger cars (including pickup trucks) with rates ranging from 35% to 70% depending on engine displacement.

- Value Added Tax (VAT): Applied to most goods and services, including cars. The current VAT rate is 10%.

- Registration Fee: This is a mandatory fee payable when registering a new car, with rates ranging from 2% to 12% depending on the locality.

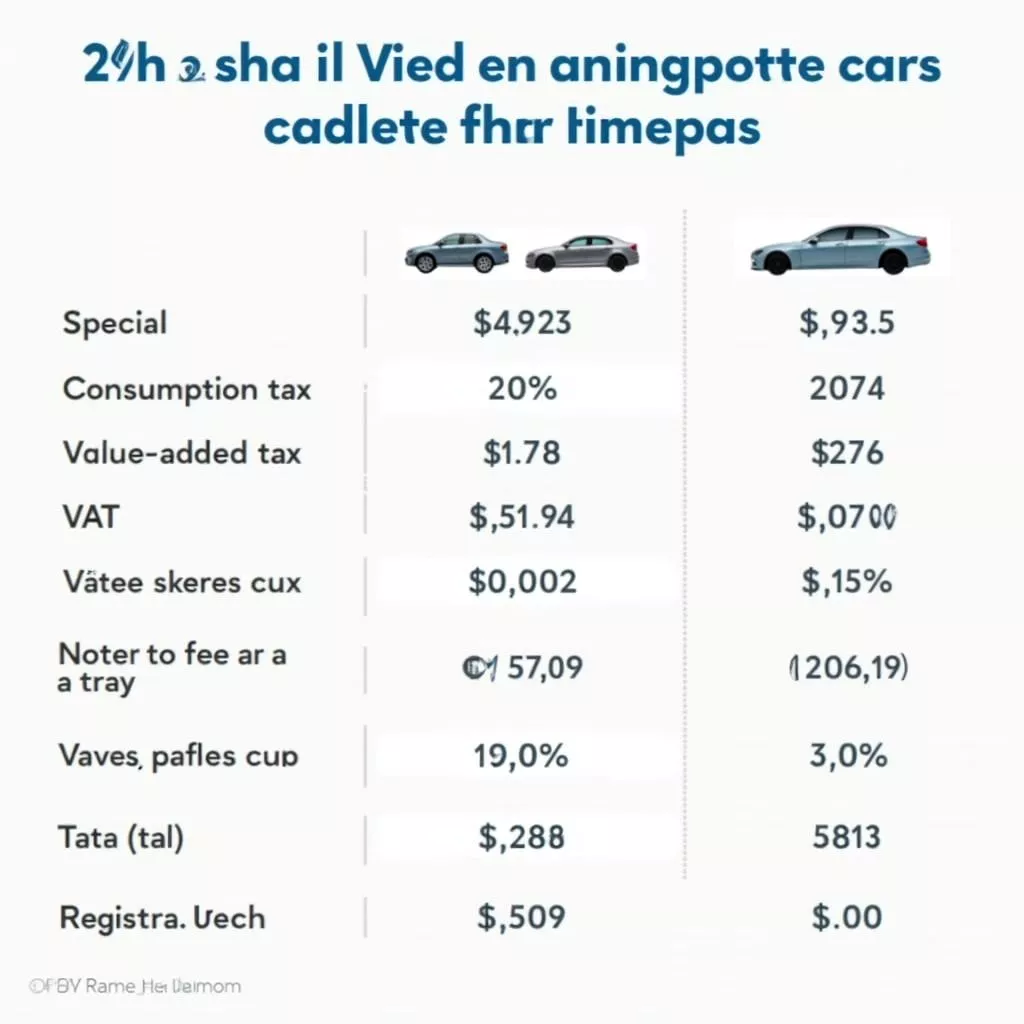

Vietnam Car Import Tax Rates

Vietnam Car Import Tax Rates

Realizing Your Dream Car Ownership

Many people wonder, how can they own their desired car without being “disillusioned” by taxes?

Opt for domestically assembled cars:

This is the optimal solution to “avoid” import duties and special consumption taxes. Domestic car manufacturers are increasingly launching diverse models with improved quality, meeting the diverse needs of users.

Thoroughly research preferential policies:

The government frequently implements preferential policies on taxes and fees for cars to stimulate the market. For instance, a 50% reduction in registration fees for domestically assembled cars.

Car Tax Incentive Policies

Car Tax Incentive Policies

Explore suitable truck models:

- Cargo Trucks: A popular and versatile choice, suitable for various transportation needs. You can find more information about compulsory car insurance benefits here.

- Light Trucks: Suitable for navigating urban areas and narrow alleys.

- Vans: Integrated with spacious and enclosed cargo compartments.

- 1-ton, 2-ton, 3.5-ton, 8-ton Trucks: Cater to the transportation of heavy and bulky goods.

Hanoi Trucks – Your Partner on Every Road

Car import taxes, although a “complex” issue, are not without solutions. Be an informed consumer, thoroughly research information to make the most suitable choice for your needs and financial capabilities.

Don’t forget to visit the “XE TẢI HÀ NỘI” website for the latest updates on the truck market, where to buy compulsory car insurance, compulsory car insurance fees and receive dedicated advice from our team of experienced specialists.

Contact us now:

Phone: 0968239999

Email: [email protected]

Or visit us at: No. TT36 – CN9 Road, Tu Liem Industrial Park, Phuong Canh Ward, Nam Tu Liem District, Hanoi.

We are always ready to accompany you on every road!

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.