Fed’s Monetary Policy Summary – Q2 2017

The Fed’s monetary policy in Q2 2017 focused on gradual normalization following the financial crisis. This summary highlights continued interest rate hikes and the initiation of balance sheet reduction discussions.

Interest Rate Hikes and Balance Sheet Reduction

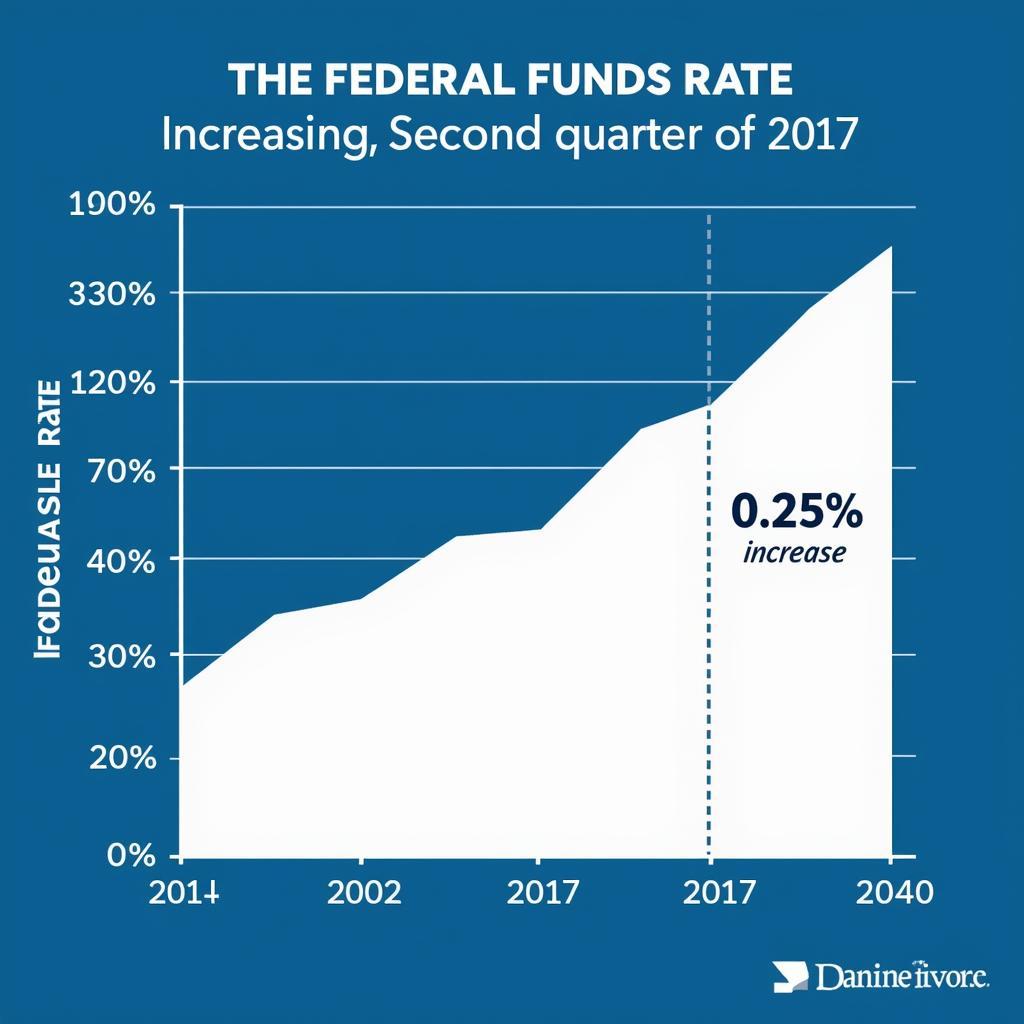

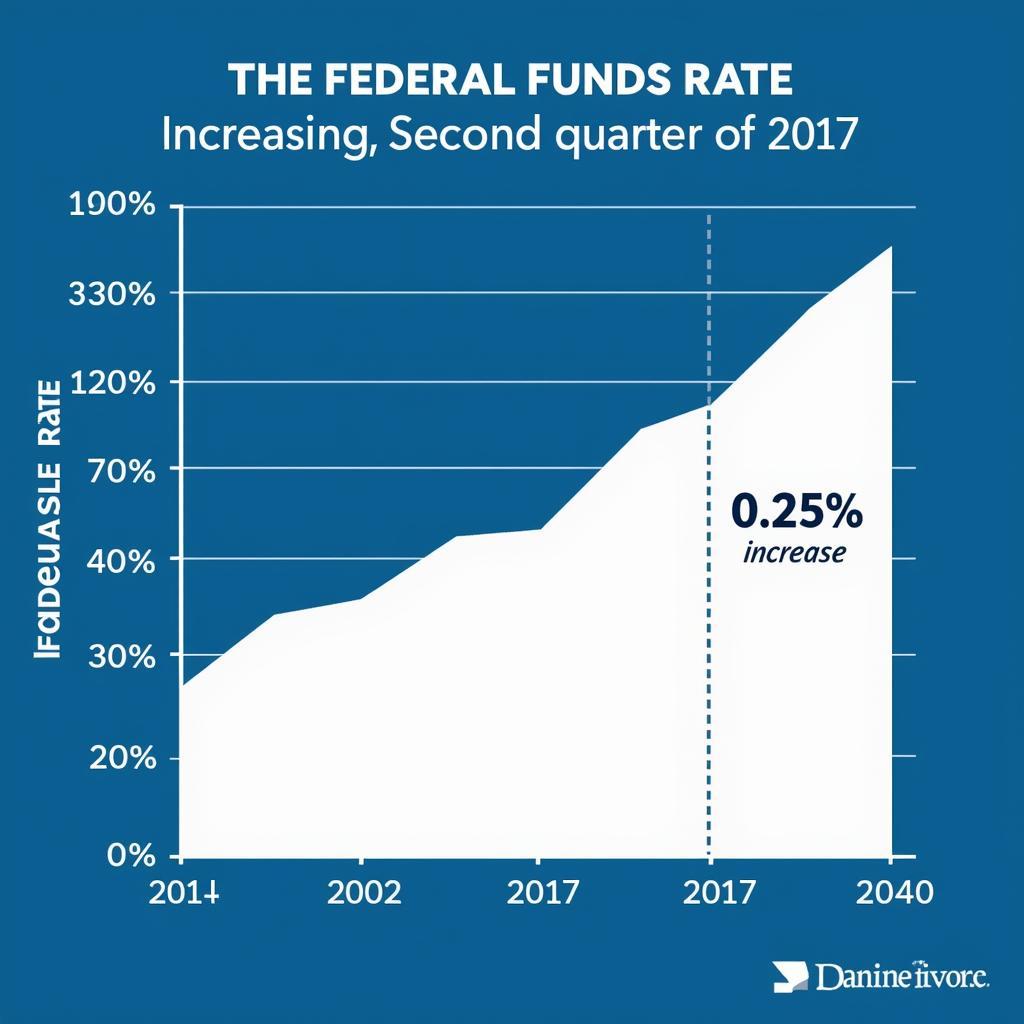

The Fed raised the federal funds rate by 0.25% in June 2017, the second increase of the year, reflecting confidence in the recovering economy. The Q2 2017 summary also revealed plans to begin reducing the size of its balance sheet, significantly expanded during the crisis through bond purchases. This plan aimed to decrease bond holdings without disrupting the market.

Federal Reserve Interest Rate Hike Q2 2017

Federal Reserve Interest Rate Hike Q2 2017

Inflation and Economic Growth

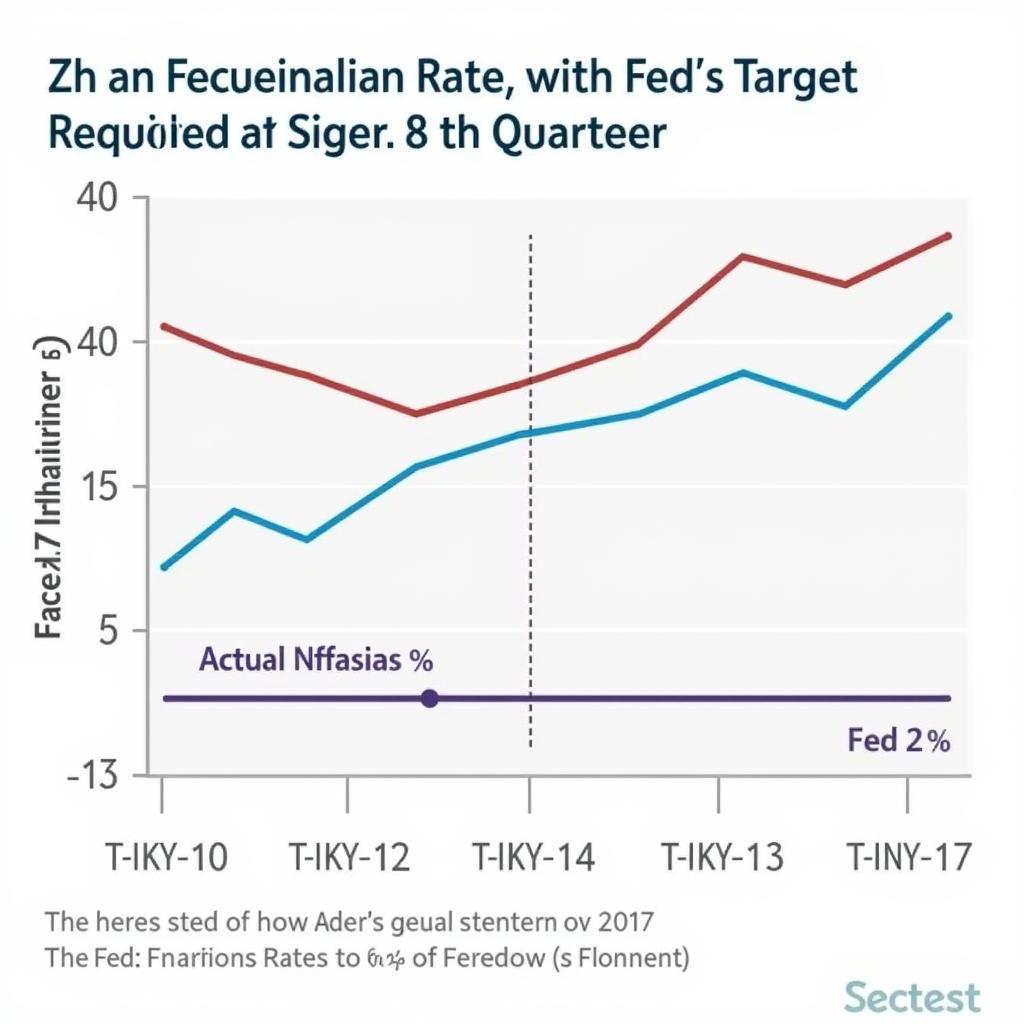

Despite steady economic growth, inflation remained below the Fed’s 2% target. The Q2 2017 summary indicated the Fed’s careful consideration of inflation, acknowledging that low inflation might be due to transitory factors. The Fed anticipated a gradual rise in inflation toward the target over the medium term.

Inflation Below Fed Target

Inflation Below Fed Target

Future Economic Outlook

The Fed maintained a positive outlook for economic growth in the medium term, expecting continued improvement in the labor market. The Q2 2017 summary indicated the Fed’s willingness to adjust monetary policy based on economic developments.

Positive Economic Outlook

Positive Economic Outlook

Conclusion

The Fed’s Q2 2017 monetary policy summary revealed a cautious yet optimistic approach to policy normalization. The interest rate hike and plans for balance sheet reduction reflected confidence in the US economy. However, the Fed remained vigilant about inflation and prepared to adjust policy as needed.

FAQ

- How many times did the Fed raise interest rates in Q2 2017? Once, in June.

- What is the Fed’s inflation target? 2%.

- What is the Fed’s balance sheet? The total value of assets held by the Fed.

- Why is the Fed reducing its balance sheet? To normalize monetary policy after the crisis.

- Did inflation in Q2 2017 meet the Fed’s target? No.

- What was the Fed’s economic outlook in Q2 2017? Positive.

- Does the Fed plan to continue raising interest rates? Potentially, depending on economic developments.

Common Questions and Scenarios

Customers often inquire about the impact of Fed policy on loan interest rates, investments, and the stock market.

Suggested Further Reading

See more articles on monetary policy, interest rates, and macroeconomics on the XE TẢI HÀ NỘI website.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.