Car Loan Calculator: Your Guide to Affordable Car Ownership

“Getting married, building a house, and buying a water buffalo” – three major milestones in life, as the old Vietnamese saying goes. Today, perhaps “buying a car” replaces the buffalo, a dream for many, especially young families. Understanding this, car loan calculators have emerged as a smart financial solution, making car ownership more accessible than ever. What is a car loan calculator? What are its pros and cons? Let’s explore with “XE TẢI HÀ NỘI”!

What is a Car Loan Calculator? Benefits of Auto Financing

Car Loan Calculator – Opening Doors for Everyone

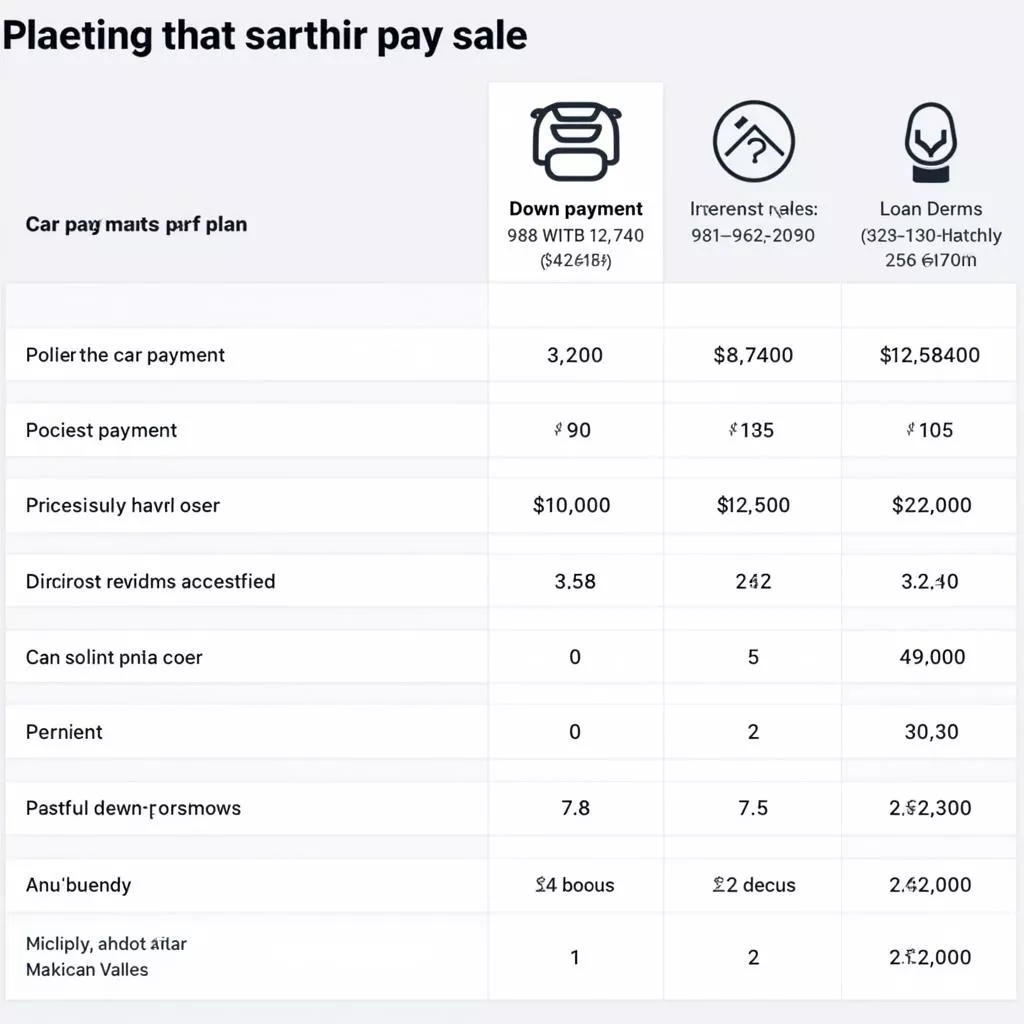

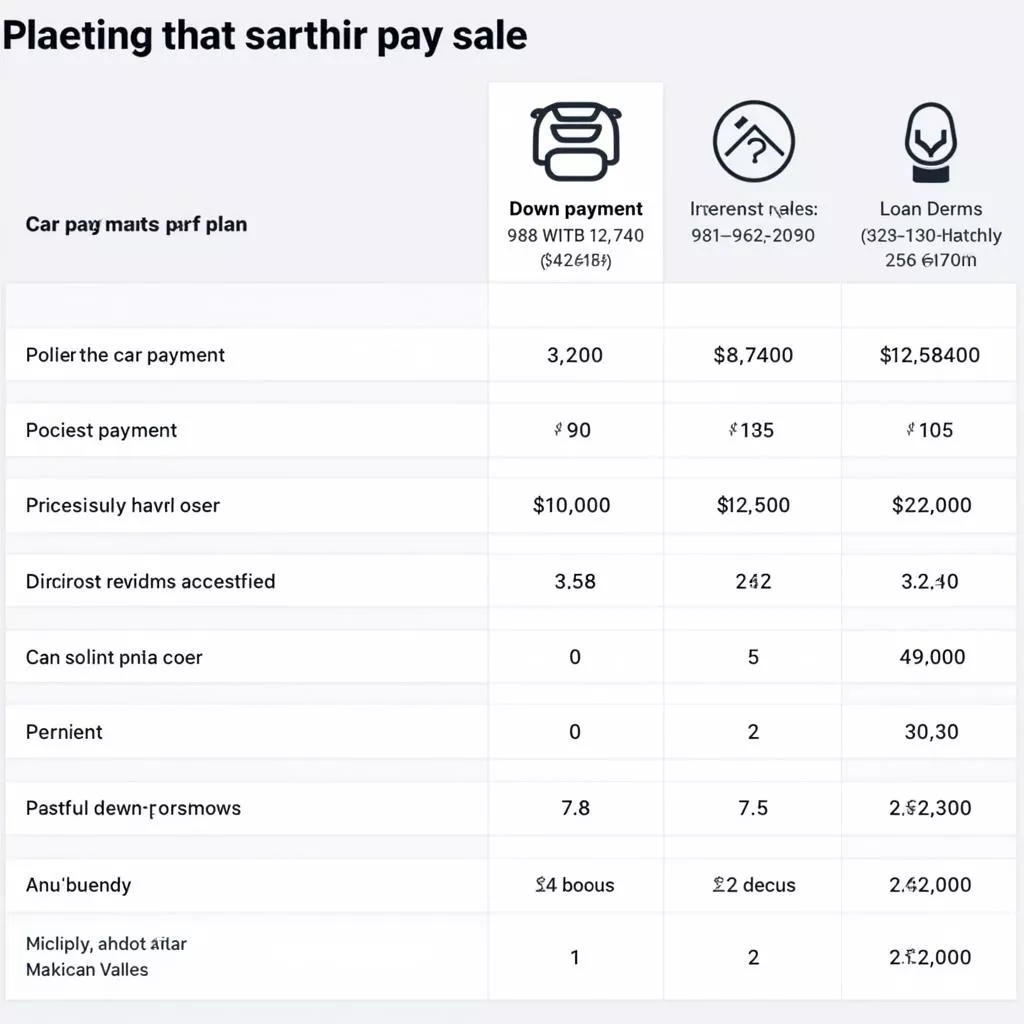

A car loan calculator provides detailed information about the costs involved in purchasing a car through financing. This calculator typically includes:

- Car Price: The listed price of the vehicle.

- Down Payment: Depending on your financial capacity and bank regulations, you can choose a suitable down payment percentage, usually ranging from 20% to 30% of the car’s value.

- Interest Rate: Each bank and loan program offers different interest rates.

- Loan Term: You can choose a loan term that aligns with your financial capabilities.

- Monthly Payment: Calculated based on the loan amount, interest rate, and loan term.

Advantages of Car Financing

Financing a car offers several practical benefits:

- Own a Car Even Without Full Funds: You only need a down payment; the bank will finance the remaining amount.

- Reduced Financial Pressure: Instead of paying a large sum upfront, you can spread the cost over several installments, matching your monthly income.

- Flexible Cash Flow Management: Installment payments allow for better financial planning, enabling investments or covering other needs.

- Improved Quality of Life: Owning a car provides convenient, safe, and comfortable transportation.

Car loan payment schedule

Car loan payment schedule

Key Considerations When Using a Car Loan Calculator

“Better safe than sorry.” When using a car loan calculator, keep the following in mind:

- Choose a Reputable Provider: Prioritize reputable dealerships, showrooms, and banks with a proven track record.

- Thoroughly Review Information: Carefully read the terms and conditions of the loan agreement, especially regarding interest rates and early repayment penalties.

- Compare Loan Offers: Different banks and dealerships offer various promotions. Compare to find the best option.

- Assess Your Financial Capacity: Determine your financial ability to choose a suitable down payment, loan term, and monthly payment, avoiding financial strain.

Responsible Car Ownership After Financing

Just like the saying “A lasting possession depends on the owner,” responsible car ownership after financing is crucial. To ensure your “beloved vehicle” remains a reliable companion:

- Regular Maintenance: Routine maintenance ensures smooth operation, durability, and extends the car’s lifespan.

- Safe Driving: Follow traffic laws and drive cautiously for your safety and the safety of others.

- Efficient Car Use: Avoid overloading and driving on rough roads to protect the engine and other components.

Regular car maintenance

Regular car maintenance

“XE TẢI HÀ NỘI” – Your Partner on Every Road

We hope this information from “XE TẢI HÀ NỘI” provides a better understanding of car loan calculators. If you are interested in truck models, light trucks, vans, 1-ton, 2-ton, 3.5-ton, 8-ton trucks, or need advice on Mitsubishi financing options, please contact us at 0968239999, email: [email protected], or visit us at TT36 – CN9 Road, Tu Liem Industrial Zone, Phuong Canh Ward, Nam Tu Liem District, Hanoi.

“XE TẢI HÀ NỘI” – Prestige Builds Brand, Quality Creates Success!

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.