Hanoi Truck Loan Policies: Your Guide to Financing

Investing in a truck is a significant decision, especially for transportation businesses and entrepreneurs. Truck loan policies offered by banks provide an effective financial solution to alleviate the initial financial burden. Understanding these policies will help you choose the right loan package and maximize your benefits.

Benefits of Truck Loans

Financing a truck purchase through a bank offers numerous advantages, making it easier to acquire the vehicle you need for your business. Some key benefits include:

- Reduced Financial Pressure: You don’t need a large upfront investment, only a down payment.

- Flexible Options: Banks offer a variety of loan packages with different interest rates and repayment terms to suit your financial capabilities.

- Simplified Procedures: Compared to self-financing, bank loans have a clear, transparent process and simpler procedures.

- Attractive Promotions: Many banks frequently offer promotional interest rates and fee reductions for truck loans.

Truck Loan Requirements

Each bank has specific loan requirements, but generally, you’ll need to meet the following criteria:

- Vietnamese Citizenship: Possess full legal capacity and have no outstanding debts with credit institutions.

- Stable Income Source: Demonstrate sufficient monthly repayment capability through salary, business income, or rental income.

- Collateral: Typically, the truck itself or other assets of comparable value serve as collateral.

- Complete and Valid Documentation: This includes personal identification, proof of income, and truck-related documents.

Similar to [Xi’s installment policy], banks require comprehensive credit history information to assess repayment ability.

Truck Loan Application Process

The truck loan application process typically involves the following steps:

- Submit Loan Application: Prepare and submit all required documents to the bank.

- Application Review: The bank will review your application, financial status, and intended use of the truck.

- Loan Agreement Signing: Upon approval, you will sign a loan agreement with the bank.

- Loan Disbursement: The bank will disburse the loan to you or the dealership.

- Vehicle Receipt and Monthly Repayments: You receive the truck and make monthly principal and interest payments as agreed.

Choosing the Right Bank

Selecting the right bank is crucial to secure the best loan package. Compare interest rates, loan terms, service fees, and promotions from different banks before making a decision. Consider factors like reputation, customer service, and branch network. This is similar to [VPBank’s credit card policy] where comparing offers and terms between banks is essential.

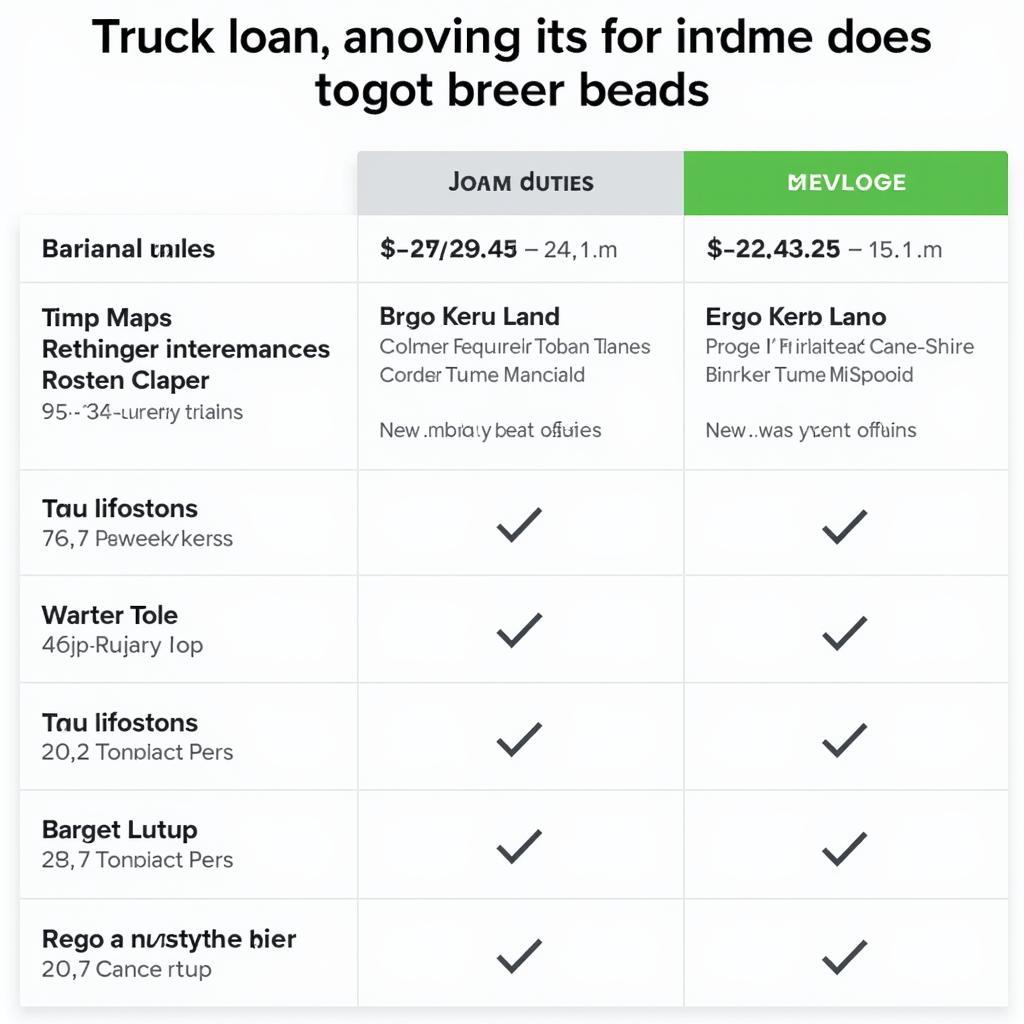

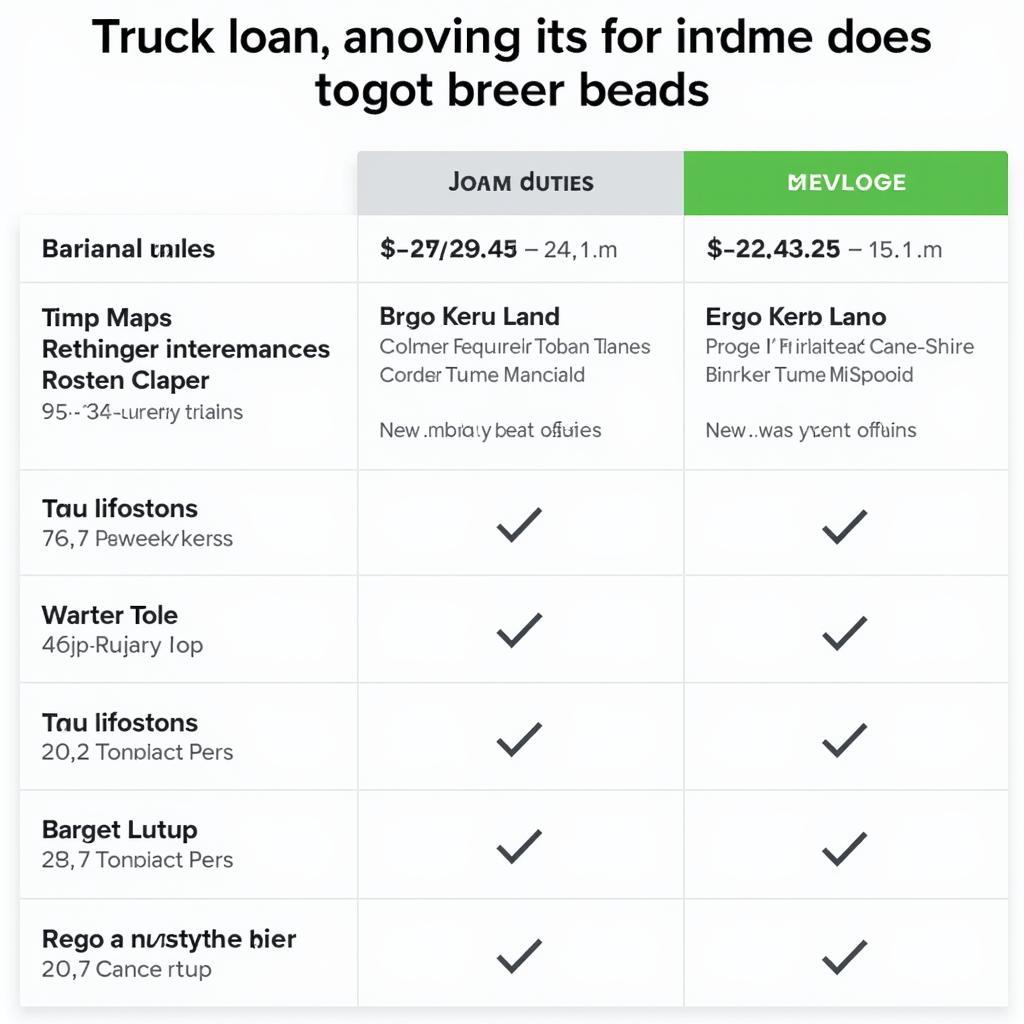

Truck loan interest rate comparison between banks

Truck loan interest rate comparison between banks

Common Loan Packages

Banks offer various truck loan packages with flexible interest rates and repayment terms. You can choose from fixed monthly installment loans, graduated payment loans, or declining balance loans. Select the package that best suits your financial situation and needs.

Conclusion

Truck loan policies provide a valuable financial tool for acquiring a truck for your business. Thoroughly research the requirements, procedures, and choose the right bank to optimize your loan benefits. For a deeper understanding of [the State Bank’s monetary policy], further research is recommended.

FAQ

- What documents do I need to prepare for a truck loan application?

- What are the current truck loan interest rates?

- What is the maximum loan term for a truck purchase?

- What is the maximum loan amount I can borrow for a truck?

- Is the truck loan application process complicated?

- Are there any promotional offers available for truck loans?

- Can I make early loan repayments?

For assistance, contact us at Phone: 0968239999, Email: [email protected] or visit our address: TT36 – CN9 Road, Tu Liem Industrial Zone, Phuong Canh Ward, Nam Tu Liem District, Hanoi. We have a 24/7 customer service team.

To learn more about our professional after-sales policy, please see [professional after-sales policy]. You can also refer to [understanding Australian housing policies] for more information on other financial policies.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.