Vietnam Motorcycle Registration Tax: A Buyer’s Guide

Uncle Ba, known throughout the neighborhood as “Motorcycle Ba” due to his lifelong passion for two-wheeled vehicles, always caused a stir with each new purchase. Seeing him with a gleaming new scooter, I asked, “Uncle Ba, a new bike must have cost a hefty registration tax!” He chuckled, “Taxes are a must, but knowing the ropes can save you a bit.” Indeed, understanding Vietnam’s motorcycle registration tax is crucial before buying.

## Motorcycle Registration Tax: Essential Information

### What is Motorcycle Registration Tax?

Simply put, motorcycle registration tax is a fee paid when purchasing a new motorcycle in Vietnam. It’s essentially a fee to register your ownership of the vehicle.

Paying motorcycle registration tax in Vietnam

Paying motorcycle registration tax in Vietnam

### Motorcycle Registration Tax Rates

The current tax rate is 1% of the vehicle’s value for newly purchased motorcycles. For used motorcycles, the rate is determined by local tax authorities and is generally lower.

### Calculating Motorcycle Registration Tax

To calculate the tax, multiply the vehicle’s value by the tax rate. For example, a new motorcycle costing 30 million VND incurs a 300,000 VND registration tax.

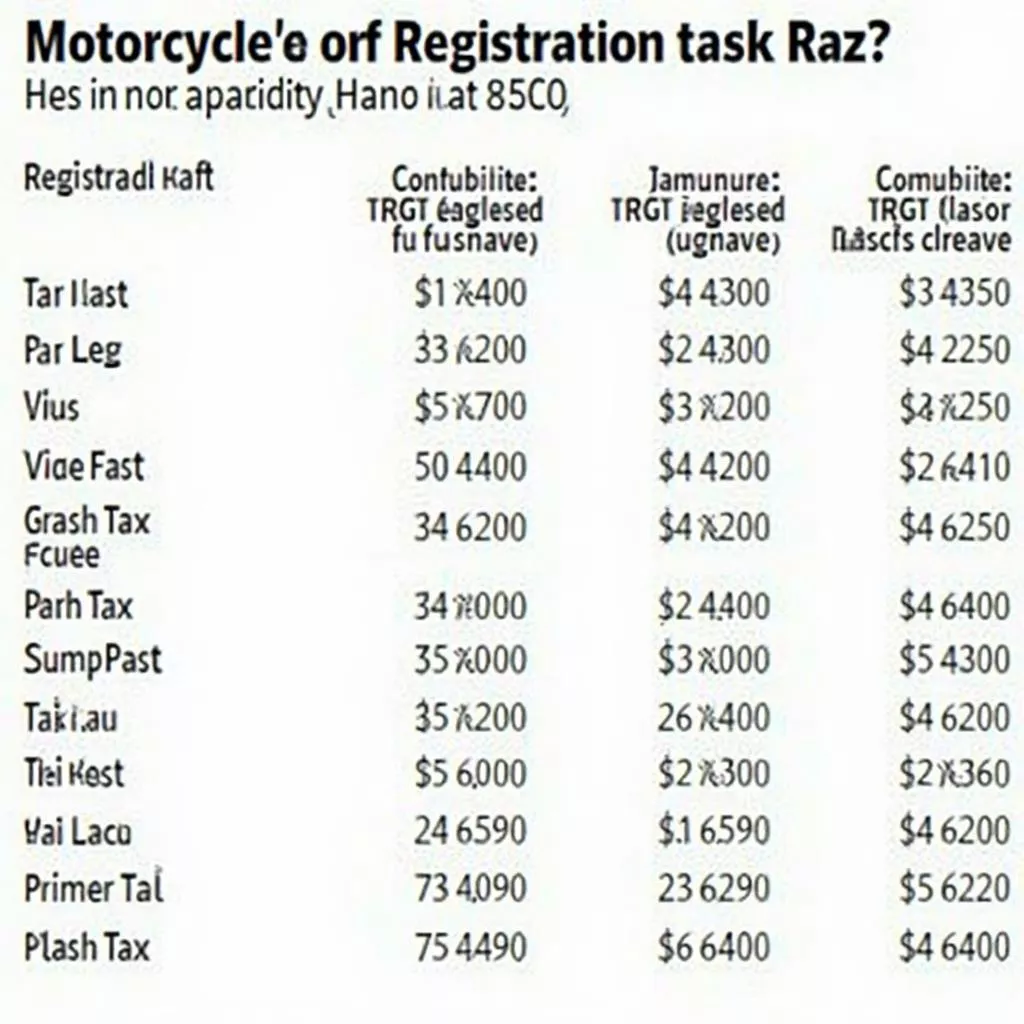

## Latest Motorcycle Registration Tax Rates in Vietnam

### Hanoi

| Vehicle Type | Tax Rate |

|---|---|

| New Motorcycle | 1% |

| Used Motorcycle | Determined by district/local tax authorities |

### Ho Chi Minh City

| Vehicle Type | Tax Rate |

|---|---|

| New Motorcycle | 1% |

| Used Motorcycle | Determined by district/local tax authorities |

### Other Provinces/Cities

Motorcycle registration tax rates in other provinces/cities are similar to Hanoi and Ho Chi Minh City. Contact your local tax office for specific information.

Motorcycle registration tax rates in Hanoi

Motorcycle registration tax rates in Hanoi

## Important Notes on Paying Motorcycle Registration Tax

- Paying registration tax is mandatory when buying a motorcycle.

- Bring all required documents when paying the tax.

- Carefully review all documents before signing.

- Consult the General Department of Taxation’s website or your local tax office for more information.

## “XE TẢI HÀ NỘI”: Your Transportation Partner

Besides providing information on motorcycle registration tax, “XE TẢI HÀ NỘI” offers reliable trucking and logistics services.

- Need motorcycle rental prices in Hanoi? Visit here.

- Need goods transported? Check out our reputable and efficient motorcycle cargo transportation services.

- “XE TẢI HÀ NỘI” operates throughout Hanoi, from Cau Giay and Thanh Xuan to Hoan Kiem and Ba Dinh.

Contact us at 0968239999 or email [email protected] for 24/7 support. “XE TẢI HÀ NỘI” – Trust Built on Reliability!

XE TẢI HÀ NỘI – Your reliable transportation partner

XE TẢI HÀ NỘI – Your reliable transportation partner

## Conclusion

Understanding Vietnam’s motorcycle registration tax ensures you’re financially prepared when purchasing a bike. We hope this article provided valuable insights. Happy riding!

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.