Car Liability Insurance Costs: What Hanoi Drivers Need to Know

Anh Tuan, a long-time truck driver in Hanoi, was always confident in his driving skills. He believed that taking care of his own vehicle was enough and considered liability insurance an unnecessary expense.

One day, while driving, a motorbike suddenly crossed his path. Despite slamming on the brakes, an accident was unavoidable. Fortunately, the motorcyclist sustained only minor injuries, but both vehicles were severely damaged.

Without liability insurance, Anh Tuan had to bear the full cost of repairs for both vehicles, amounting to tens of millions of Vietnamese dong.

Anh Tuan’s story serves as a lesson for many, especially truck drivers, about the importance of car liability insurance. So how are these insurance premiums calculated?

Understanding Car Liability Insurance Premiums

The Significance of Car Liability Insurance Premiums

Car liability insurance premiums are the amount of money vehicle owners pay to insurance companies for financial protection in case of accidents causing damage to third parties.

Simply put, when you purchase liability insurance, you transfer the risk of accidents to the insurance company. In the event of an accident, the insurance company will compensate the injured party according to the law and the insurance policy, relieving you of the financial burden.

Factors Affecting Car Liability Insurance Premiums

According to insurance expert Robert Miller, author of “The Complete Guide to Auto Insurance,” several factors influence car liability insurance premiums, including:

- Vehicle Type: Trucks, buses, cars… each type of vehicle has a different insurance rate.

- Purpose of Use: Commercial vehicles, family cars… also affect the premium.

- Seating Capacity: The more seats a vehicle has, the higher the insurance premium.

- Geographic Location: Densely populated urban areas typically have higher premiums than rural areas.

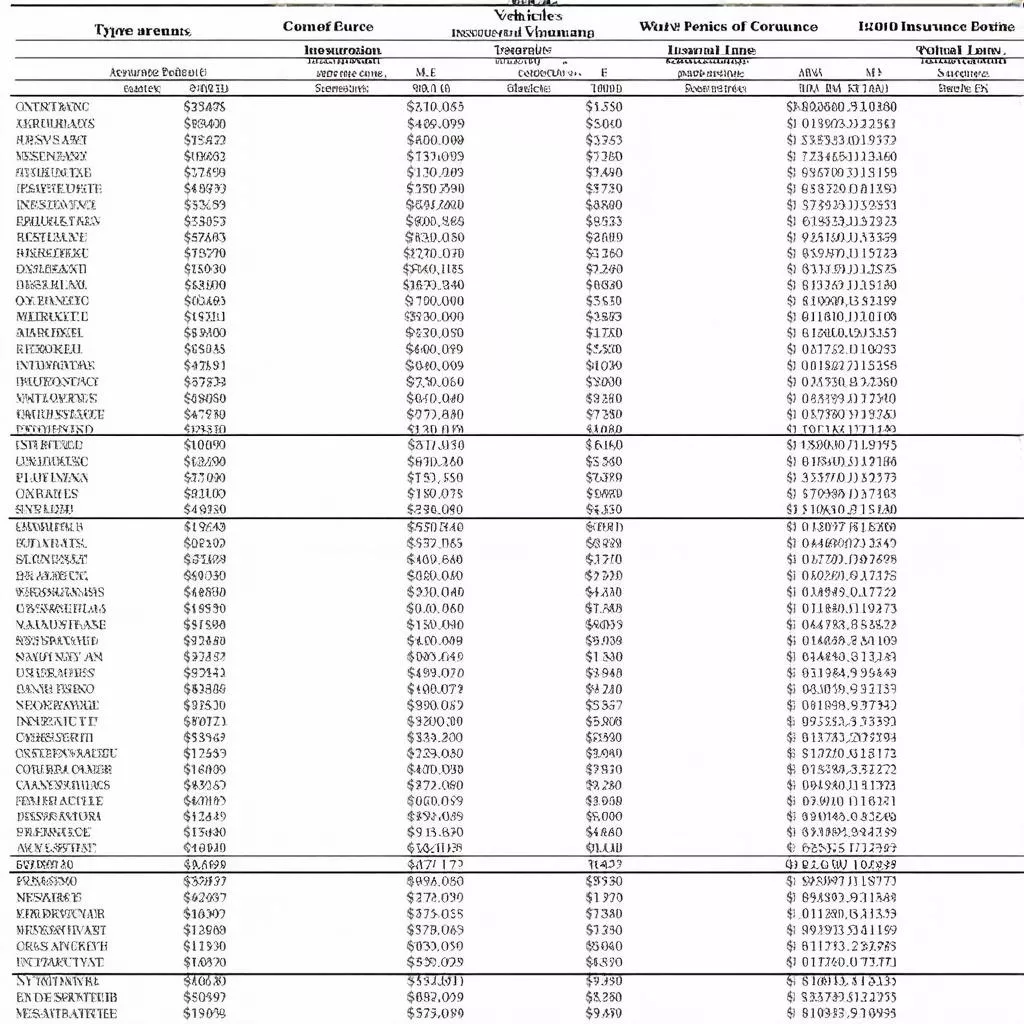

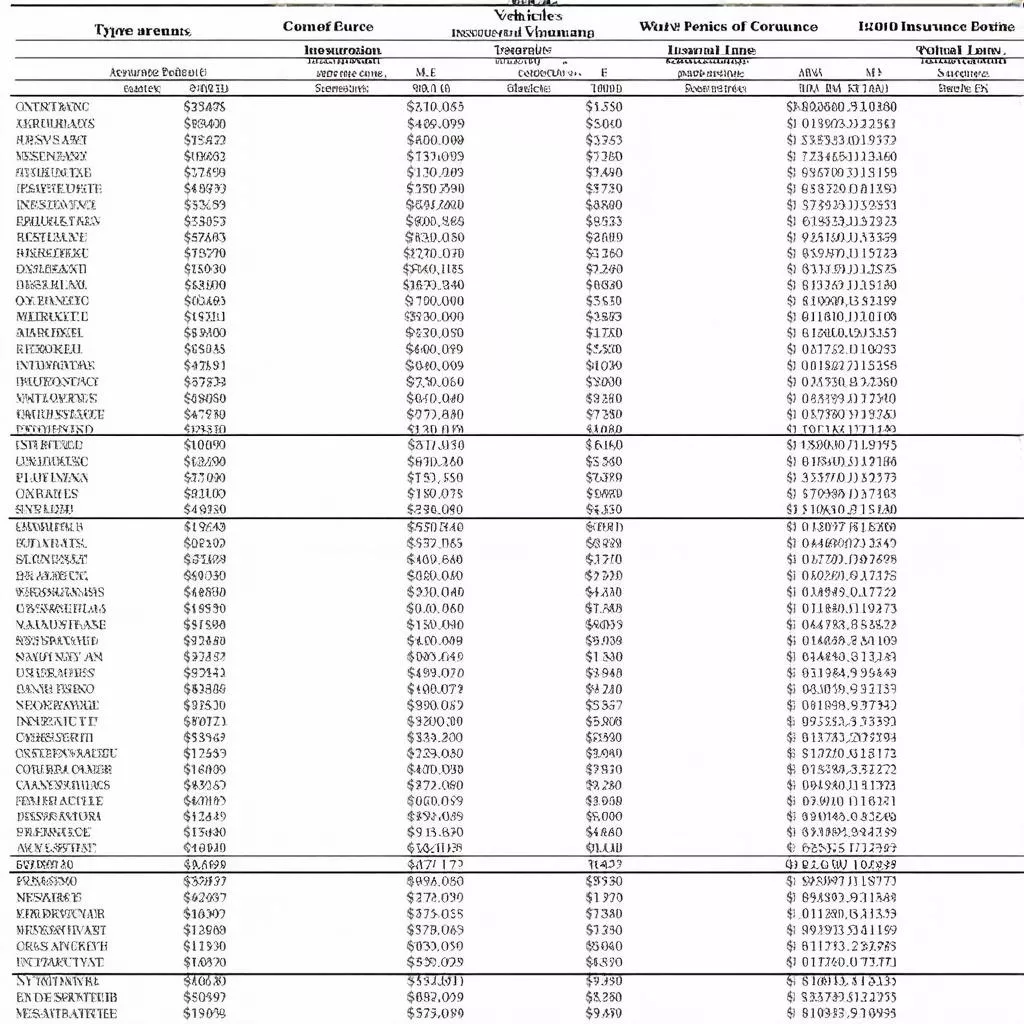

Car insurance premium chart

Car insurance premium chart

Benefits of Understanding Car Liability Insurance Premiums

Drive with Peace of Mind

Understanding insurance premiums allows you to choose a policy that suits your needs and financial capabilities. This provides peace of mind, allowing you to focus on your work without worrying about unforeseen risks on the road.

Avoid Unnecessary Disputes

In the event of an accident, having liability insurance ensures a smoother and faster claims process. You won’t have to directly negotiate with the injured party, avoiding unnecessary disputes and conflicts.

Contribute to a Civilized and Safe Society

Participating in car liability insurance is not only a responsibility to oneself and one’s family but also to the community. It contributes to a safer, more civilized, and modern traffic environment.

Frequently Asked Questions about Car Liability Insurance Premiums

Question 1: Is car liability insurance mandatory?

Answer: According to Vietnamese law, car liability insurance is mandatory for all motor vehicle owners.

Question 2: What is the penalty for not having car liability insurance?

Answer: The penalty for not having car liability insurance is clearly stipulated in the Road Traffic Law and related legal documents. You can find more information on the Traffic Police Department’s website or contact us for specific advice.

Question 3: How can I purchase car liability insurance?

Answer: You can purchase car liability insurance directly from insurance companies, insurance agents, or online through the websites of service providers.

Learn More About Trucks and Services at XE TẢI HÀ NỘI

Besides learning about liability insurance, you can explore articles about various truck models, specialized vehicles, and tips for buying, selling, and using trucks effectively on our website xetaihanoi.edu.vn.

Hanoi Trucks

Hanoi Trucks

Contact Us

XE TẢI HÀ NỘI is a reputable provider of high-quality trucks at competitive prices, along with excellent after-sales service.

For any inquiries about trucks or assistance with car liability insurance, please contact us at Hotline: 0968 239 999. We are available 24/7 to assist you.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.