Latest Tax Policies for Truck Businesses in Hanoi

The latest tax policies directly impact trucking businesses, especially those operating box trucks, light trucks, vans, and trucks with capacities of 1 ton, 2 tons, 3.5 tons, and 8 tons. Understanding these regulations helps businesses optimize costs, ensure legal compliance, and achieve sustainable growth.

Impact of the Latest Tax Policies on the Trucking Industry

Tax policy is always a top concern in the trucking business. Changes in tax policies, including value-added tax (VAT), excise tax, corporate income tax, and related fees, can significantly affect a company’s profitability. Staying updated on the latest tax policies is essential for businesses to adjust their strategies accordingly. For example, a reduction in registration tax for new trucks can be a good opportunity for businesses to invest in expanding their fleet. Conversely, an increase in environmental protection taxes may lead businesses to consider investing in more environmentally friendly trucks. Following this introduction, we will delve deeper into the specific changes. You can also learn more about public policy to better understand its role in the economy.

Types of Taxes Applicable to Trucks

Various taxes apply to trucks, depending on their load capacity, type, and intended use. Some common taxes include registration tax, road tax, environmental protection tax, and VAT. Each tax has a different calculation method and rate. Understanding these taxes helps businesses accurately calculate operating costs and make informed business decisions.

Truck Registration Tax

Registration tax is payable when registering a new truck. The registration tax rate varies by location. For example, in Hanoi, the registration tax rate for trucks may differ from other provinces. Businesses need to thoroughly understand the regulations in their locality to avoid unnecessary errors.

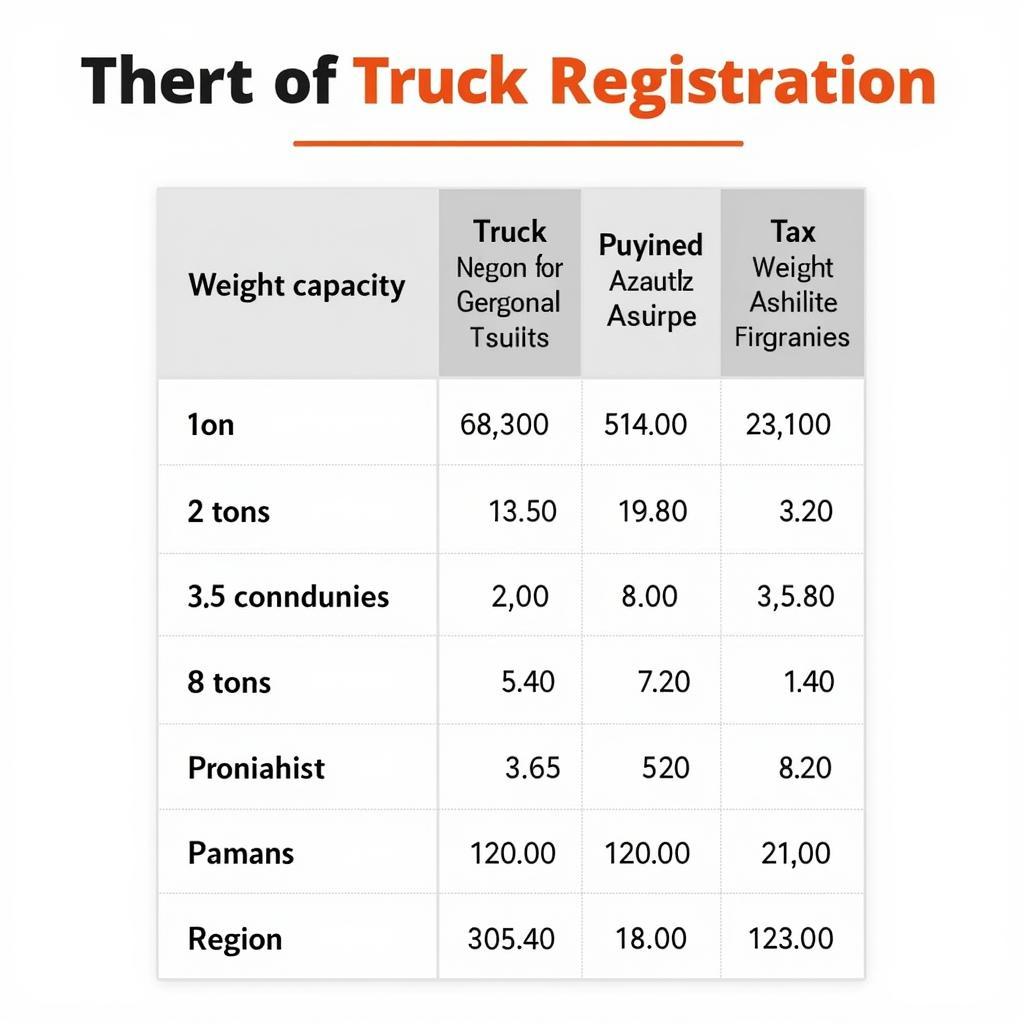

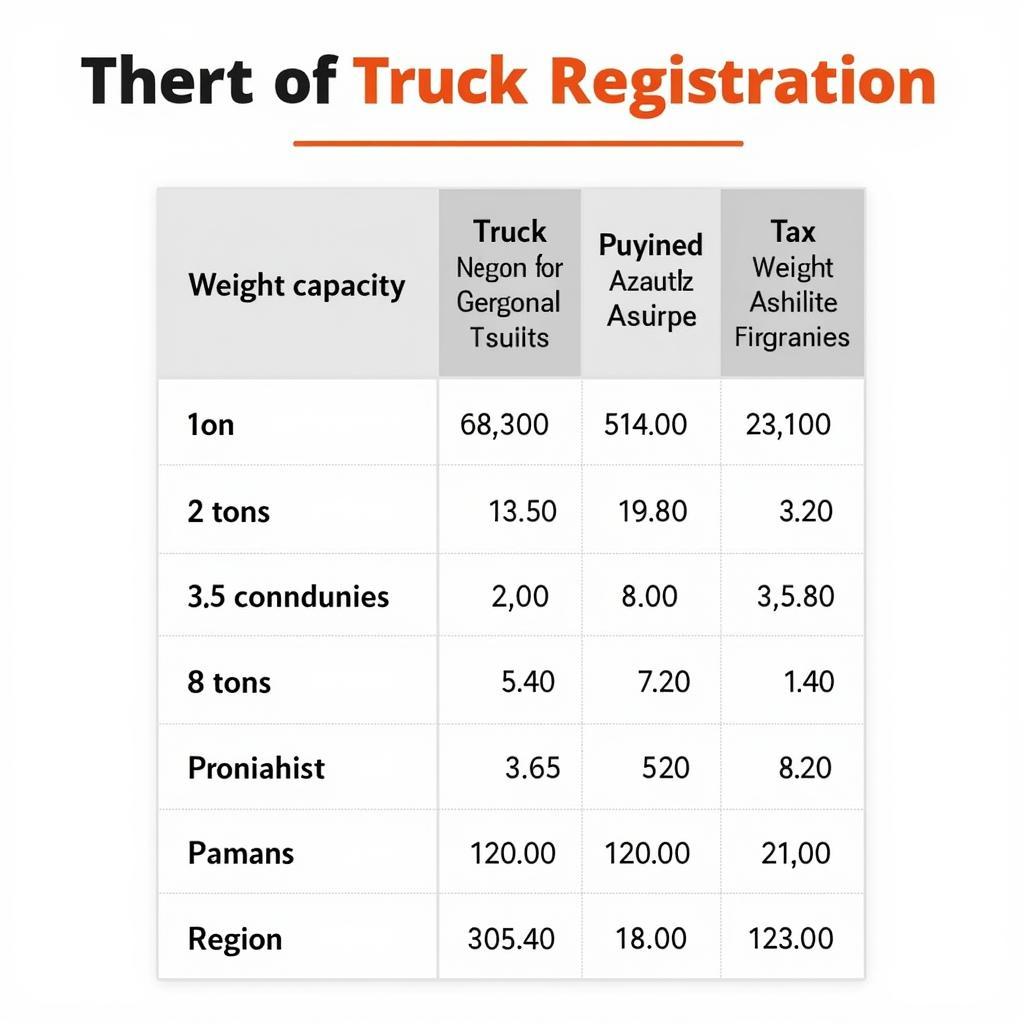

Truck registration tax rates by load capacity

Truck registration tax rates by load capacity

Road Tax

Road tax is an annual tax that contributes to the maintenance and development of the road system. The road tax rate depends on the truck’s load capacity. The heavier the truck, the higher the road tax. Paying road tax in full is the responsibility of every truck owner. Refer to Decision 62 for a deeper understanding of related policies.

Significant Changes in Truck Tax Policy

Recently, there have been significant changes in truck tax policy. For instance, adjusting the excise tax for diesel trucks has impacted transportation costs. Additionally, implementing tax incentives for clean energy trucks encourages businesses to invest in environmentally friendly vehicles. Exploring financial law books will provide further knowledge on financial and tax regulations.

Mr. Nguyen Van A, a transportation economics expert, stated: “Staying informed about changes in tax policy is crucial for trucking businesses to optimize costs and enhance competitiveness.”

Conclusion

The latest tax policies significantly impact the trucking industry. Understanding and staying updated on these regulations is vital for the sustainable development of businesses.

FAQ

- How is truck registration tax calculated?

- What is the road tax rate for an 8-ton truck?

- Are there any tax incentives for electric trucks?

- What is the procedure for paying road tax?

- Where can I find information on truck tax policies?

- How do the latest tax policies affect truck prices?

- How can trucking businesses optimize their tax costs?

Suggested Questions and Related Articles

You can learn more about policies favoring the wealthy and public policy in Europe on our website.

Contact Us for Support

Phone: 0968239999, Email: [email protected] Or visit us at: TT36 – CN9 Road, Tu Liem Industrial Park, Phuong Canh Ward, Nam Tu Liem District, Hanoi. We have a 24/7 customer support team.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.