Understanding Vietnam Bank for Social Policies Interest Rates

Calculating interest rates from the Vietnam Bank for Social Policies (VBSP) is crucial for borrowers, especially those seeking loans for household economic development or government assistance programs. Understanding these calculations allows for effective financial management and avoids unexpected costs.

What are VBSP Interest Rates?

VBSP interest rates apply to loans under social policy credit programs. These rates are typically lower than commercial rates, making loans more accessible for targeted groups. These programs often support low-income households, near-poor households, ethnic minorities, people with disabilities, and other groups as defined by the Vietnamese Government.

Factors Influencing Interest Rate Calculation

VBSP interest rate calculations depend on several factors:

- Loan Program: Each program has different interest rates and calculation methods. For example, agricultural development loan rates might differ from housing construction loan rates.

- Loan Term: Longer loan terms may have higher interest rates.

- Loan Amount: Larger loan amounts may have lower interest rates.

- Geographic Location: Rates can vary regionally, depending on local economic and social development.

Interest Rate Calculation Formula

VBSP interest rates are usually calculated annually based on the principal balance. A simple formula is:

- Annual Interest = Loan Amount x Annual Interest Rate / 100

However, actual calculations can be more complex depending on the bank’s method (fixed, floating, or reducing balance interest rates).

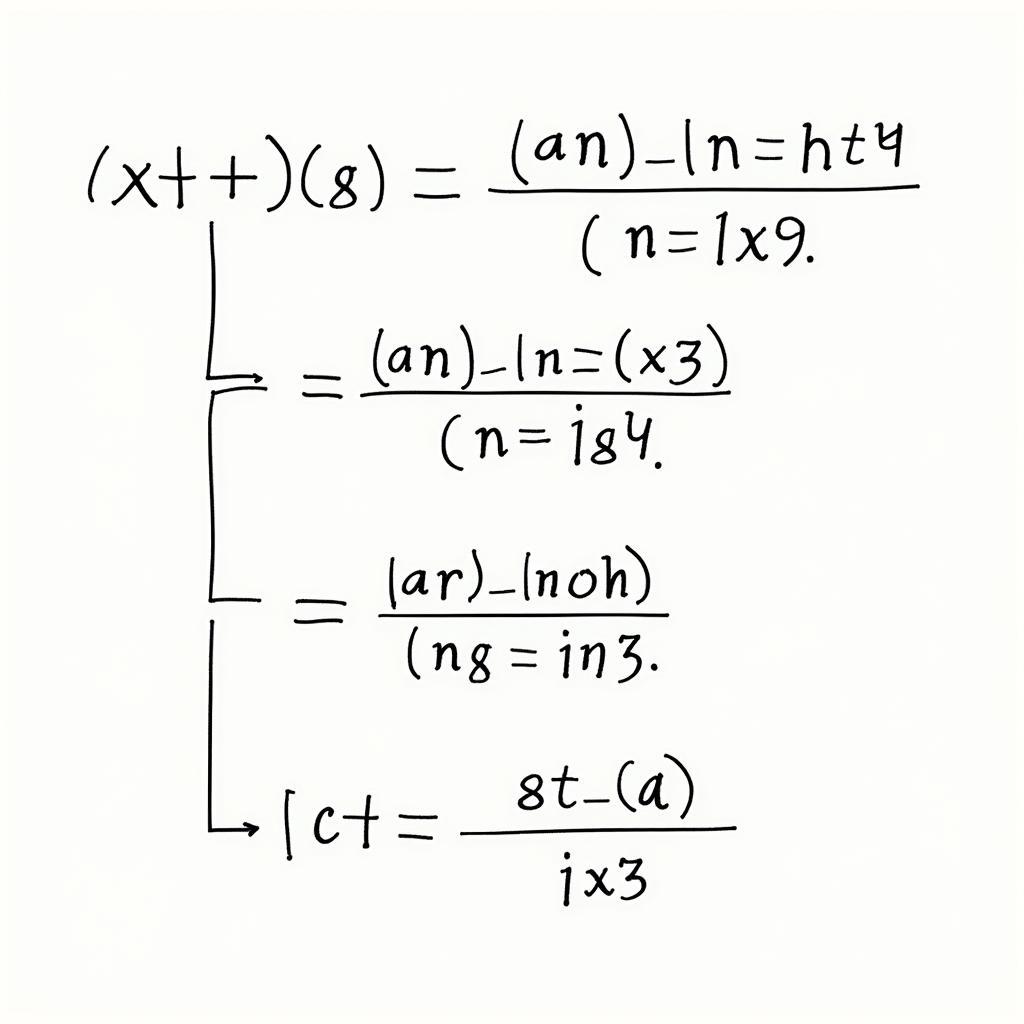

VBSP Interest Rate Calculation Formula

VBSP Interest Rate Calculation Formula

Interest Calculation Example

If you borrow 100 million VND at a 5% annual interest rate for one year, the interest payable after one year is:

- 100,000,000 x 5% = 5,000,000 VND

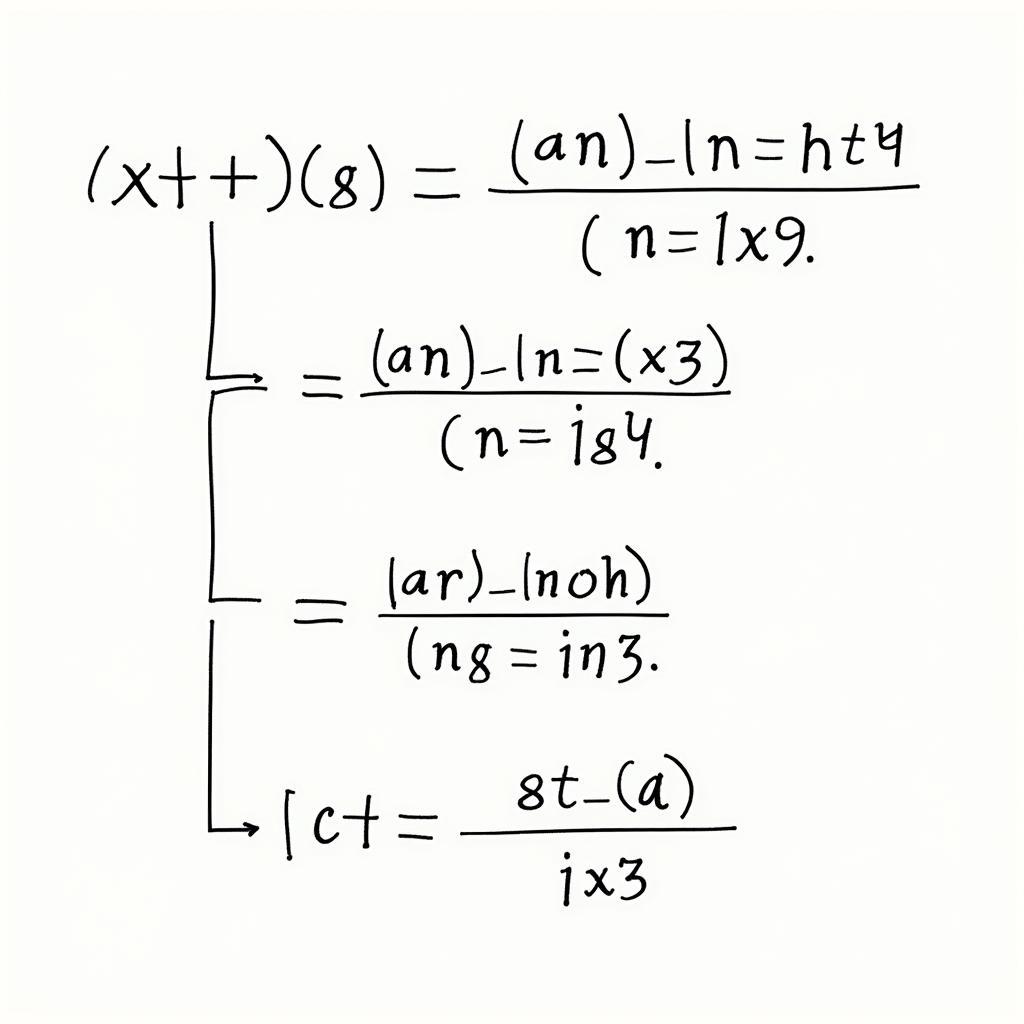

VBSP Interest Calculation Example

VBSP Interest Calculation Example

Finding Information on Interest Rates

For precise interest rate information on your loan, contact the VBSP directly or visit their official website. This ensures you understand the loan terms and conditions, avoiding potential issues.

Nguyen Van A, a financial expert in Hanoi, stated: “Understanding VBSP interest rate calculations is crucial for borrowers to manage their finances effectively.”

Tran Thi B, director of a VBSP branch in Ho Chi Minh City, emphasized: “We are always ready to assist customers with inquiries regarding interest rates and loan terms.”

Finding VBSP Interest Rate Information

Finding VBSP Interest Rate Information

Conclusion

VBSP interest rate calculations depend on various factors. Thoroughly researching interest rates and loan terms ensures effective financial management and efficient loan utilization.

FAQ

- Are VBSP interest rates fixed?

- Where can I find information on interest rates?

- What is the VBSP loan application process?

- What is the maximum loan term?

- What types of businesses can I use a VBSP loan for?

- Who is eligible for preferential interest rates?

- How do I calculate my monthly interest payment?

Common Question Scenarios

- Customers inquiring about specific loan interest rates.

- Customers comparing interest rates between loan programs.

- Customers seeking clarification on reducing balance interest rate calculations.

Related Content Suggestions

- VBSP Loan Application Process

- Preferential Loan Programs

- Bank Interest Rate Comparison

For assistance, contact us at Phone: 0968239999, Email: [email protected], or visit us at: TT36 – CN9 Road, Tu Liem Industrial Park, Phuong Canh Ward, Nam Tu Liem District, Hanoi. We offer 24/7 customer support.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.