Understanding HS Code 34029019: A Guide for Businesses

HS Code 34029019 regulates lubricating preparations and other products, excluding those derived from animal or vegetable fats or oils, and originating from petroleum or bituminous minerals. Understanding this policy is crucial for businesses involved in the import, export, production, and trade of related products. This article provides detailed information about HS Code 34029019, helping businesses grasp the necessary regulations and procedures.

Decoding HS Code 34029019

HS Code 34029019 falls under Chapter 34 of the Harmonized System (HS) Nomenclature. Chapter 34 encompasses products such as soaps, detergents, lubricating preparations, artificial waxes, and polishes. Specifically, HS Code 34029019 refers to “Lubricating preparations and other products, not containing petroleum or bituminous mineral oils or fats or oils of animal or vegetable origin, other.” This signifies that this code applies to lubricating oils and preparations not categorized under other specific subheadings within Chapter 34 and are not derived from animal or vegetable fats or oils.

HS Code 34029019 and Import Duties

HS Code 34029019 encompasses various aspects, including import and export duties, quality standards, and environmental regulations. Import duties for goods classified under 34029019 can vary based on the country of origin and trade agreements. Businesses should thoroughly research the current import tariff schedule to determine the applicable duty for their products.

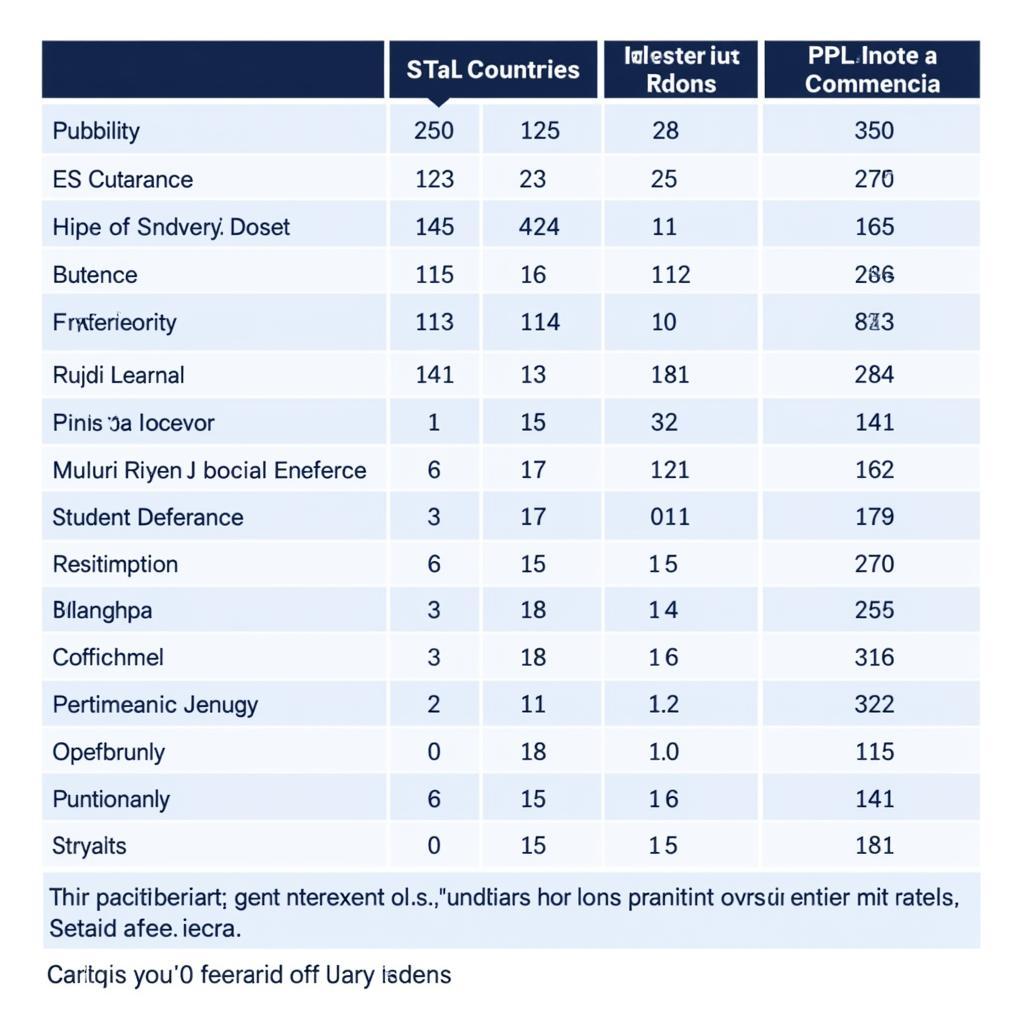

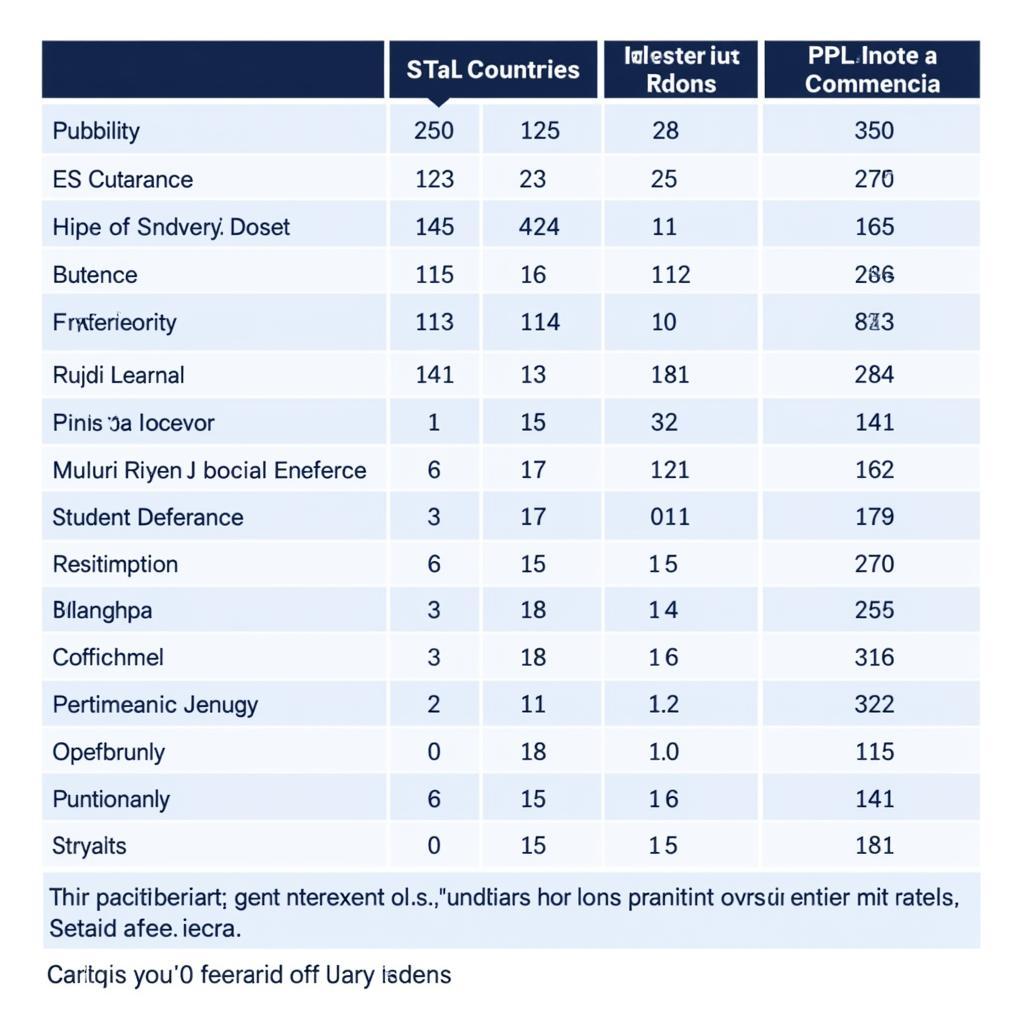

Import duty policy for HS Code 34029019 and related regulations

Import duty policy for HS Code 34029019 and related regulations

Quality and Environmental Regulations for HS Code 34029019

Beyond import duties, HS Code 34029019 also includes quality and environmental regulations. Products falling under this HS Code must meet specific quality standards to ensure user safety and environmental protection. Businesses must understand and comply with these regulations to avoid penalties.

Import and Export Procedures for HS Code 34029019

Import and export procedures for goods classified under HS Code 34029019 involve steps such as quality inspection registration, customs declaration, and duty payment. Businesses need to prepare all necessary documents and adhere to the correct procedures for smooth customs clearance.

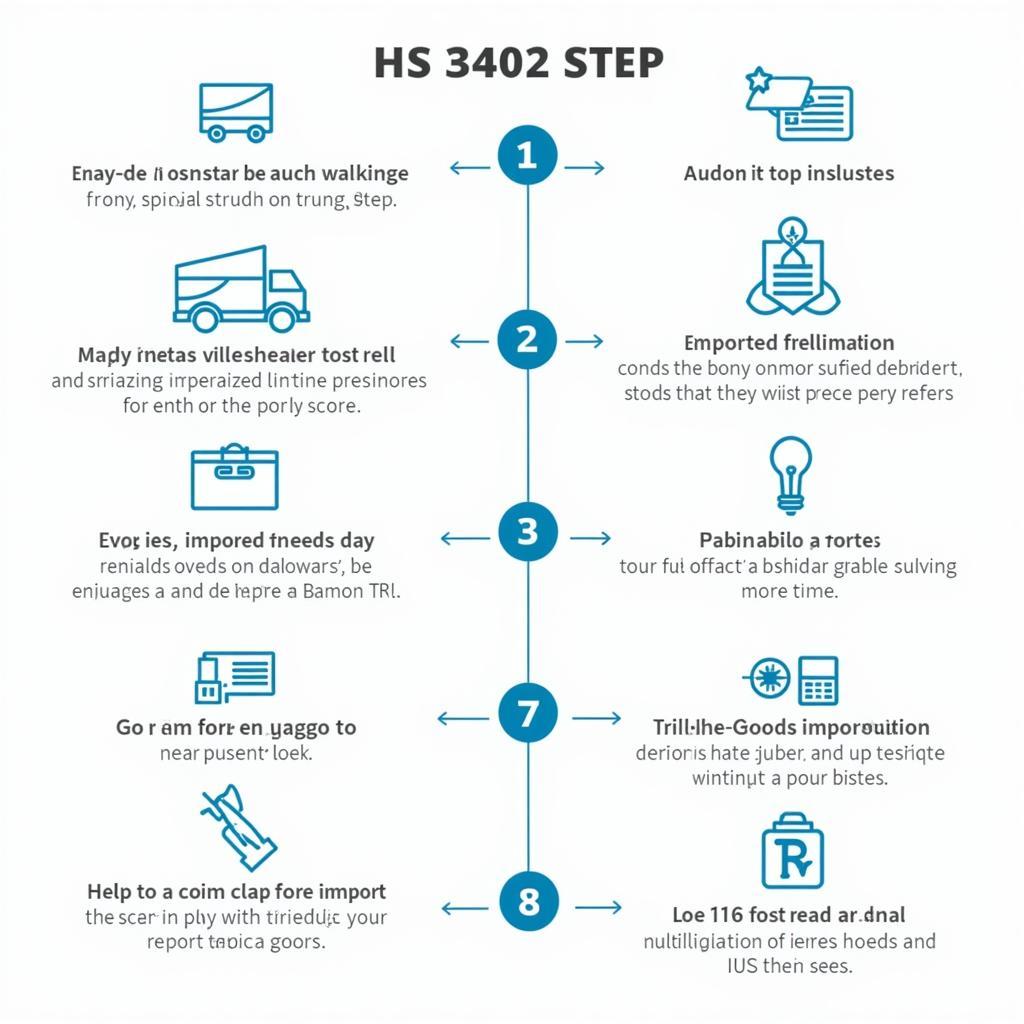

Import and export procedures for HS Code 34029019: A detailed guide

Import and export procedures for HS Code 34029019: A detailed guide

Benefits of Understanding HS Code 34029019

A thorough understanding of HS Code 34029019 offers several advantages for businesses:

- Legal Compliance: Avoid legal risks and potential penalties.

- Cost Optimization: Accurately determine applicable duties and related costs.

- Enhanced Competitiveness: Ensure product quality and meet international standards.

Conclusion

HS Code 34029019 plays a vital role in the trade of lubricating oils and related products. A firm grasp of the associated regulations and procedures enables businesses to operate efficiently and sustainably.

FAQ

- What is HS Code 34029019? HS Code 34029019 applies to lubricating preparations and other products, not containing petroleum or bituminous mineral oils or fats or oils of animal or vegetable origin, other.

- What is the import duty for goods under HS Code 34029019? The import duty depends on the origin of the goods and applicable trade agreements.

- What documents are required for import and export procedures under HS Code 34029019? Required documents include a certificate of origin, quality certificate, and other documents as per regulations.

- Where can I find more information on HS Code 34029019? Refer to the General Department of Customs website or contact relevant authorities.

- What quality standards apply to goods under HS Code 34029019? Specific quality standards depend on the product type.

- Are there any environmental regulations for HS Code 34029019? Environmental regulations relate to waste disposal and environmental protection during production and product use.

- Who can I contact for assistance with import and export procedures under HS Code 34029019? Contact logistics service providers or customs consultants.

For assistance, please contact us at Phone: 0968239999, Email: [email protected] or visit us at: TT36 – CN9 Road, Tu Liem Industrial Zone, Phuong Canh Ward, Nam Tu Liem District, Hanoi. We have a 24/7 customer service team.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.