Cambodia’s 2017 Tax Policy Changes: Impact on Trucking

Cambodia’s 2017 tax policy introduced significant changes impacting transportation businesses, especially those importing trucks from Vietnam. This article analyzes these key changes and their effects on the trucking industry.

Impact on the Transportation Industry

The 2017 Cambodian tax policy significantly impacts the transportation sector, altering operational and import costs. Understanding these new regulations is crucial for businesses to adjust their strategies accordingly.

Truck Import Taxes

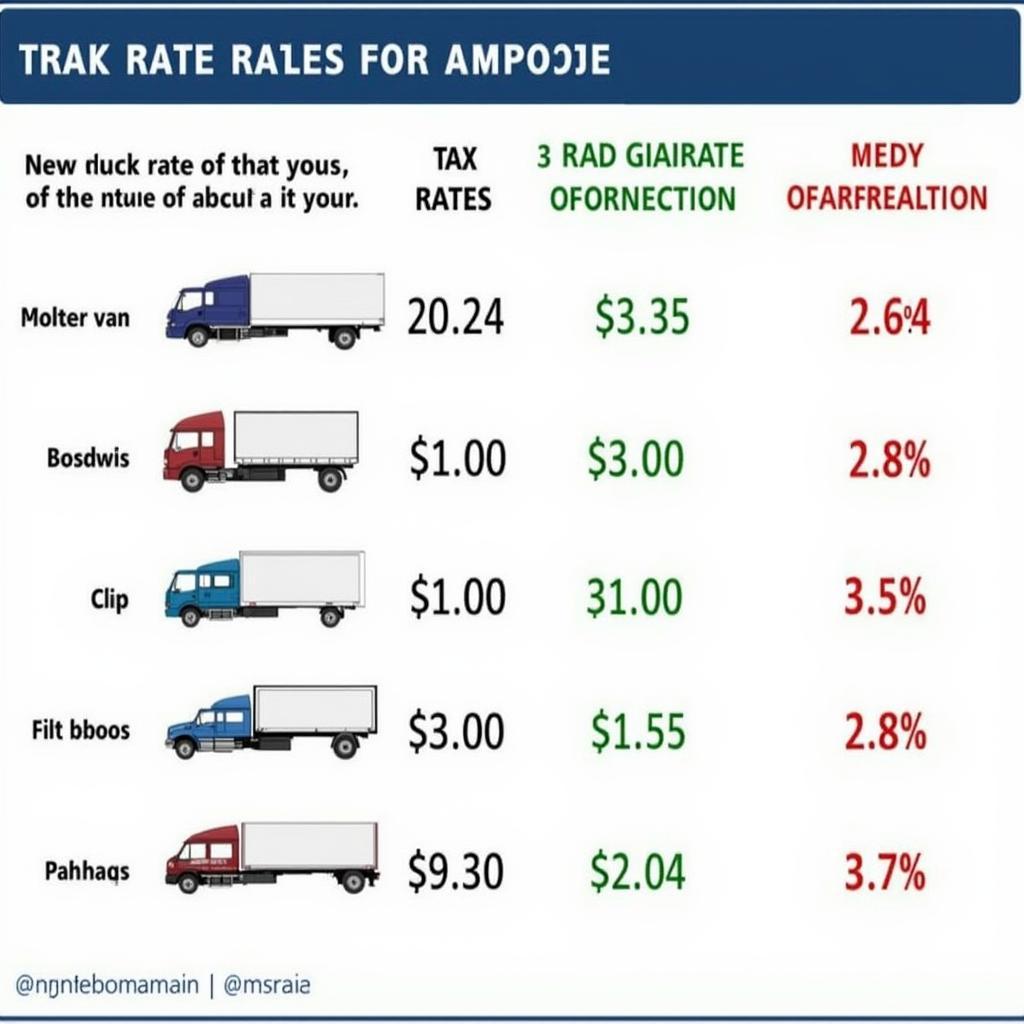

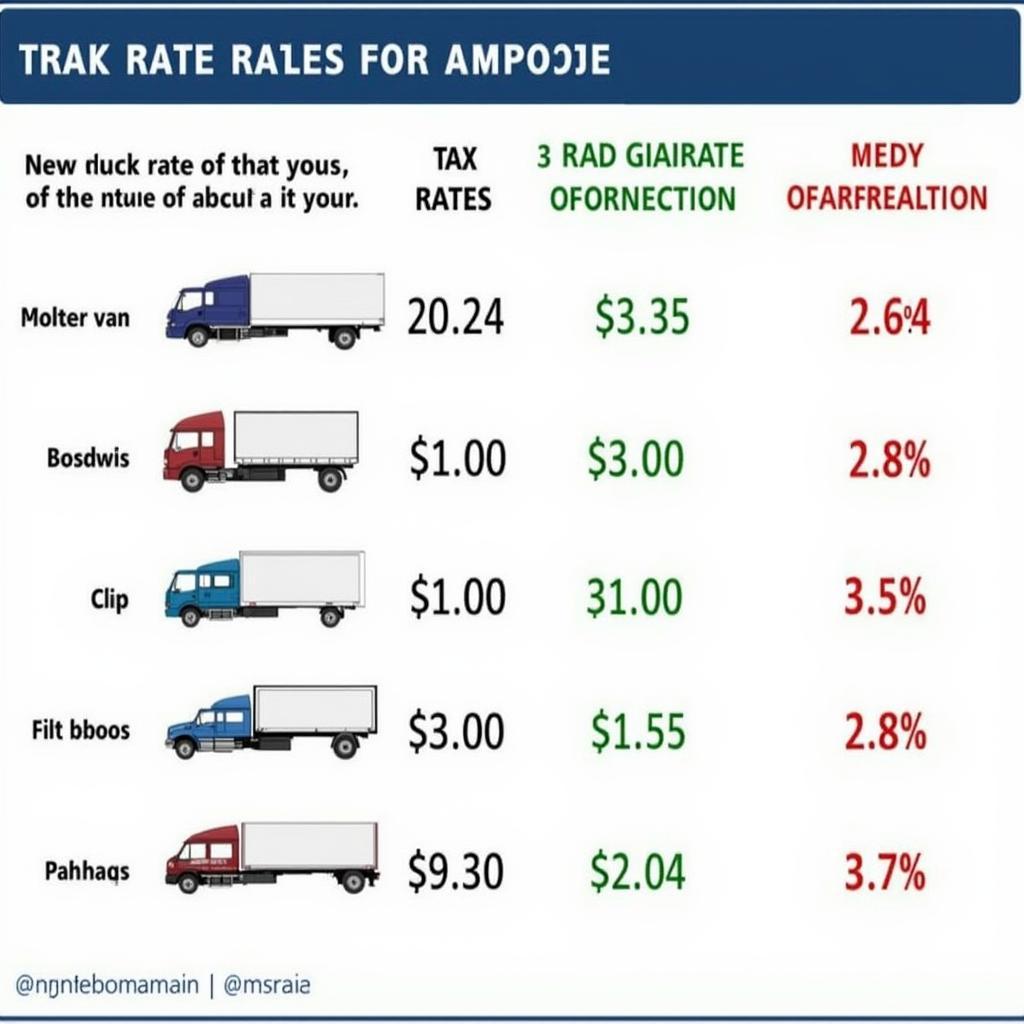

One of the most notable changes is the adjustment to truck import taxes. The new rates directly affect the cost of imported trucks, ranging from box trucks and light trucks to vans and trucks with capacities of 1 ton, 2 tons, 3.5 tons, and 8 tons.

Cambodia's 2017 Truck Import Tax Policy

Cambodia's 2017 Truck Import Tax Policy

Value Added Tax (VAT)

The new tax policy also adjusts the Value Added Tax (VAT) applied to transportation services. This impacts freight rates and industry competition.

Corporate Income Tax

Corporate income tax was also adjusted in the new tax policy. The new rate can affect the profitability of transportation companies operating in Cambodia.

Key Considerations for Businesses

To adapt to Cambodia’s 2017 tax policy, transportation businesses should consider the following:

- Understand the new regulations: Thoroughly research the specific terms and regulations of the new tax policy to avoid violations and optimize costs.

- Adjust business strategies: Review business strategies, including pricing, target markets, and investment plans.

- Seek professional advice: If necessary, consult with tax and legal experts to ensure full compliance.

Conclusion

Cambodia’s 2017 tax policy brings significant changes to the transportation industry. Understanding and adapting to these changes is key for trucking businesses to maintain efficient operations and remain competitive. The new policy requires thorough preparation from businesses.

FAQ

- Does the new tax policy apply to all types of trucks?

- What are the specific truck import tax rates?

- How can businesses stay updated on the new tax policy?

- Are there any tax incentives for transportation companies investing in Cambodia?

- Where can I seek tax advice?

- Does the new tax policy affect the price of used trucks?

- Have road taxes changed under the new tax policy?

Common Questions and Scenarios

Many customers inquire about the application of the new tax policy to used trucks. Others are interested in changes to customs procedures for importing vehicles.

Suggested Related Articles and Resources

You can learn more about box trucks, light trucks, vans, and trucks with capacities of 1 ton, 2 tons, 3.5 tons, and 8 tons on our website.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.