Vietnam Monetary Policy in 2018

Vietnam’s monetary policy in 2018 focused on macroeconomic stability, inflation control, and supporting sustainable economic growth. 2018 marked a significant period of monetary policy adjustments to adapt to domestic and international market fluctuations.

Monetary Policy Objectives in 2018

The monetary policy in 2018 aimed to control inflation, stabilize exchange rates, and support economic growth. The government set an inflation target of under 4% and maintained a stable exchange rate. Inflation control was considered a top priority to ensure macroeconomic stability. Maintaining a stable exchange rate facilitated import-export activities and attracted foreign investment. Simultaneously, the monetary policy aimed to support reasonable economic growth, create jobs, and improve people’s living standards. You can learn more about mortgage loans for house construction from policy banks.

Monetary Policy Instruments

The State Bank of Vietnam utilized various monetary policy instruments to achieve its objectives. These tools included adjusting the operating interest rate, the reserve requirement ratio, and open market operations. Adjusting the operating interest rate helped control inflation and influenced the credit activities of commercial banks. The reserve requirement ratio was a crucial tool for regulating the money supply in the economy. Furthermore, the State Bank also employed open market operations, such as buying and selling government bonds, to adjust the money supply.

Challenges and Difficulties

The monetary policy in 2018 faced numerous challenges and difficulties. Inflationary pressure from rising global commodity prices, exchange rate fluctuations, and risks from international financial markets were factors impacting the effectiveness of the monetary policy. Balancing inflation control and supporting economic growth was also a significant challenge. The State of Vietnam’s Tax Policy in 2018 is also a factor to consider.

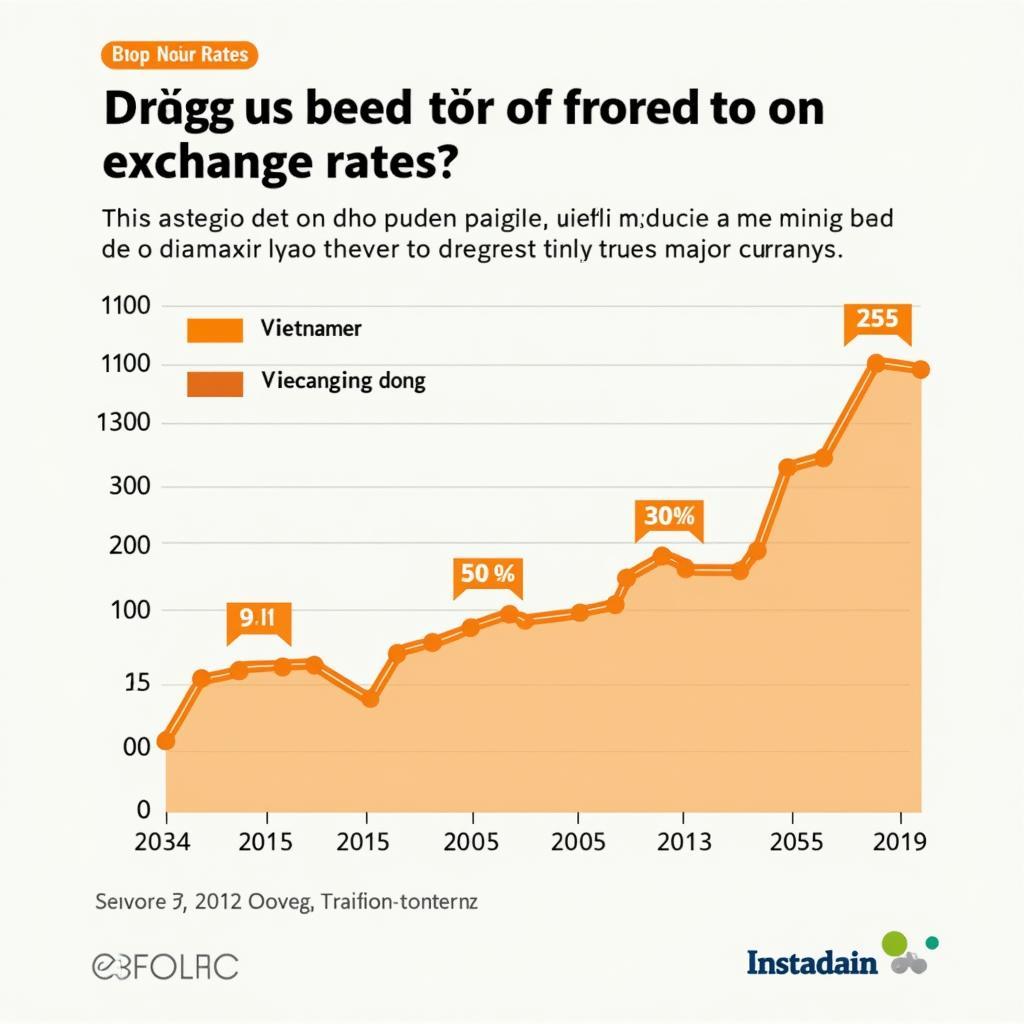

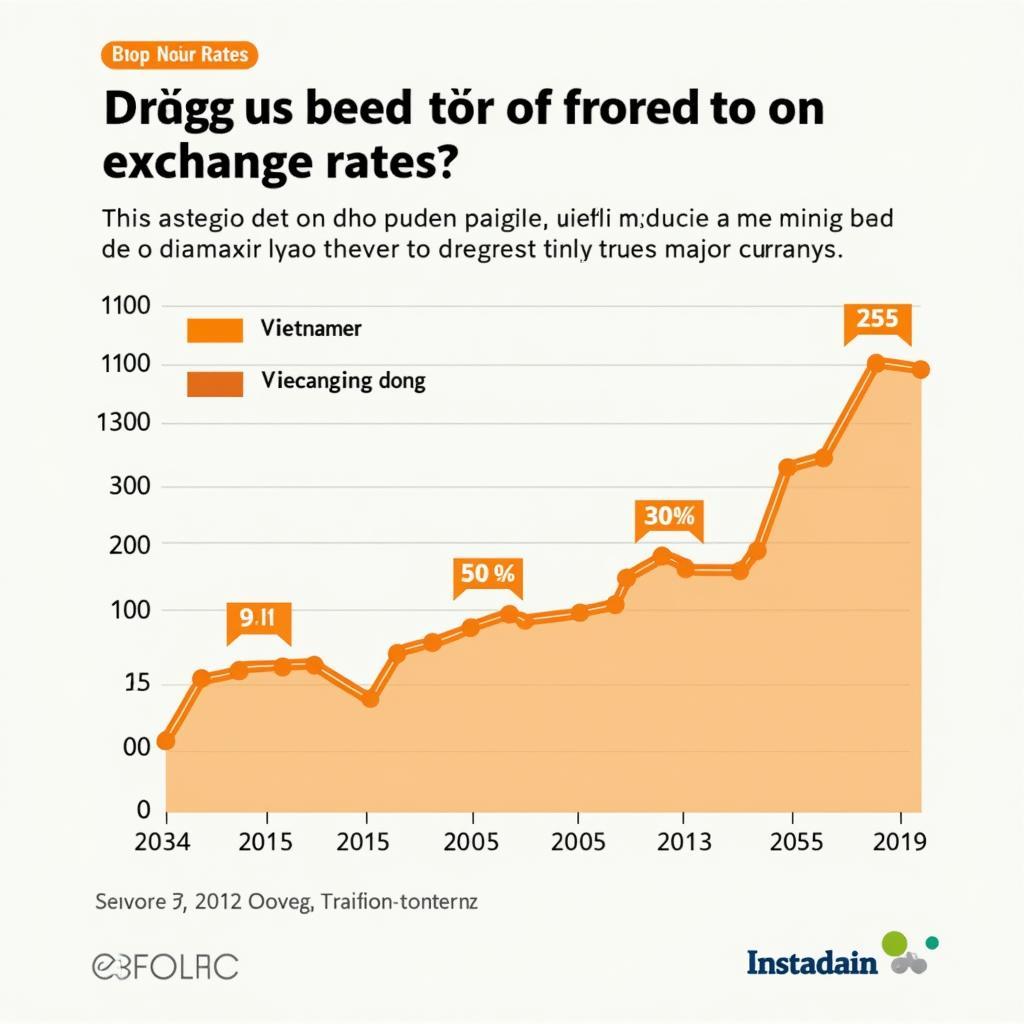

Impact of monetary policy on exchange rates

Impact of monetary policy on exchange rates

Evaluating the Effectiveness of Monetary Policy

Overall, the monetary policy in 2018 achieved positive results in controlling inflation and stabilizing the macroeconomy. Inflation was controlled below the target, the exchange rate remained relatively stable, and economic growth was maintained at a reasonable level. However, many challenges remain to ensure the sustainable development of the economy. More information on the latest social insurance policy in 2018.

Expert Nguyen Van A – Economist at the Institute of Economic Research: “The monetary policy in 2018 made significant contributions to macroeconomic stability, creating a foundation for sustainable development.”

Conclusion

Vietnam’s monetary policy in 2018 achieved certain results in controlling inflation and supporting economic growth. However, many challenges need to be addressed to ensure the stability and sustainable development of the economy in the future. You can learn more about policy and procedures for unemployment insurance. Information on the ASUS graphics card warranty policy in 2018 may not be directly related but could be helpful for some readers.

For support, please contact Phone Number: 0968239999, Email: [email protected] Or visit us at: No. TT36 – CN9 Road, Tu Liem Industrial Park, Phuong Canh Ward, Nam Tu Liem District, Hanoi. We have a 24/7 customer service team.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.