Vietnam’s Current Monetary Policy

Vietnam’s current monetary policy is being managed flexibly to stabilize the macroeconomy and support sustainable growth. This article will delve into the current monetary policy, its impact on the economy, and future trends.

Objectives of Vietnam’s Monetary Policy

Vietnam’s current monetary policy aims to control inflation, stabilize the currency’s value, and support economic growth. The government aims to keep inflation at a reasonable level while creating favorable conditions for businesses to access loans and promote production and business activities. Another important objective is to maintain financial market stability and prevent systemic risks. The implementation of monetary policy in Vietnam plays a crucial role in achieving macroeconomic goals.

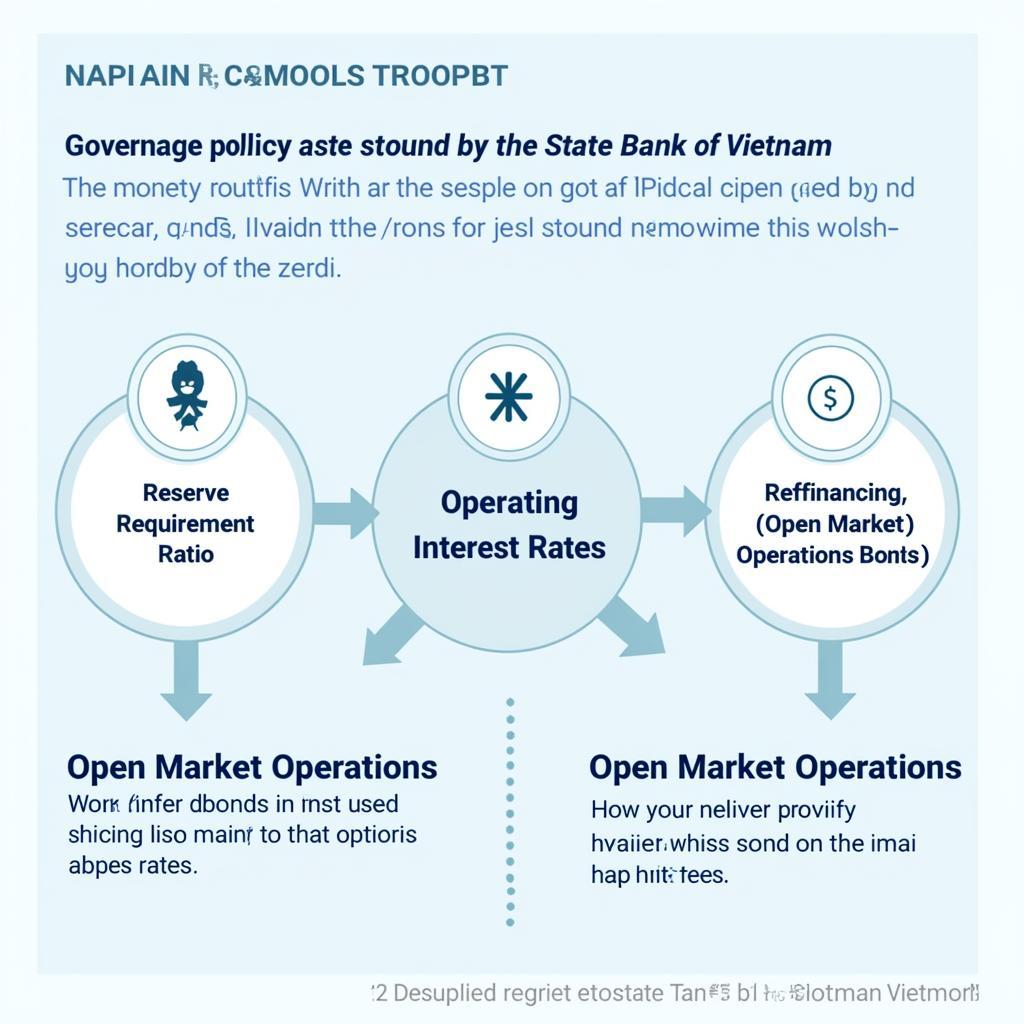

Tools of Monetary Policy

The State Bank of Vietnam uses various tools to manage monetary policy. Some key tools include:

- Reserve requirement ratio: This is the percentage of deposits that commercial banks must hold at the State Bank. Adjusting this ratio affects banks’ lending capacity.

- Policy interest rates: The State Bank uses refinancing rates, rediscount rates, and open market interest rates to influence market interest rates.

- Open market operations: The State Bank buys or sells government bonds to adjust the money supply in the market.

Vietnam's monetary policy tools

Vietnam's monetary policy tools

Impact of Monetary Policy on the Economy

Monetary policy has a strong impact on many areas of the economy. For example, lowering interest rates can encourage investment and consumption, contributing to economic growth. Conversely, raising interest rates can help curb inflation but can also slow economic growth. Monetary policy also affects exchange rates and foreign investment flows. Therefore, monetary policy management needs to be flexible and appropriate to the actual situation of the economy.

Forecasting Future Monetary Policy Trends

In the context of complex global economic fluctuations, forecasting Vietnam’s future monetary policy is challenging. However, many experts believe that the State Bank will continue to maintain a flexible, cautious, and proactive monetary policy, adapting to domestic and international economic developments. Inflation control will remain a top priority, along with supporting sustainable economic growth. Policies will also aim to strengthen the financial system and improve the efficiency of state management of monetary policy. Information on electricity pricing policies in other countries can also provide insights into how other nations respond to economic fluctuations.

Vietnam's future monetary policy trends forecast

Vietnam's future monetary policy trends forecast

Quote from Expert Le Minh Tuan, Director of the Institute of Economic Research: “Monetary policy in the coming time needs to be flexible, closely follow market developments, and be closely coordinated with other macroeconomic policies.”

Challenges of Current Monetary Policy

The current monetary policy management faces many challenges, including inflationary pressure, exchange rate fluctuations, and the impact of the global economy. The government needs timely and effective measures to overcome these challenges. Exploring questions for the Policy Bank exam can provide further knowledge in this area.

Conclusion

Vietnam’s current monetary policy is being managed flexibly and cautiously to achieve the goal of macroeconomic stability and support sustainable growth. However, there are still many challenges to overcome to ensure the effectiveness of monetary policy in the context of a fluctuating global economy. Lectures on dividend policy fullgr provides more information on other aspects of economic policy.

Challenges of Vietnam's monetary policy

Challenges of Vietnam's monetary policy

Quote from Expert Nguyen Thi Hoa, Director of the Center for Economic Analysis: “It is necessary to strengthen forecasting and analysis to proactively respond to market fluctuations.”

Quote from Expert Pham Van Nam, Macroeconomic Expert: “The synchronous coordination between monetary policy and fiscal policy is an important factor to ensure the effectiveness of macroeconomic management.”

For support, please contact Phone Number: 0968239999, Email: [email protected] Or visit us at: No. TT36 – CN9 Road, Tu Liem Industrial Park, Phuong Canh Ward, Nam Tu Liem District, Hanoi. We have a 24/7 customer service team.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.