Accounting for Vehicle Registration Fees in MISA Software

Accounting for vehicle registration fees in MISA is crucial for transportation, automobile sales, and car ownership businesses. Understanding this process ensures efficient financial management and legal compliance.

Guide to Vehicle Registration Fee Accounting in MISA Software

Vehicle registration fees are mandatory upon registering car ownership. Accurate accounting in MISA not only helps manage expenses but also ensures accurate financial reporting. Here’s a detailed guide:

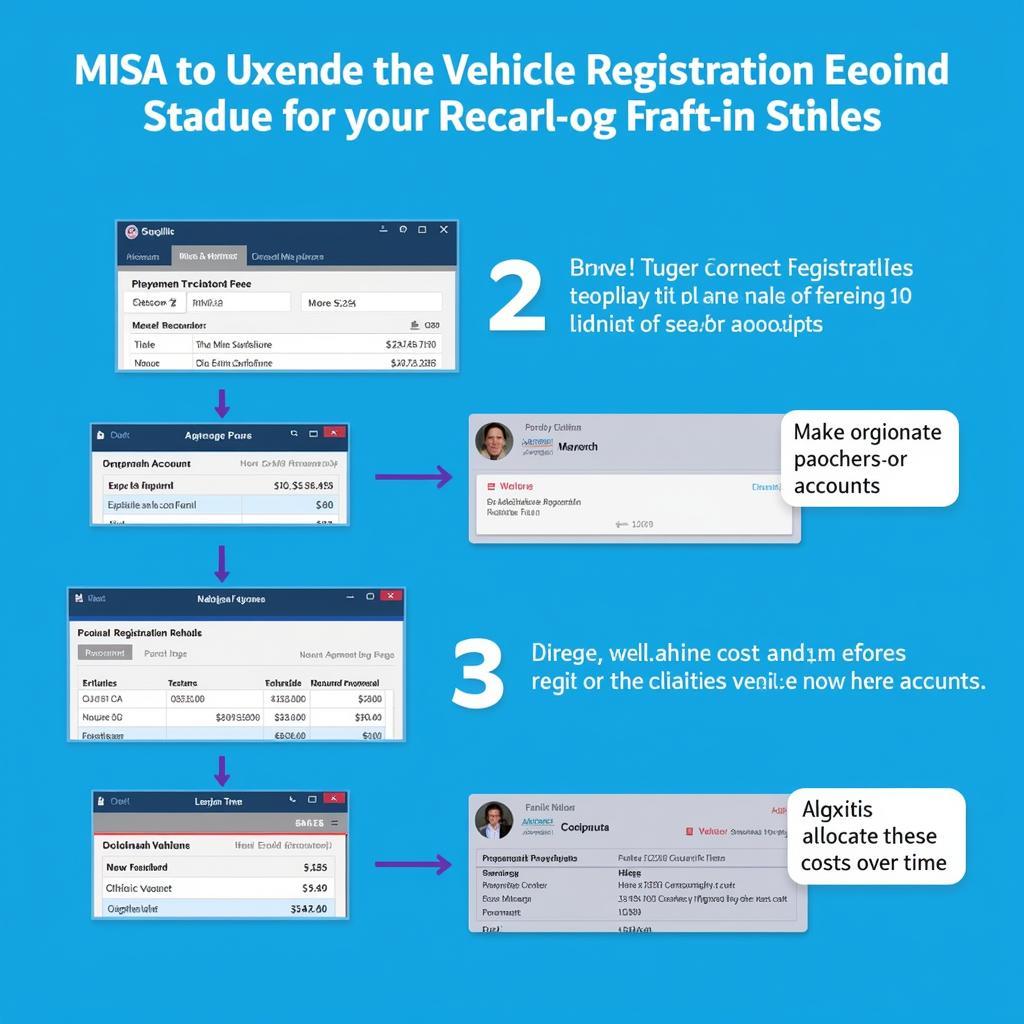

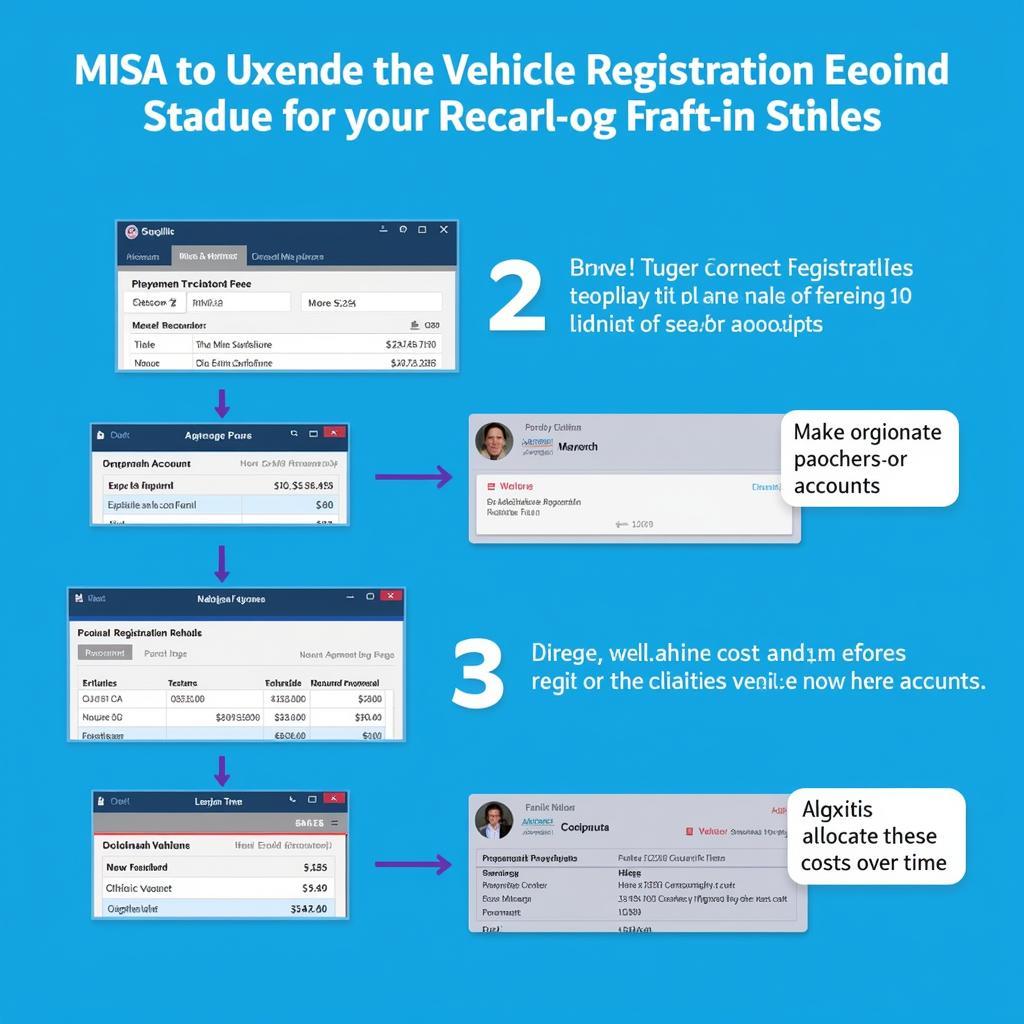

Steps for Accounting for Vehicle Registration Fees in MISA

To account for vehicle registration fees in MISA, follow these steps:

-

Identify the Account: The account used is typically account 242 – Prepaid Expenses.

-

Create a Payment Voucher: Create a voucher to record the registration fee expense. Include details like the amount, date, payee, and expense description.

-

Accounting Entry: In MISA, make the following journal entry:

- Debit Account 242 – Prepaid Expenses

- Credit Account 111/112 – Cash/Bank Deposit

-

Expense Allocation: After payment, the fee is allocated over the vehicle’s useful life. This is done monthly or quarterly, depending on company policy. The allocation entry is:

- Debit Account 213 – Depreciation of Fixed Assets

- Credit Account 242 – Prepaid Expenses

Vehicle registration fee accounting in MISA

Vehicle registration fee accounting in MISA

Example of Vehicle Registration Fee Accounting in MISA

Suppose Company A buys a truck for 500 million VND with a 50 million VND registration fee. The entries in MISA would be:

-

Upon paying the registration fee:

- Debit Account 242 – 50,000,000

- Credit Account 111 – 50,000,000

-

When allocating the expense (assuming a 10-year allocation):

- Debit Account 213 – 416,667 (50,000,000 / 120 months)

- Credit Account 242 – 416,667

Similar to vehicle purchase accounting in MISA, registration fee accounting requires accuracy and attention to detail.

Important Notes on Vehicle Registration Fee Accounting in MISA

Key considerations include:

- Legal Basis: Understand current registration fee regulations for correct tax rates.

- Timing of Entry: Record the transaction immediately upon payment.

- Document Retention: Keep all relevant documents for future reference.

Accounting for vehicle registration fees in MISA is straightforward with proper understanding. It ensures accurate financial reporting, expense management, and legal compliance. To learn more about auto garage accounting, explore other related accounting practices.

Conclusion

Vehicle registration fee accounting in MISA is crucial for business accounting. By following these steps and guidelines, companies ensure accurate financial reporting and efficient cost management. Learn more about car insurance accounting in MISA to understand related vehicle expenses.

FAQ on Vehicle Registration Fee Accounting in MISA

- What is a vehicle registration fee?

- How is the vehicle registration fee calculated?

- Which account is used for vehicle registration fee accounting in MISA?

- What documents should I keep when accounting for vehicle registration fees?

- How are registration fees allocated in MISA?

- How are errors in registration fee accounting handled?

- Are there accounting software options besides MISA for vehicle registration fees?

FAQ on vehicle registration fee accounting

FAQ on vehicle registration fee accounting

Understanding vehicle registration fee accounting is essential for those interested in car dealership accounting.

For assistance, contact us at Phone: 0968239999, Email: [email protected], or visit us at: TT36 – CN9 Road, Tu Liem Industrial Zone, Phuong Canh Ward, Nam Tu Liem District, Hanoi. We offer 24/7 customer support.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.