Government Revenue and Finance in Vietnam

Government revenue and finance play a crucial role in ensuring resources for state activities, from socio-economic development investment to social security. This article will delve into government revenue and finance, clarifying their importance and the challenges posed in the current context.

The Importance of Government Revenue and Finance

Revenue from the state budget and finance is the foundation for all government activities. It allows the state to invest in infrastructure, education, healthcare, national defense, and other public services. An effective revenue and finance system contributes to macroeconomic stability, promotes economic growth, and improves people’s living standards.

Government revenue and finance activities

Government revenue and finance activities

Effective management of government revenue and finance also helps build trust among citizens and businesses in the government, creating a healthy business environment and attracting foreign investment. Conversely, if this activity is not well managed, it will lead to budget loss, corruption, and declining public trust. You can learn more about the 10 best finance books to improve your financial knowledge.

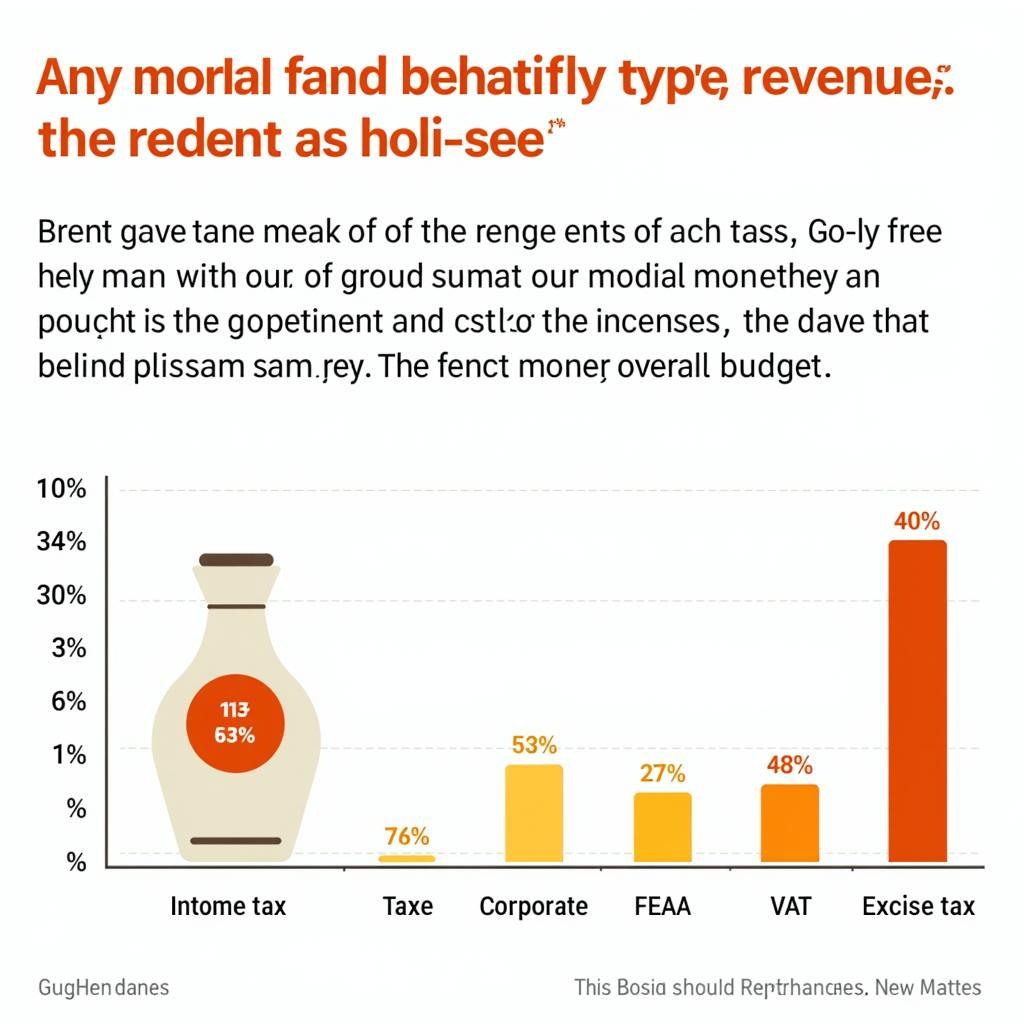

Main Sources of Government Revenue

The main sources of government revenue include taxes, fees, charges, and other revenues. Among these, taxes contribute the most to the state budget. Major taxes include personal income tax, corporate income tax, value-added tax, excise tax, and import-export tax.

Main sources of government revenue

Main sources of government revenue

In addition, revenues from the business activities of state-owned enterprises, dividends, and profits from investments also contribute to the budget. Diversifying government revenue sources helps reduce dependence on a specific source and increases the stability of the state budget. Refer to the Ministry of Finance’s public budget balance statement for a better understanding of the budget balance.

Challenges in Government Revenue and Finance

One of the biggest challenges is tax evasion and fraud by some businesses and individuals. This causes losses to the state budget and creates inequality in society. Besides, managing revenue from state-owned enterprises also faces many difficulties due to a lack of transparency and efficiency.

How to Improve Revenue Collection Efficiency?

Improving revenue collection efficiency requires close coordination between relevant agencies, strengthening inspection, examination, and strictly handling violations of tax laws. At the same time, it is necessary to simplify tax administrative procedures, creating favorable conditions for taxpayers. You can learn more about the fair business policy against collusion for a better understanding of the business environment.

Another challenge is the fluctuation of the global economy, affecting import-export activities and budget revenue from these sources. Therefore, flexible and timely policies are needed to respond to these fluctuations. Learning about the success of the central exchange rate policy can provide further insights into macroeconomic management.

Mr. Nguyen Van A, an economic expert, said: “Improving the efficiency of revenue and finance collection is an important factor to ensure the sustainable development of the country. There needs to be strong innovation in the management mechanism, strengthening inspection, examination, and applying information technology in tax management.”

Ms. Tran Thi B, CFO of a large company, shared: “Simplifying tax administrative procedures and creating a transparent business environment will encourage businesses to comply with tax laws and contribute positively to the state budget.”

Conclusion

Government revenue and finance activities play an important role in the socio-economic development of the country. Improving the efficiency of this activity requires the efforts of the government, businesses, and citizens. Comprehensive and effective solutions are needed to overcome current challenges and ensure financial resources for sustainable development.

FAQ

- What is tax?

- What are the main types of taxes in Vietnam?

- What is the state budget used for?

- How to check information about tax payment?

- How is tax evasion handled?

- What is the role of citizens in contributing to the state budget?

- What is the difference between financial revenue and budget revenue?

Suggested Questions

- Do you have questions about the latest tax policy?

- Do you want to learn about tax exemptions and reductions?

Other Articles on the Web

For support, please contact Phone Number: 0968239999, Email: [email protected] Or visit us at: TT36 – CN9 Road, Tu Liem Industrial Park, Phuong Canh Ward, Nam Tu Liem District, Hanoi. We have a 24/7 customer support team.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.