Interest Rates: A Key Monetary Policy Tool

Interest rates are a crucial monetary policy tool, influencing the economy by affecting spending and investment. Adjusting interest rates helps control inflation, stimulate economic growth, and maintain financial stability.

Interest Rates and Their Role in Monetary Policy

Monetary policy utilizes interest rates as a primary tool for regulating the economy. By raising or lowering interest rates, the central bank can influence the money supply, thereby impacting inflation and economic growth. Low interest rates encourage borrowing, stimulating investment and consumption, contributing to growth. Conversely, high interest rates reduce borrowing demand, control inflation, and stabilize the economy. Interest rate adjustments provide a flexible and effective means for central banks to respond quickly to market fluctuations.

How Interest Rates Affect Economic Activity

Interest rates directly influence the investment and consumption decisions of businesses and individuals. Low interest rates reduce borrowing costs, encouraging businesses to expand production, operations, create jobs, and foster economic growth. Simultaneously, low interest rates encourage consumers to borrow for home purchases, vehicles, stimulating consumption and driving growth. Conversely, when interest rates are high, borrowing costs rise, making businesses more cautious about investments, and consumers limit spending, leading to a slowdown in economic growth.

Types of Interest Rates and Their Impacts

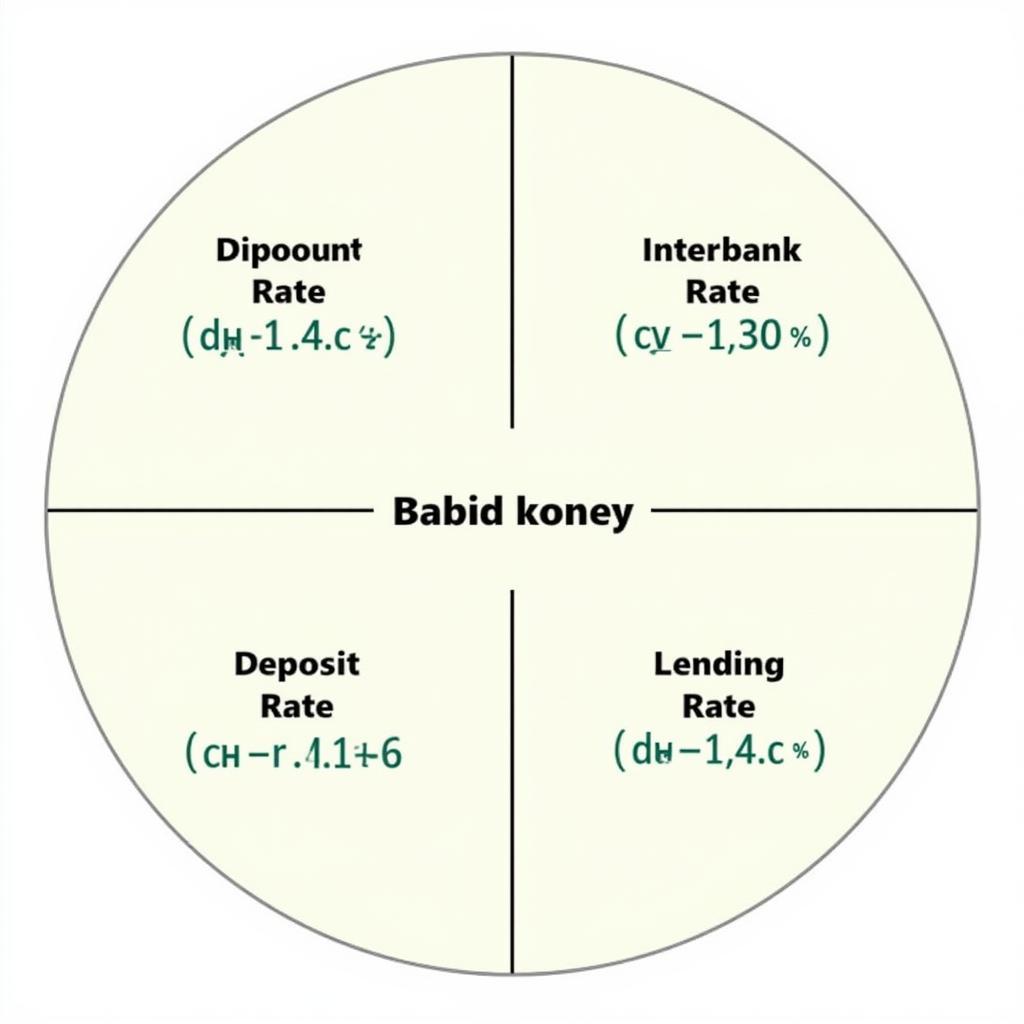

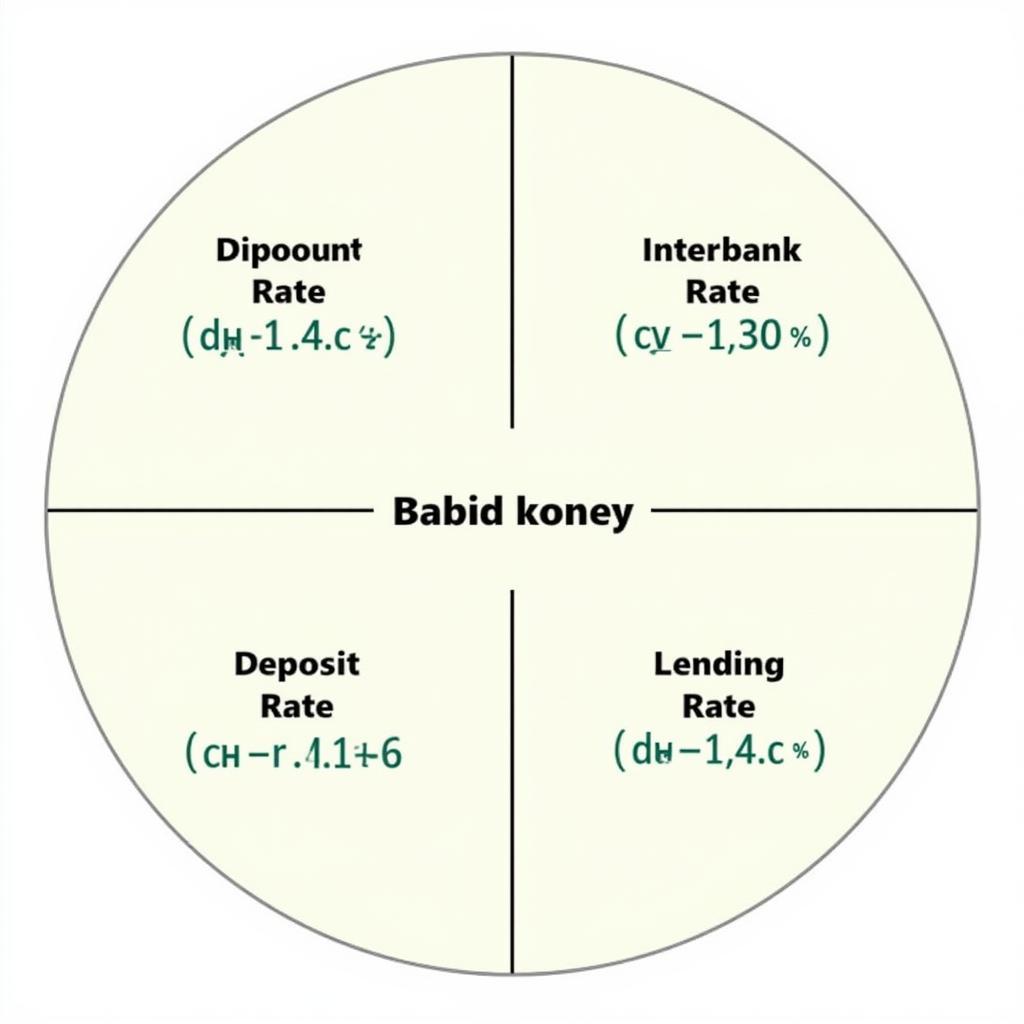

Various types of interest rates exist, each with its own impact on the economy. The discount rate is the interest rate at which the central bank lends to commercial banks. The interbank rate is the rate at which commercial banks lend to each other. The deposit rate is the interest rate banks pay to depositors. The lending rate is the interest rate banks charge borrowers. All these rates are interconnected and influenced by monetary policy.

Different types of interest rates and their impact on the economy

Different types of interest rates and their impact on the economy

Interest Rates as a Monetary Policy Tool: Real-World Examples

Interest rate adjustments are a vital tool used in various economic situations. For example, during periods of high inflation, the central bank may raise interest rates to reduce borrowing demand and curb inflation. Conversely, during economic recessions, the central bank may lower interest rates to stimulate investment and consumption, promoting economic recovery. Expansionary monetary policy is also a crucial tool of monetary policy.

Economist Nguyen Van A states: “Interest rates are the most important tool of monetary policy, having a profound impact on all aspects of the economy.”

Conclusion

Interest rates are a monetary policy tool that plays a crucial role in regulating the economy, controlling inflation, and promoting growth. Understanding interest rates and their impact helps individuals and businesses make informed financial decisions.

FAQ

- What is an interest rate? An interest rate is the fee charged for borrowing money, usually expressed as an annual percentage rate.

- What is monetary policy? Monetary policy refers to the actions undertaken by a central bank to manipulate the money supply and credit conditions to stimulate or restrain economic activity.

- How do interest rates affect me? Interest rates impact the cost of borrowing for home purchases, vehicle purchases, or consumer loans.

- How does the central bank adjust interest rates? The central bank adjusts interest rates through tools such as the discount rate and open market operations.

- How can I stay updated on interest rate information? You can track interest rate information from financial news sources and the central bank’s website. The 2018 policy may provide further information.

- Why are interest rates important? Interest rates are important because they influence investment, consumption, inflation, and economic growth.

- What should I do when interest rates change? You should review your financial plan when interest rates change. Loan eligibility criteria for policy banks in Ho Chi Minh City might be helpful.

Economist Pham Thi B notes: “Closely monitoring interest rate fluctuations is essential for personal and business financial planning.”

U.S. government foreign trade policy is also related to interest rates.

For assistance, please contact us at Phone: 0968239999, Email: [email protected] Or visit us at: TT36 – CN9 Road, Tu Liem Industrial Zone, Phuong Canh Ward, Nam Tu Liem District, Hanoi. We have a 24/7 customer support team. Phu Yen’s policy on training young intellectuals may also have useful information.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.