What Salary Should You Have Before Buying a Car?

“Building a house, getting married, and buying a buffalo” – these are three major milestones in life. While owning a car may have replaced the buffalo, it has become more common than ever. A car is not just a means of transportation; it symbolizes success, convenience, and a comfortable life. However, the question of what salary is sufficient to buy a car often leaves many people pondering.

What Monthly Salary Is Enough to Bring Home Your Dream Car?

Mr. Nguyen Van A, a personal finance expert at ABC Consulting, once shared: “Buying a car is not simply purchasing an item; it’s deciding to invest a significant amount of money. Therefore, careful financial consideration is crucial.”

A man reviewing a budget spreadsheet

A man reviewing a budget spreadsheet

In reality, there’s no specific salary number that deems one “ready” to buy a car. Besides income, the decision depends on several factors:

1. Usage Needs

Do you need a car for personal or family use? How frequently will you use it? If you primarily travel short distances within the city, a motorbike might be more suitable. Conversely, if you have a large family and frequently travel long distances, owning a car would be much more convenient.

2. Financial Capacity

Beyond the car’s purchase price, you need to factor in additional costs like registration fees, license plate fees, insurance, maintenance, repairs, fuel, and parking. According to many car owners, the total monthly cost of car ownership typically ranges from 5 to 10 million VND, or even higher, depending on the car model and usage frequency.

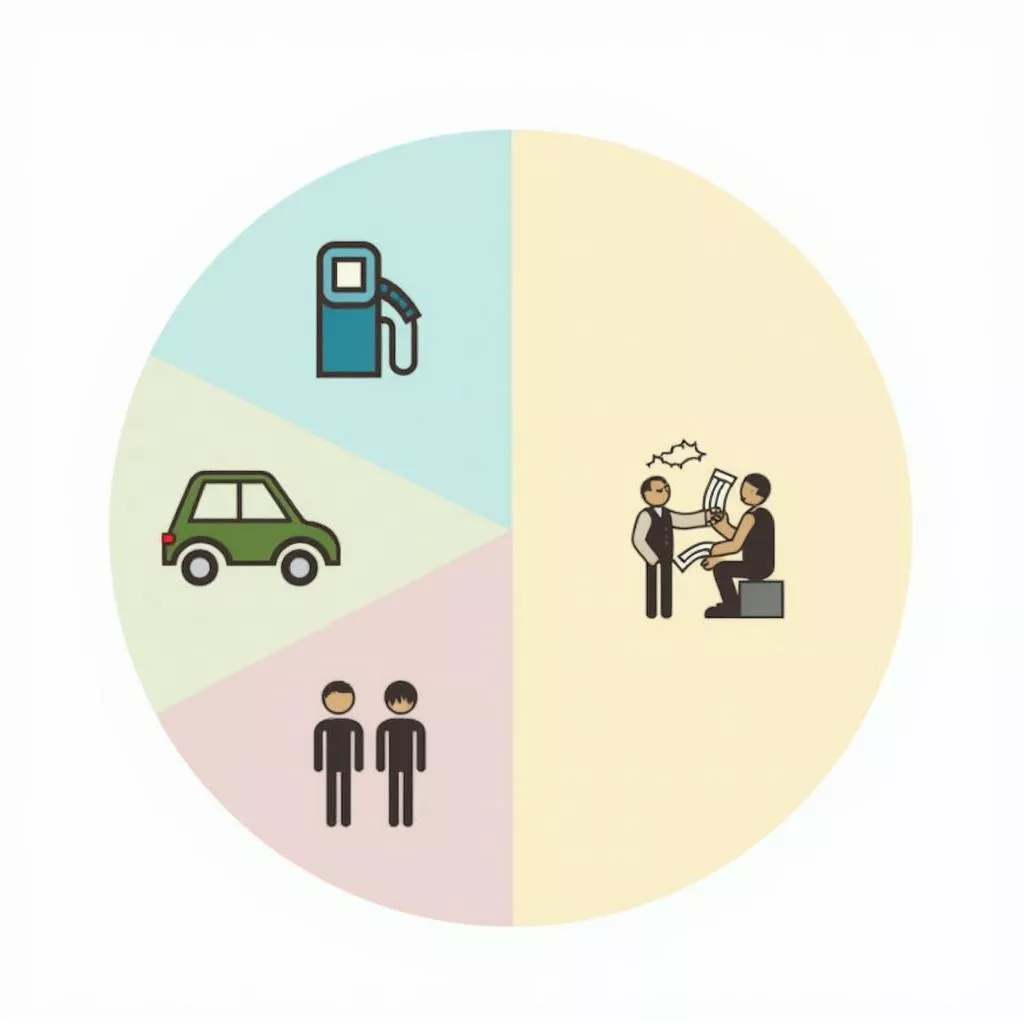

A pie chart illustrating monthly car expenses including fuel, maintenance, tolls…

A pie chart illustrating monthly car expenses including fuel, maintenance, tolls…

3. Funding Source

Are you willing to take out a car loan? If so, carefully calculate your monthly repayment capacity to ensure financial balance.

4. The “Playing it Safe” Mentality

Many people believe in long-term stability and prefer to “save for a rainy day.” Even with modest incomes, they are determined to buy a car for long-term security.

So, What Salary Is Enough to Buy a Car?

According to experienced car owners, to avoid a car purchase becoming a financial burden, you should ensure:

- A minimum down payment of 30% of the car’s value: Having a substantial amount of cash upfront reduces the pressure of loan repayments.

- Total monthly loan payments not exceeding 30% of your income: This ensures you still have enough to cover other essential living expenses.

For example, if you want to buy a car worth 500 million VND, you need at least 150 million VND for the down payment. You can borrow the remaining 350 million VND from a bank with a preferential interest rate for a 5-year term. This would result in monthly payments of around 7-8 million VND.

A woman signing a car loan contract with a bank employee

A woman signing a car loan contract with a bank employee

Important Considerations When Deciding to Buy a Car:

- Choose a car model that suits your needs and financial capabilities: Instead of chasing luxury and expensive models, prioritize affordable cars that meet your and your family’s needs.

- Thoroughly research the car: Before making a purchase, spend time researching different car models, comparing prices, and evaluating the pros and cons of each to choose the best fit.

- Understand the car buying process: Familiarize yourself with car loan procedures, insurance policies, and other related processes to avoid unnecessary complications.

Xe Tải Hà Nội – Your Source for Quality Trucks at Great Prices

Besides financial considerations, choosing a reputable dealer is also crucial. Xe Tải Hà Nội proudly provides a wide range of high-quality trucks, including box trucks, light trucks, vans, and trucks with capacities of 1 ton, 2 tons, 3.5 tons, and 8 tons, all at competitive prices. Contact us today for expert advice and support.

Contact Information:

- Phone: 0968239999

- Email: [email protected]

- Address: No. TT36 – CN9 Road, Tu Liem Industrial Zone, Phuong Canh Ward, Nam Tu Liem District, Hanoi.

You can also explore other related articles on our website:

We hope this article has provided you with valuable information to make the best decision for yourself.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.