Best Car Insurance Companies in Hanoi

Choosing the right car insurance can be a daunting task. A well-informed decision not only protects your finances but also provides peace of mind on every journey. This article provides comprehensive information to help you choose the best car insurance for your needs.

Factors to Consider When Choosing Car Insurance

Choosing car insurance isn’t as simple as opting for the cheapest option. Several factors should be considered to find the policy that best suits your needs and budget. Key factors to consider include:

- Reputation and Financial Strength of the Insurance Company: Research the company’s history, market share, and financial stability. A reputable and financially sound company ensures your claims are paid fully and promptly.

- Coverage: Different policies offer varying coverage. Determine your needs, such as whether you require only mandatory liability insurance or desire comprehensive coverage.

- Premiums: Comparing premiums across different insurers is essential, but don’t solely focus on price. Consider coverage and customer service.

- Customer Service: Excellent customer service ensures prompt and efficient support during the claims process.

- Network of Partner Garages: A wide network of affiliated garages facilitates convenient vehicle repairs in case of accidents.

Interested in buying a used imported car? Learn more about buying Japanese imported cars.

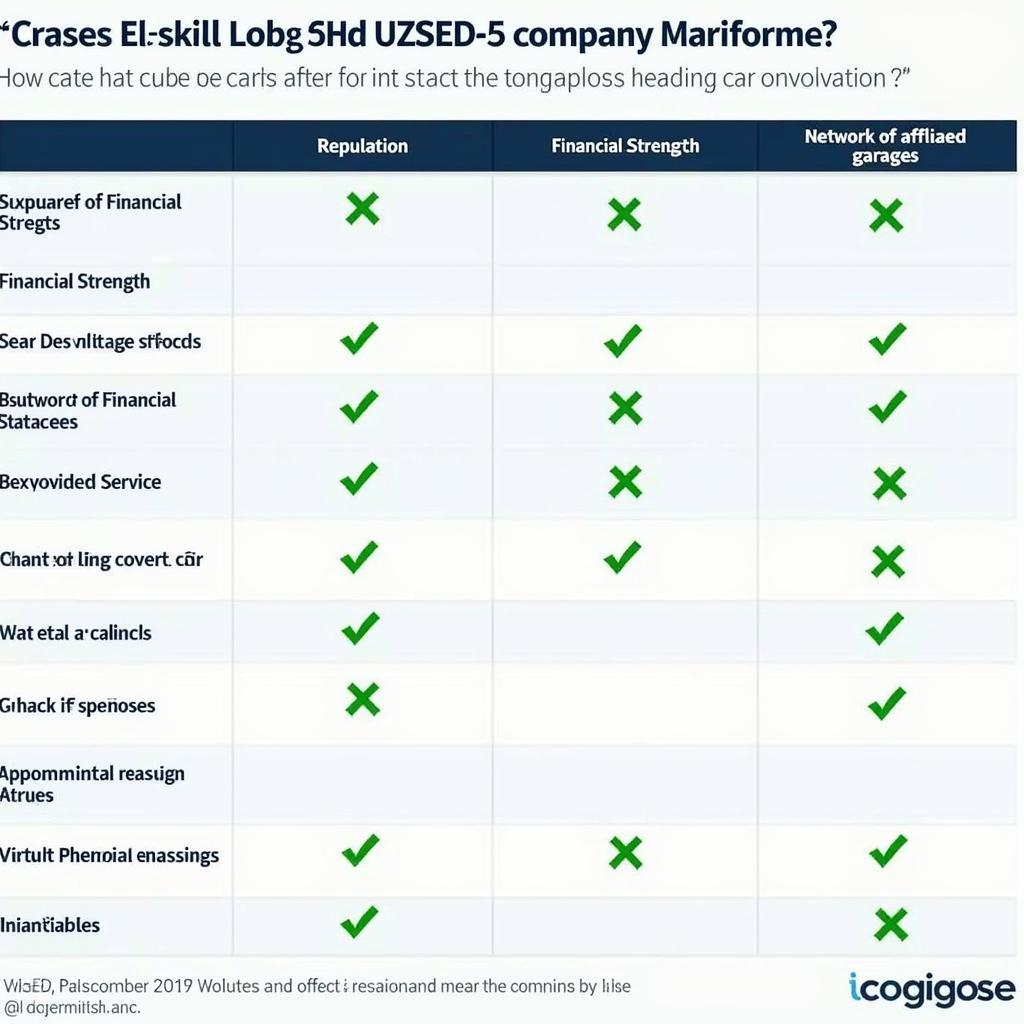

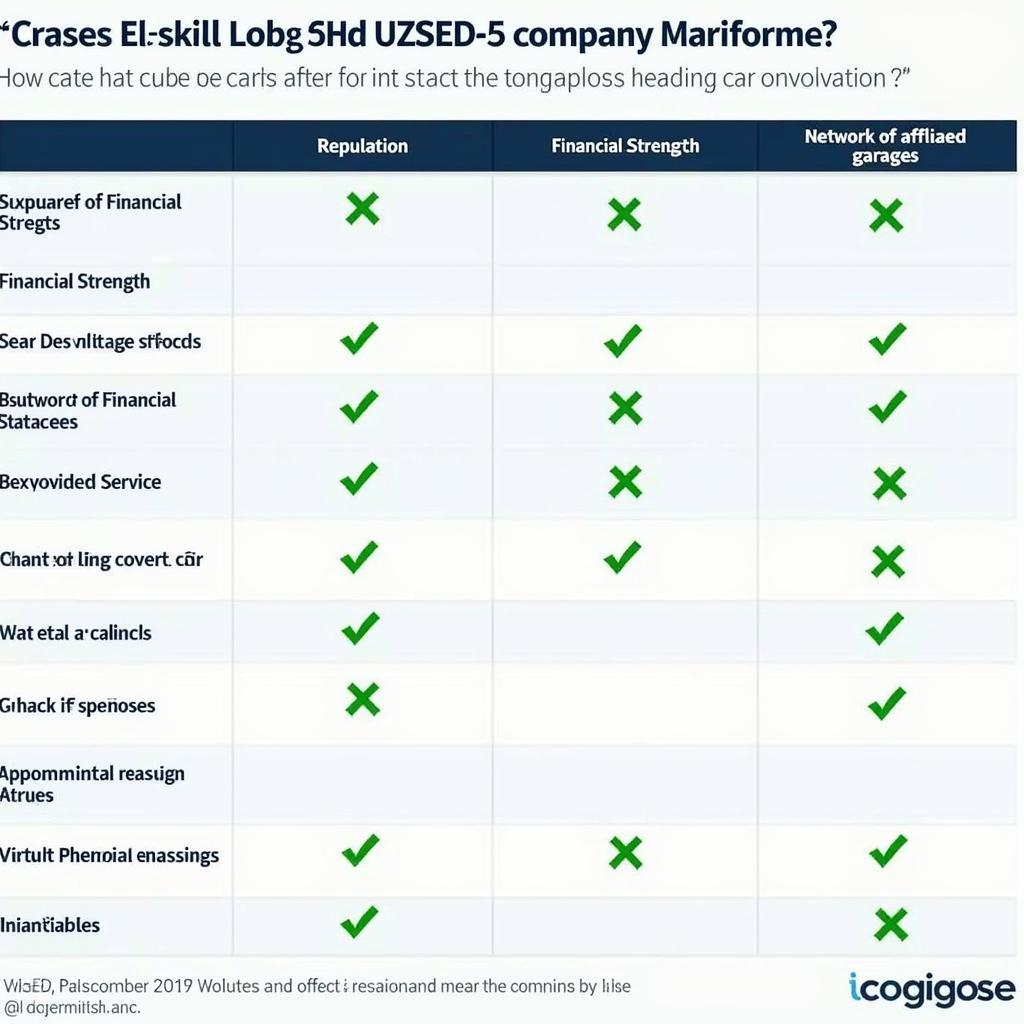

Comparing Popular Car Insurance Companies

Numerous car insurance companies operate in the market. To simplify your decision, we compare some popular providers based on the criteria mentioned above. Note that this information is for reference only; conduct your own research for a comprehensive understanding.

PVI Insurance

PVI Insurance is a leading insurance company in Vietnam, known for its strong reputation, financial stability, and extensive network of partner garages.

Bao Viet Insurance

Bao Viet Insurance is another reliable option with a long operating history and diverse insurance packages.

Liberty Insurance

Liberty Insurance is highly regarded for its excellent customer service and efficient claims processing.

Comparison of leading car insurance companies

Comparison of leading car insurance companies

Best Car Insurance for Trucks

Choosing the right insurance for trucks is crucial due to the higher risk of accidents and damages compared to cars. Consider factors like truck weight, cargo type, and operating area, in addition to the factors mentioned earlier.

Truck insurance: The right choice for transportation businesses

Truck insurance: The right choice for transportation businesses

If you’re a car salesperson, learn more about being a car salesperson in Hanoi.

Conclusion

The best car insurance company depends on individual needs and circumstances. This article aims to provide helpful information for making an informed decision.

Nguyen Van A, a motor vehicle insurance expert, advises, “Choosing car insurance shouldn’t be solely based on price but should consider factors like company reputation, coverage, and customer service.”

FAQ

- What is mandatory car insurance?

- What is comprehensive car insurance?

- What is the process for purchasing car insurance?

- What should I do to file a claim after an accident?

- Can I purchase car insurance online?

- How can I compare insurance premiums across different companies?

- Can I cancel my car insurance policy?

Looking for driver’s license test preparation materials? Visit our driver’s license test resources.

Common Scenarios When Choosing Car Insurance

- Scenario 1: New car purchase, seeking comprehensive coverage.

- Scenario 2: Older car, requiring only mandatory insurance.

- Scenario 3: Frequent long-distance travel, needing comprehensive roadside assistance.

Related Articles and Resources

- How much does a Range Rover cost? Find out Range Rover prices.

- Learn about the Lang Son car market at Lang Son Car Market.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.