Vietnam’s New Import and Export Policies: A Comprehensive Guide

New import and export policies are significantly impacting global and Vietnamese trade. Staying informed about these changes is crucial for businesses to maintain a competitive edge and achieve sustainable growth. This article will analyze the latest policies, their impact on import and export activities, and provide valuable advice for businesses.

Impact of New Policies on Import and Export Businesses

Import and export policies are constantly evolving, requiring businesses to adapt quickly. New policies can create both opportunities and challenges. For example, reducing import taxes on certain goods can help businesses reduce costs and increase profits. Conversely, stricter quality control measures can make it difficult for businesses to meet new standards.

Key Changes in Import and Export Tax Policies

Some significant changes in import and export tax policies include adjustments to import and export tax rates for certain goods, the implementation of anti-dumping and anti-subsidy measures, and other trade remedies. These changes aim to protect domestic production, promote exports, and ensure trade balance.

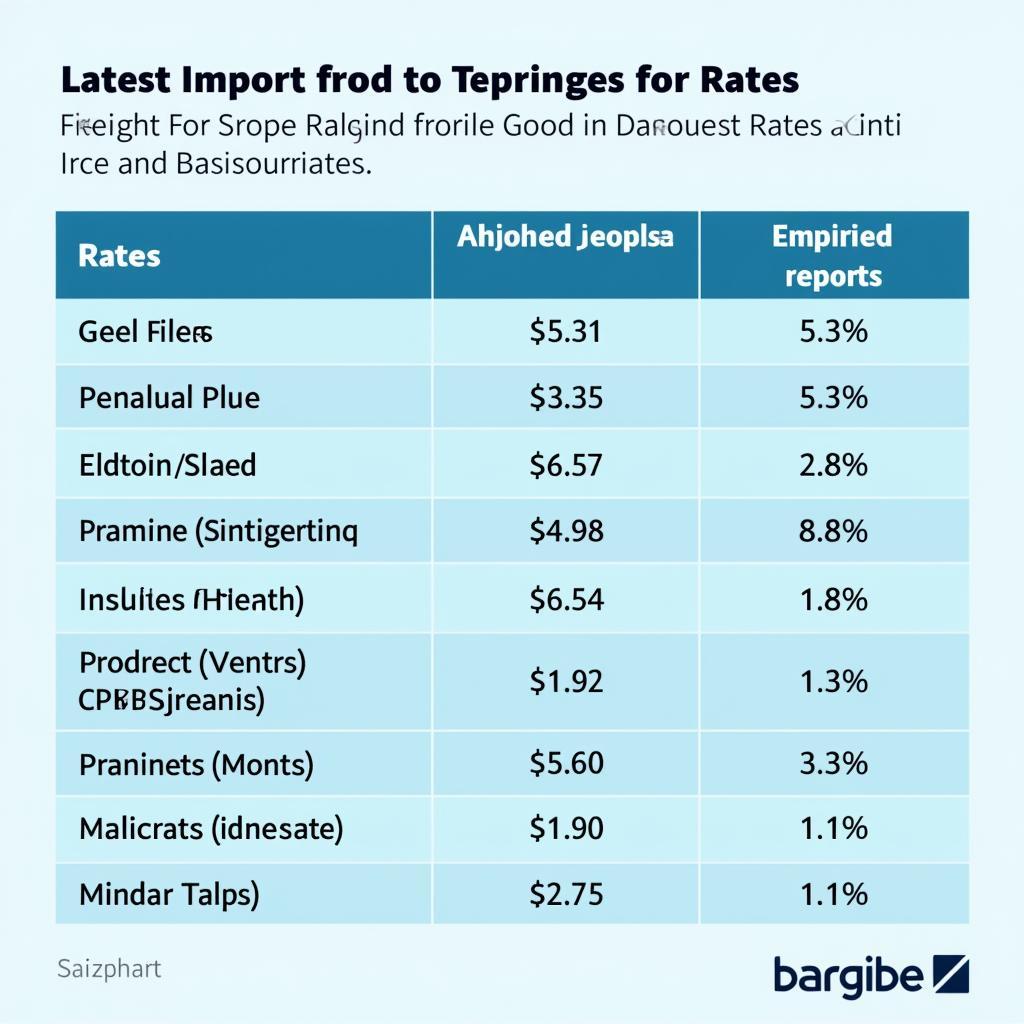

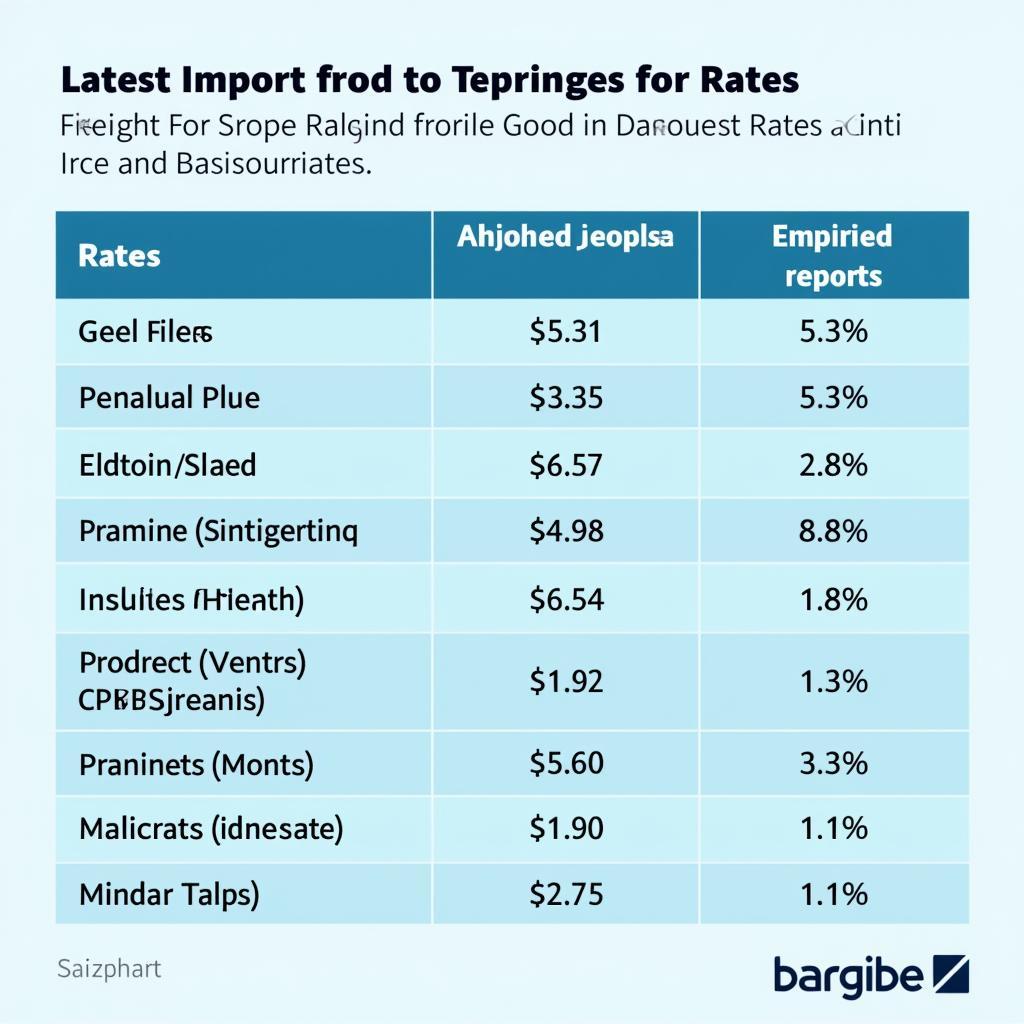

Updated import and export tax policies

Updated import and export tax policies

Impact of Free Trade Agreements on Import and Export

Vietnam participates in numerous Free Trade Agreements (FTAs), providing many opportunities for import and export businesses. These FTAs often include tariff reductions or eliminations, simplified customs procedures, and favorable trade conditions. However, businesses must understand the regulations and standards of each FTA to maximize benefits and avoid legal risks.

Customs Procedures and Import and Export Goods Management

Customs procedures and import and export goods management have also undergone significant changes. The application of information technology in customs management simplifies procedures, reduces clearance time, and increases transparency. However, businesses need to update their knowledge and skills to effectively utilize electronic customs systems.

New Regulations on Import and Export Goods Quality Control

New regulations on import and export goods quality control are becoming increasingly stringent. This aims to ensure consumer safety and environmental protection. Businesses need to proactively understand and meet the quality, safety, hygiene, and technical standards of imported and exported goods to avoid penalties and damage to their brand reputation.

According to Mr. Nguyen Van A, a leading logistics expert in Vietnam, “Staying informed about changes in import and export policies is crucial for business survival. Businesses need to invest in human resource training, enhance management capacity, and apply technology to adapt to the increasingly competitive business environment.”

Technology Application in Import and Export Supply Chain Management

The application of technology in import and export supply chain management is becoming an inevitable trend. Technological solutions such as blockchain, IoT, and AI help optimize logistics processes, reduce transportation costs, and improve warehouse management efficiency.

Ms. Tran Thi B, Director of Company Cổ phần D, shared: “Applying technology has helped us significantly reduce transportation time and costs, while enhancing our competitiveness in the international market.”

Conclusion

New import and export policies are creating significant changes in trade activities. Businesses need to proactively research, analyze, and adapt to these changes to capitalize on opportunities and overcome challenges. Investing in technology, enhancing management capacity, and complying with legal regulations are key to success for import and export businesses in the new era.

FAQ

- Which new policies affect import and export taxes?

- How can businesses meet the new regulations on goods quality control?

- What is the role of technology in import and export supply chain management?

- Which Free Trade Agreements have a significant impact on Vietnam’s import and export activities?

- What should businesses do to benefit from the new import and export policies?

- What risks might businesses face if they do not update themselves on the new import and export policies?

- Where can businesses find official information on import and export policies?

Suggested Related Articles and Questions

- Suitable trucks for import and export goods transportation

- Procedures for registering trucks for commercial transportation

- Truck price list in Hanoi

For assistance, please contact us at Phone: 0968239999, Email: [email protected] or visit our address: No. TT36 – CN9 Road, Tu Liem Industrial Zone, Phuong Canh Ward, Nam Tu Liem District, Hanoi. We have a 24/7 customer service team.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.