Understanding Monetary Policy: A Comprehensive Guide

Monetary policy is a crucial tool for regulating the economy. It involves controlling the money supply, interest rates, and credit to achieve macroeconomic goals like price stability, economic growth, and job creation. Understanding these fundamentals helps us grasp how the economy functions and how monetary policy impacts our daily lives.

Objectives of Monetary Policy

Monetary policy aims to achieve economic stability. Key objectives typically include controlling inflation, promoting sustainable economic growth, and maintaining low unemployment. To achieve these goals, governments often use tools like adjusting interest rates, controlling the money supply, and intervening in foreign exchange markets. You can learn more about other policies at General Department of Taxation Policy.

Tools of Monetary Policy

Interest Rates

Interest rates are the most important tool of monetary policy. By raising or lowering interest rates, the central bank can influence borrowing costs, thereby impacting investment and consumption. Low interest rates encourage borrowing and investment, while high interest rates have the opposite effect.

Reserve Requirements

Reserve requirements are the percentage of deposits that commercial banks must hold at the central bank. Changes in reserve requirements affect banks’ lending capacity, thus impacting the money supply.

Open Market Operations

The central bank can buy or sell government bonds on the open market to adjust the money supply. Buying bonds injects money into the economy, while selling bonds withdraws money from circulation.

Exchange Rates

In some cases, the central bank can intervene in the foreign exchange market to influence exchange rates. This can help stabilize prices of imports and exports, thereby impacting inflation.

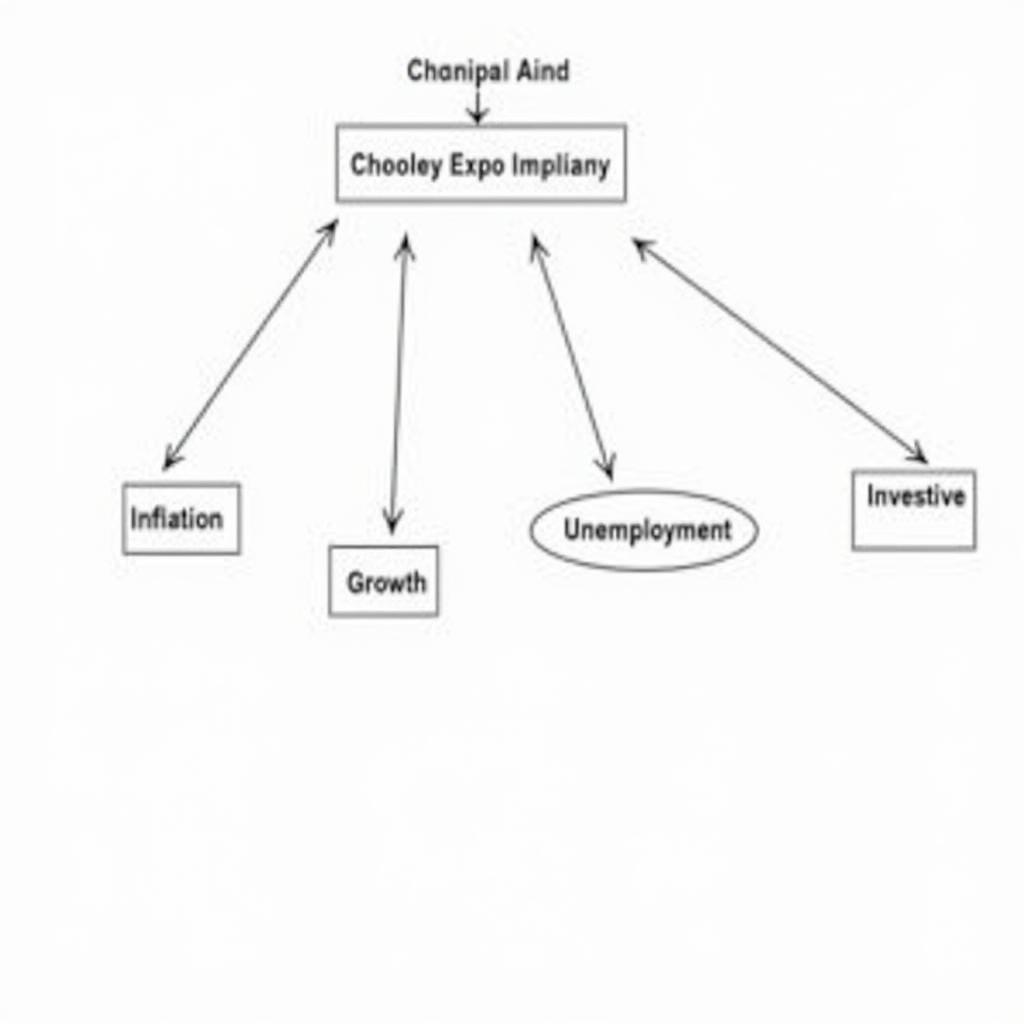

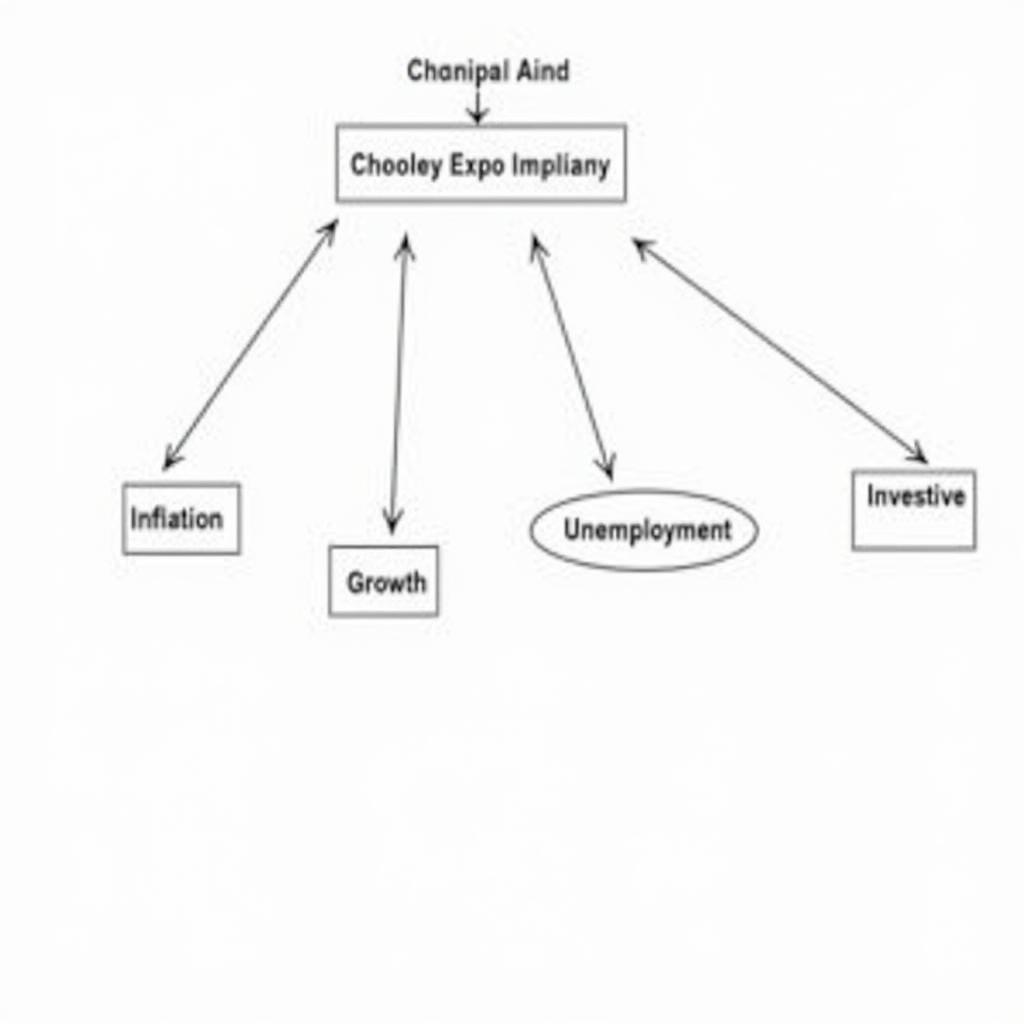

Impact of Monetary Policy

Monetary policy has a broad impact on the economy. It affects inflation, economic growth, unemployment rates, investment, and consumption. Effective monetary policy implementation requires careful consideration and analysis of the current economic situation. If you are interested in healthcare policy, please refer to Healthcare Policy in the US.

Impact of Monetary Policy

Impact of Monetary Policy

Nguyen Van A, an economist at the Institute of Economic Research, stated: “Monetary policy is a powerful tool, but it needs to be used cautiously. Misuse of monetary policy can lead to negative consequences for the economy.”

Challenges in Implementing Monetary Policy

Implementing monetary policy faces many challenges, including global market volatility, rapid technological change, and future uncertainties. Governments need to be flexible and adaptable to address these challenges. You can learn more about return policies at Just Men’s Return Policy.

Challenges of Monetary Policy

Challenges of Monetary Policy

Tran Thi B, Director of Bank X, shared: “In the current context, predicting the impact of monetary policy is increasingly difficult. We need to constantly monitor and assess the situation to make appropriate decisions.”

Conclusion

The fundamentals of monetary policy involve using tools like interest rates, reserve requirements, and open market operations to achieve macroeconomic goals. Understanding these concepts is crucial for comprehending how the economy operates.

FAQ

- What is monetary policy?

- What are the main objectives of monetary policy?

- What are the main tools of monetary policy?

- How does monetary policy impact the economy?

- What are the challenges in implementing monetary policy?

- Who is responsible for implementing monetary policy?

- How to evaluate the effectiveness of monetary policy?

You can learn more about the government budget at Government Budget Formula. Learn more about the role of public policy at Thesis on the Role of Public Policy.

For assistance, please contact Phone Number: 0968239999, Email: [email protected] Or visit us at: No. TT36 – CN9 Road, Tu Liem Industrial Park, Phuong Canh Ward, Nam Tu Liem District, Hanoi. We have a 24/7 customer support team.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.