Your Guide to Financing a Truck in Hanoi: A Step-by-Step Process

Anh Tuan, a resident of Dong Anh district, Hanoi, has spent his life relying on his old motorbike. His biggest dream was to own a truck for his business, increasing his income and providing for his family. However, his savings weren’t enough to realize this dream. One day, a friend told him about truck financing, offering a glimmer of hope. What is truck financing? Is it as complicated as people say? Let’s explore the details with Xe Tai Ha Noi in this article!

Truck Financing – The Key to Owning Your Dream Truck

Truck financing involves borrowing money from a bank or financial institution to purchase a truck, then repaying the loan in installments over a set period. This allows individuals with limited capital, like Anh Tuan, to own their dream truck without a long wait.

Advantages of Truck Financing

- Reduced Financial Pressure: Instead of a large upfront payment, you can divide the cost into smaller, manageable installments.

- Faster Ownership: You can receive your truck and start your business even without having 100% of the purchase price.

- Flexible Vehicle Selection: Choose a truck that suits your needs and budget.

Potential Drawbacks

- Additional Costs: Besides the principal amount, you’ll pay interest to the lender.

- Risk of Repossession: Failure to make timely payments may lead to the truck being repossessed.

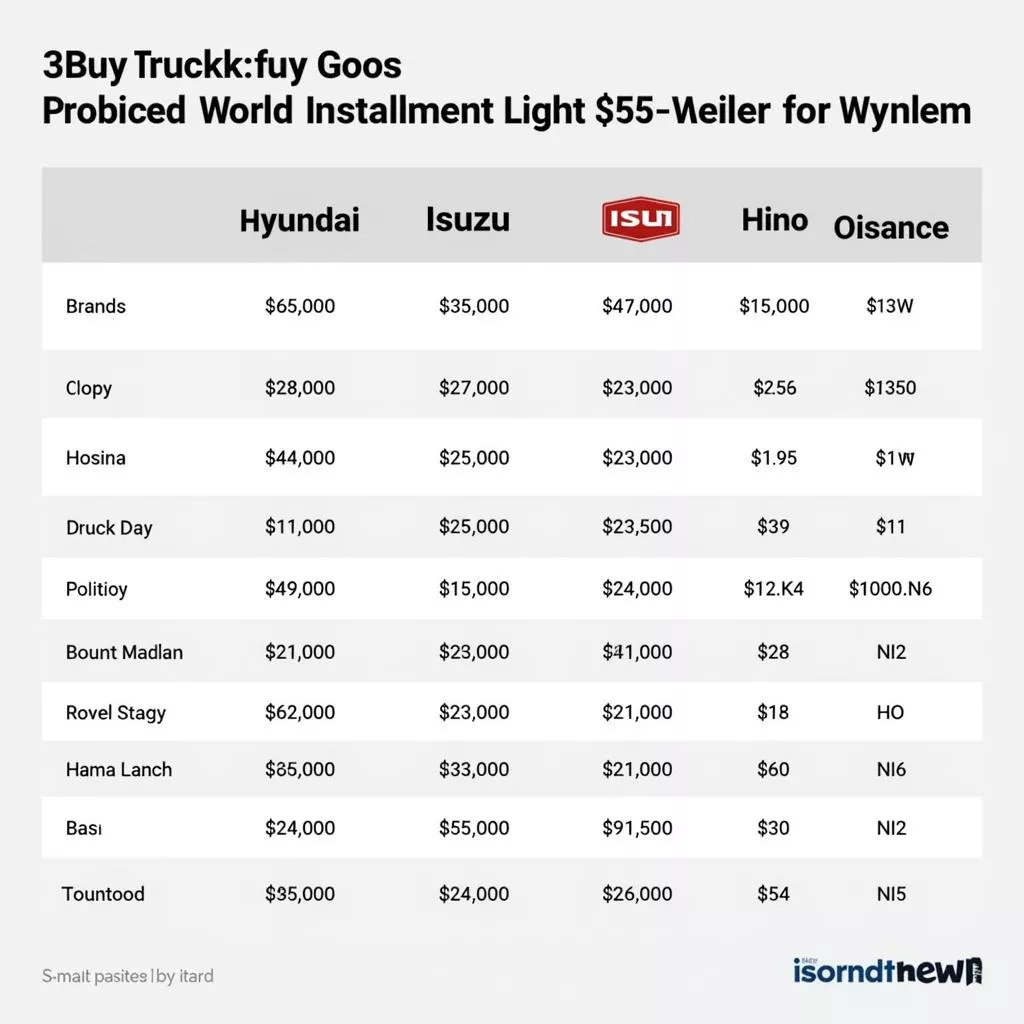

Truck financing price list

Truck financing price list

Truck Financing Price List (Reference)

| Brand | Model | Listed Price (VNĐ) | Down Payment (Estimated) |

|---|---|---|---|

| Hyundai | Mighty N250 | 500.000.000 | 150.000.000 |

| Isuzu | QKR77HE4 | 400.000.000 | 120.000.000 |

| Hino | XZU720 | 600.000.000 | 180.000.000 |

Note: This price list is for reference only. Actual prices may vary depending on the time of purchase, dealership, and promotions.

Important Considerations for Truck Financing

- Choose a Reputable Lender: Research interest rates, fees, and contract terms before committing to a loan.

- Assess Your Financial Capacity: Ensure you can afford the monthly payments to avoid penalties or repossession.

- Select the Right Truck: Different trucks have varying load capacities and dimensions, suitable for different goods and routes.

Truck driver transporting goods

Truck driver transporting goods

Frequently Asked Questions about Truck Financing

1. What Documents are Required for a Truck Loan Application?

Typically, you’ll need:

- ID Card/Citizen Identity Card

- Household Registration Book

- Marriage Certificate/Single Certificate

- Proof of Income (Employment Contract, Bank Statement, etc.)

- Collateral Documents (if applicable)

2. What is the Down Payment for Truck Financing?

The down payment usually ranges from 20% to 30% of the truck’s value.

3. What is the Loan Term for Truck Financing?

Loan terms typically range from 36 to 72 months.

Easy Truck Financing at Xe Tai Ha Noi

With extensive experience in the truck industry, Xe Tai Ha Noi is a trusted partner of reputable banks and financial institutions. We are committed to providing customers with simple, fast truck financing procedures and the best interest rates.

Contact Xe Tai Ha Noi at [address], hotline [phone number], or visit our website [website address] for detailed consultation and the best quotes.

Similar Products at Xe Tai Ha Noi

Besides trucks, Xe Tai Ha Noi also offers a wide range of other vehicles, including:

- Dump Trucks

- Tractor Trucks

- Specialized Vehicles

Various truck models

Various truck models

Conclusion

We hope this article has provided valuable information about truck financing. We wish you the best in owning your dream truck and achieving success in your career!

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.