Vietnam Truck Taxes: What You Need to Know Before Buying

“September is the lucky month to buy a vehicle,” my friend, a long-time truck driver on the Lang – Hoa Lac route, winked as I admired a brand new Hino box truck at the dealership near Big C Thang Long. Indeed, buying a truck isn’t just about choosing an auspicious date; it’s an economic calculation where “truck taxes” are a crucial factor.

Truck Taxes in Vietnam: A Common Concern

“Truck taxes” are a phrase that often causes headaches for buyers, especially first-time owners. Understanding truck tax information not only helps you prepare financially but also avoids potential legal issues.

What are Truck Taxes?

Simply put, truck taxes are the percentage of the vehicle’s value that you must pay to the government when buying and using it. This tax rate depends on several factors:

- Vehicle Type: Trucks, buses, cars, etc.

- Engine Displacement: Larger engines generally incur higher taxes.

- Origin: Domestically assembled or imported vehicles.

- Registration Area: Major cities like Hanoi often have higher registration fees.

Why Pay Truck Taxes?

Truck taxes are a significant source of revenue for the state budget, used to invest in transport infrastructure development, ensure public order and safety, and fund various social programs.

Latest Truck Tax Rates in Vietnam

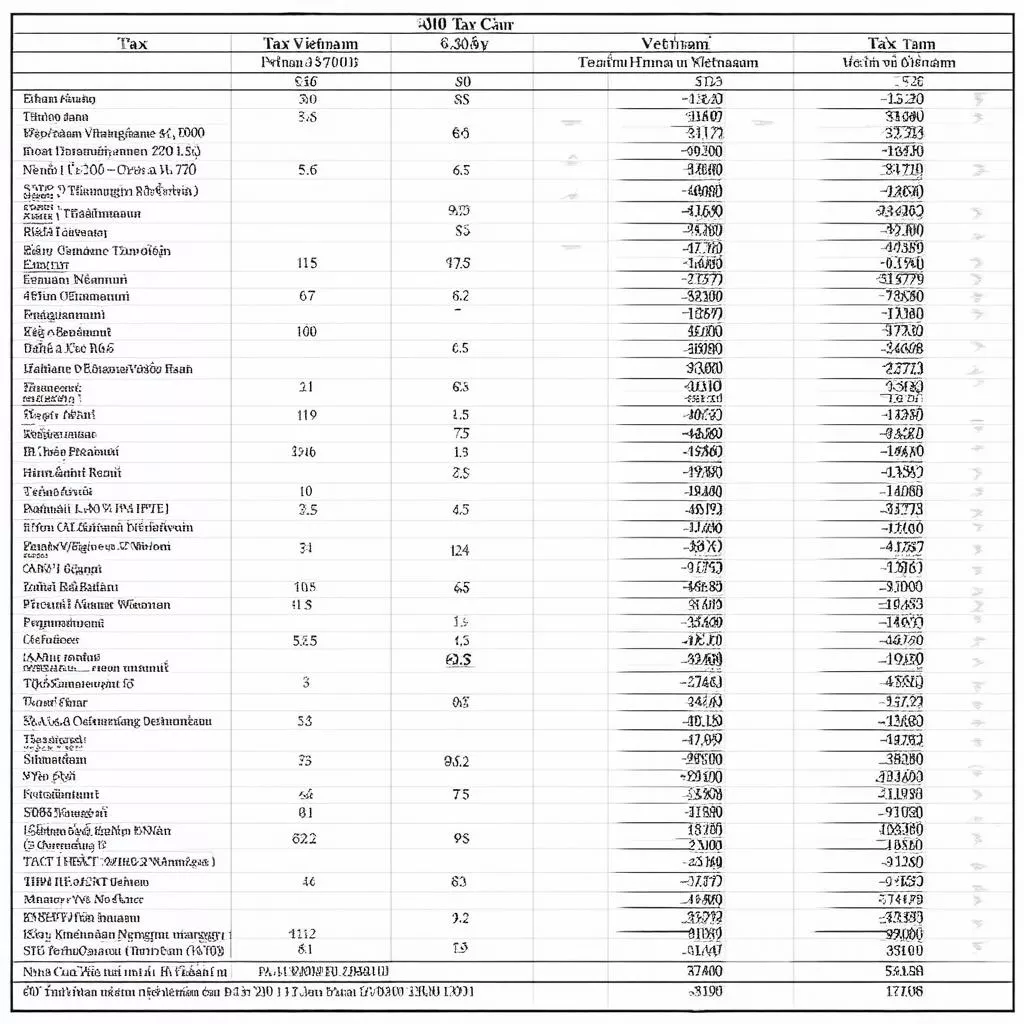

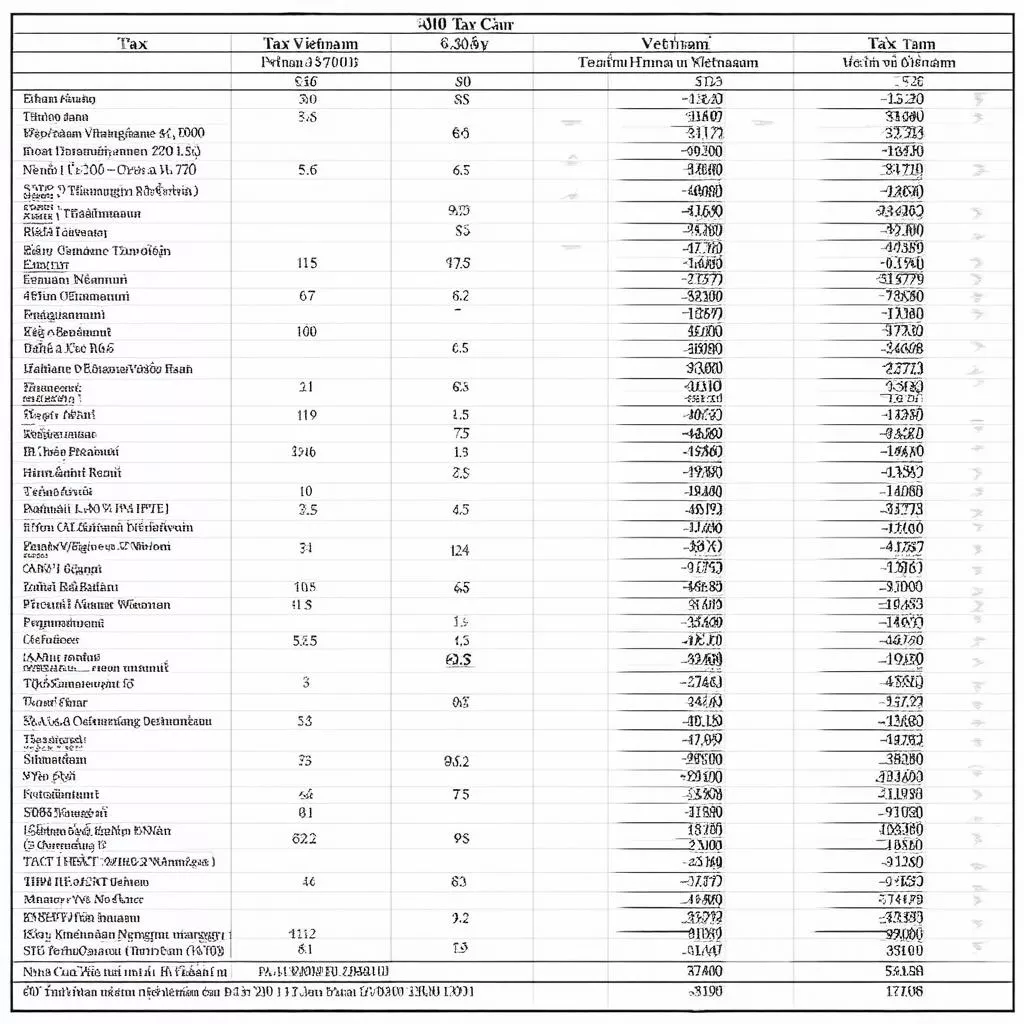

For a comprehensive overview, XE TẢI HÀ NỘI provides the latest truck tax rate table:

| Vehicle Type | Engine Displacement | Tax Rate |

|---|---|---|

| Car | Under 1,500cc | 10% |

| 1,500cc – 2,500cc | 15% | |

| Above 2,500cc | 20% | |

| Truck | Under 2,500 kg | 2% |

| 2,500 – 3,500 kg | 5% | |

| Above 3,500 kg | 7% |

Note: This table is for reference only. Actual tax rates may vary based on local regulations.

Vietnam Truck Tax Rates

Vietnam Truck Tax Rates

Hit the Road with Confidence: Truck Tax Tips

To avoid surprises and unnecessary hassles when buying a truck, keep these points in mind:

- Thorough Research: Consult various sources like the Ministry of Finance website, dealerships, or consultants for truck tax information.

- Choose Reputable Dealers: Buying from reputable dealerships like XE TẢI HÀ NỘI ensures vehicle origin, quality, and comprehensive tax and fee guidance.

- Keep Receipts and Documents: These are essential for tax payment and vehicle registration procedures.

“Big car, big direction,” Mr. Nguyen Van A, a Hanoi-based vehicle feng shui expert, once said. Choosing a truck that suits your needs, financial capabilities, and understanding tax regulations are crucial for a smooth journey and good fortune on the road.

Frequently Asked Questions about Truck Taxes

- Are truck taxes different from car taxes? Yes, truck taxes are generally lower than car taxes due to their primary use for cargo transportation.

- How can I calculate the exact tax amount? Use online truck tax calculators or contact XE TẢI HÀ NỘI consultants for assistance.

XE TẢI HÀ NỘI Truck Dealership

XE TẢI HÀ NỘI Truck Dealership

Choose XE TẢI HÀ NỘI: Your Trusted Truck Partner

With showrooms across Hanoi’s districts, including Cau Giay, Long Bien, and Ha Dong, XE TẢI HÀ NỘI is a trusted source for quality trucks. We offer a wide range of brands like Hyundai, Isuzu, and Thaco Trường Hải to meet diverse customer needs.

Contact XE TẢI HÀ NỘI for consultation and attractive offers!

Learn More:

Trucks are not just vehicles; they’re the livelihood of many families. We hope this article provides valuable insights into truck taxes, empowering you to confidently invest and bring home your ideal truck.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.