Vietnam Car Import Taxes: A Comprehensive Guide

“Vehicles are like people, each with a soul,” an old saying emphasizing the importance of transportation in our lives. For those looking to own a brand new truck, understanding car import taxes is crucial. These taxes significantly contribute to the final vehicle price, directly impacting your budget.

What Are Car Import Taxes?

Car import taxes are levied on vehicles imported into Vietnam. Their purpose is to regulate the market, protect domestic production, and generate government revenue.

Types of Taxes on Imported Cars

When importing a car, you will be subject to the following taxes:

1. Import Duty

Import duty is calculated based on the value of the imported car. The specific rate is outlined in the Import-Export Tax Law and is updated regularly.

2. Value Added Tax (VAT)

VAT is calculated on the car’s value, including the import duty. The current VAT rate is 10%.

3. Special Consumption Tax (SCT)

SCT applies to certain consumer goods, including cars. It’s calculated based on engine displacement and vehicle type.

Calculating Car Import Taxes

To calculate the cost of importing a car, understand these formulas:

1. Taxable Value:

Taxable Value = CIF Price + Domestic Transportation Costs

2. Import Duty:

Import Duty = Taxable Value x Import Duty Rate

3. VAT:

VAT = (Taxable Value + Import Duty) x 10%

4. SCT:

SCT = Taxable Value x SCT Rate

5. Total Import Cost:

Total Import Cost = Taxable Value + Import Duty + VAT + SCT

Note: Import duty and SCT rates can change based on government policies and time.

Factors Influencing Car Import Taxes

Several factors influence car import taxes:

1. Vehicle Type:

Different vehicle types have varying import duty and SCT rates. For example, trucks generally have lower rates than passenger cars.

2. Engine Displacement:

Larger engine displacements result in higher SCT rates.

3. Country of Origin:

Cars imported from countries with free trade agreements with Vietnam often have lower import duties.

4. Year of Manufacture:

Newer cars generally have higher SCT rates.

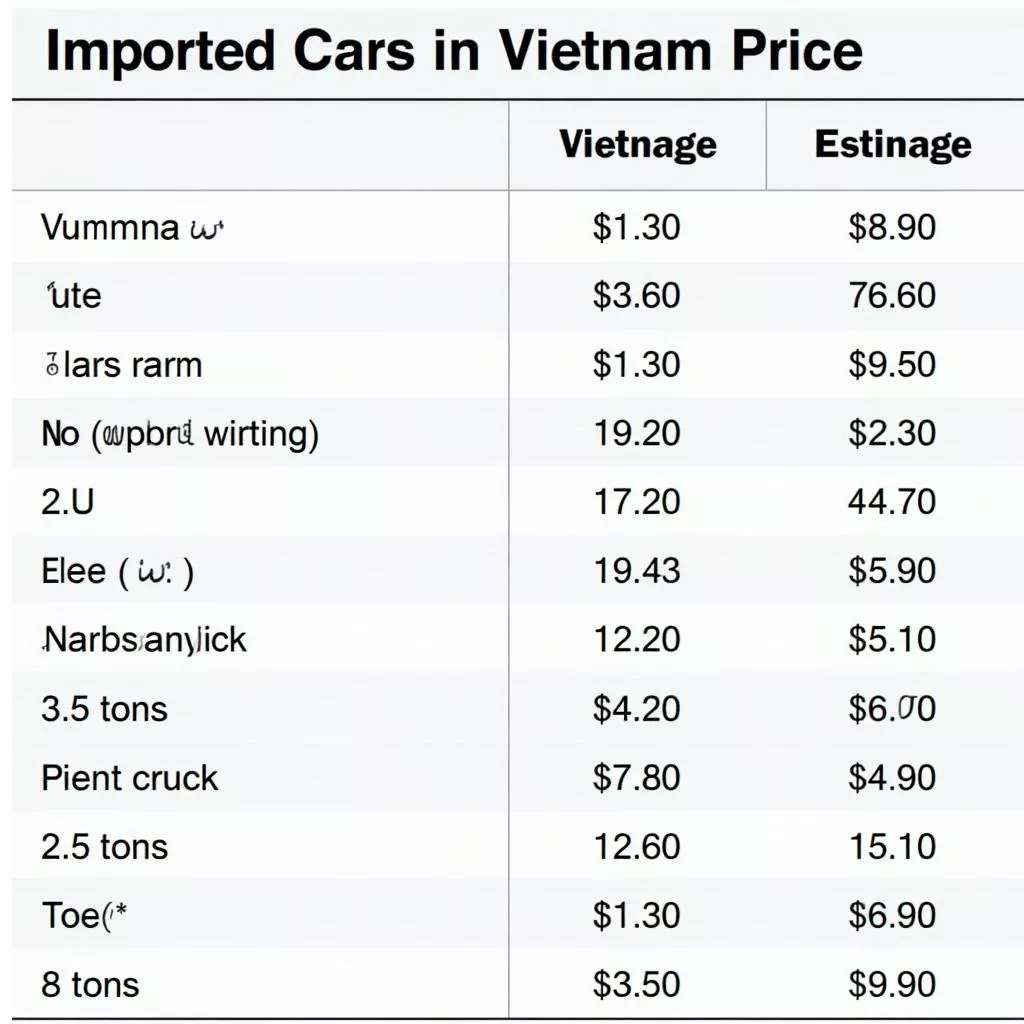

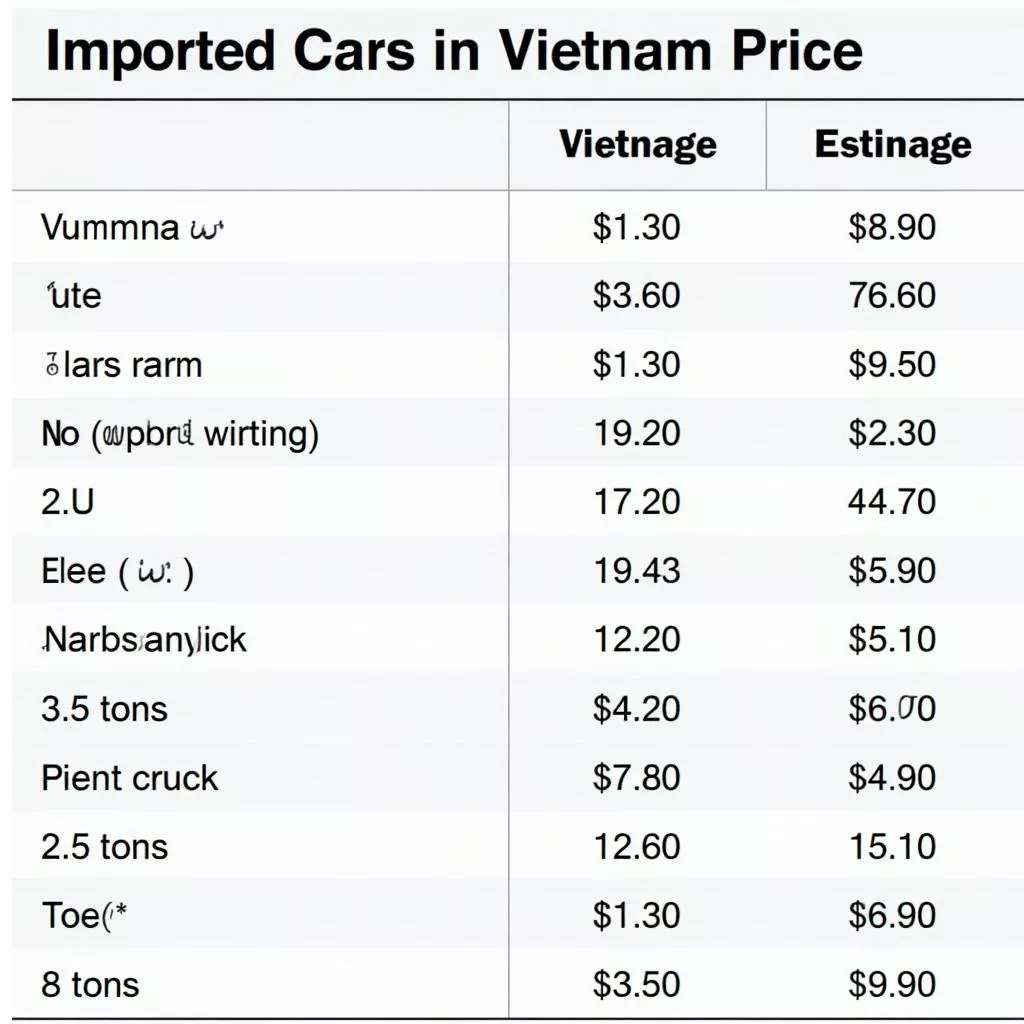

Imported Car Price List

Imported Car Price List

Imported Car Price List

Important Considerations When Importing a Car

1. Import Procedures:

Car import procedures are complex and require extensive documentation. Contact customs authorities for detailed requirements.

2. Additional Costs:

Besides taxes, expect additional costs like shipping, insurance, inspection, and registration fees.

3. Standard Regulations:

Imported cars must meet Vietnam’s technical safety and environmental protection standards.

Reputable Car Importers in Hanoi

For quality and safety, choose reputable car importers in Hanoi. Xe Tải Hà Nội is a trusted provider of high-quality trucks at reasonable prices, offering efficient and professional import procedures.

Conclusion

Understanding car import taxes is essential for making informed purchase decisions aligned with your needs and budget. Thoroughly research tax information before buying to avoid potential risks.

Contact Xe Tải Hà Nội for consultation and support regarding trucks!

Phone: 0968239999 Email: [email protected] Address: No. TT36 – CN9 Road, Tu Liem Industrial Zone, Phuong Canh Ward, Nam Tu Liem District, Hanoi.

Interested in the price of the Audi RS5 in Vietnam? Or finding a reliable car registration service in Hanoi? Visit the Xe Tải Hà Nội website for helpful information on trucks and related services!

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.