Importing a Car to Vietnam: A Guide to Taxes and Fees

Dreaming of owning a luxurious imported car? Before you make your purchase, it’s crucial to understand the taxes and fees involved in importing a vehicle to Vietnam. This comprehensive guide will walk you through the process.

Types of Taxes on Imported Cars

When importing a car, you’ll encounter several key taxes:

- Import Duty: Applies to both Completely Built Units (CBUs) and Completely Knocked Down (CKD) kits.

- Special Consumption Tax (SCT): This tax varies depending on the vehicle’s engine displacement.

- Value Added Tax (VAT): Applied to the vehicle’s value after import duty and SCT are added.

- Registration Fee: This fee varies depending on the locality where the car is registered.

Calculating Import Taxes for Cars

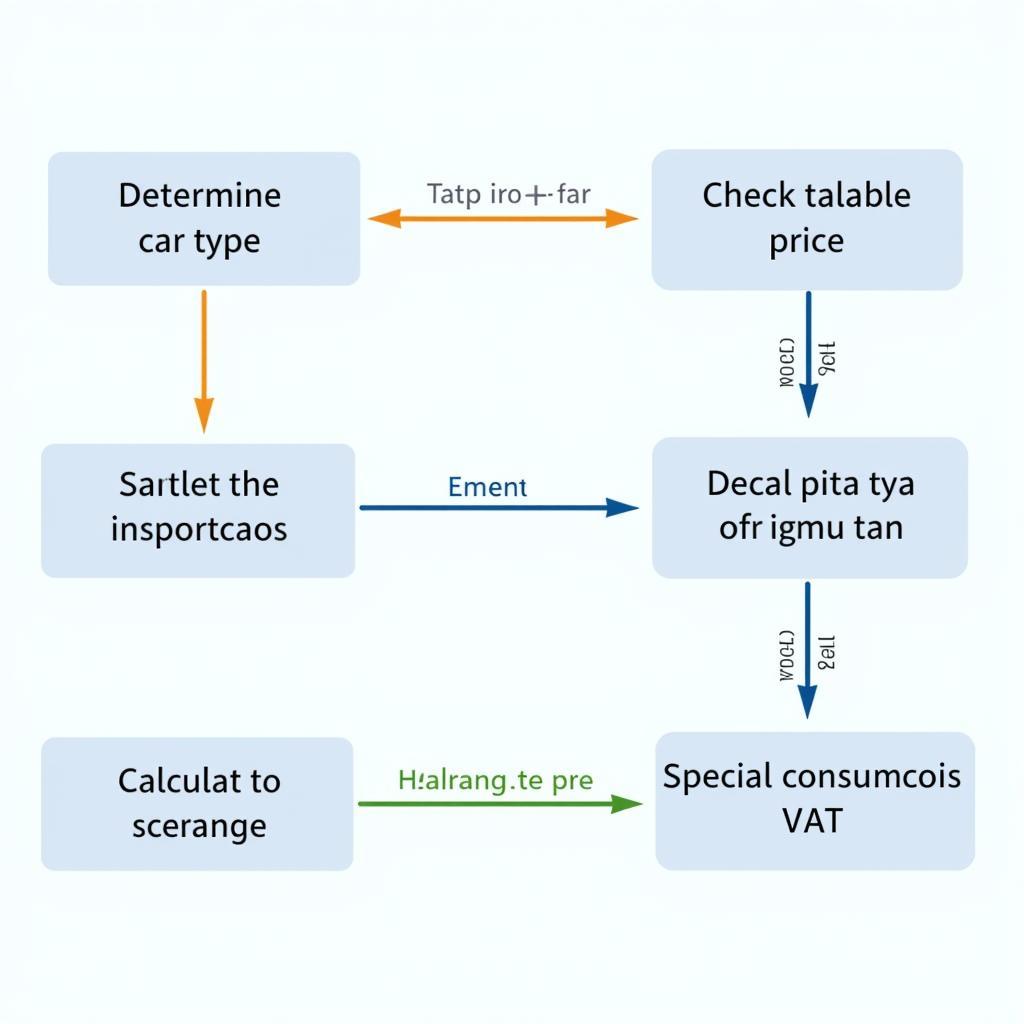

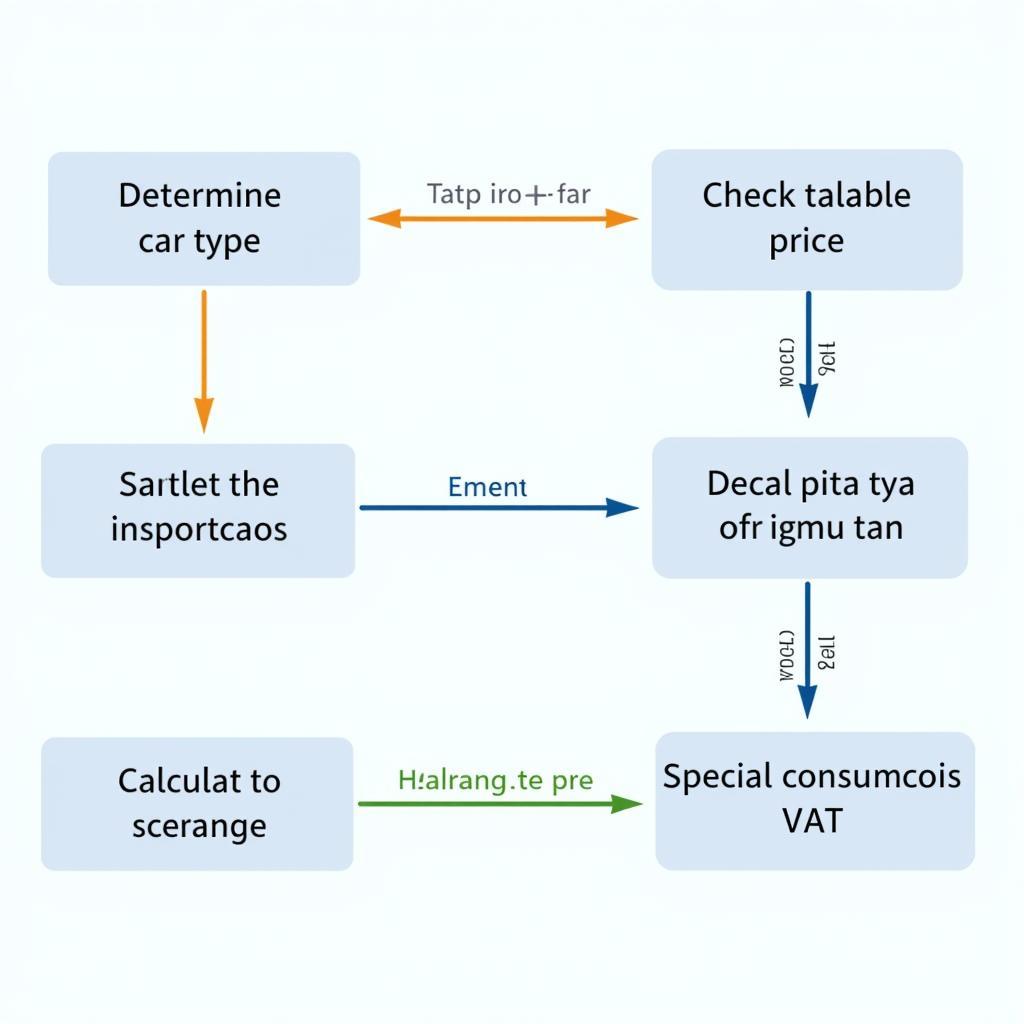

To accurately calculate the total tax amount, follow these steps:

- Determine the vehicle type: Identify the type of vehicle (passenger car, truck, specialized vehicle, etc.) and its country of origin.

- Consult the tax schedule: Refer to the current import duty, SCT, and VAT rates applicable to your vehicle type.

- Calculate the taxable value: This includes the vehicle’s price at the port of entry, shipping costs, insurance, and other related expenses.

- Calculate the import duty: Import Duty = Taxable Value x Import Duty Rate.

- Calculate the SCT: SCT = (Taxable Value + Import Duty) x SCT Rate.

- Calculate the VAT: VAT = (Taxable Value + Import Duty + SCT) x VAT Rate.

Car import tax calculation process

Car import tax calculation process

Important Considerations for Calculating Taxes

- Tax rates can change: Import tax rates are subject to change based on government policies.

- Tax incentives: Certain vehicles may qualify for tax incentives, such as those imported from countries with free trade agreements.

- Consult with experts: For the most accurate and up-to-date information, consult with tax professionals or reputable import agents.

“Understanding import tax regulations is crucial for budgeting and avoiding potential complications.” – Mr. Nguyen Van A, Car Tax Consultant.

Types of taxes on imported cars

Types of taxes on imported cars

Frequently Asked Questions About Car Import Taxes

-

Are import taxes different for electric cars compared to gasoline cars?

- Yes, electric vehicles often benefit from preferential import tax rates compared to gasoline-powered cars.

-

Are there any tax incentives for importing used cars?

- Used cars typically do not qualify for import tax incentives.

-

How do I calculate the registration fee for an imported car?

- The registration fee depends on the locality where you register the vehicle. Contact the local tax authority for specific information.

-

Should I handle the import and tax procedures myself?

- Importing and calculating taxes can be complex. It’s recommended to use the services of a reputable import company to ensure compliance with regulations.

Need Help with Your Car Needs?

We hope this article has clarified the process of calculating import taxes for cars in Vietnam. For more information, explore these related articles:

For inquiries about trucks, light trucks, vans, 1-ton, 2-ton, 3.5-ton, and 8-ton trucks, please contact us:

Phone: 0968239999 Email: [email protected] Address: TT36 – CN9 Road, Tu Liem Industrial Zone, Phuong Canh Ward, Nam Tu Liem District, Hanoi.

We are available to assist you 24/7!

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.