Vietnam Tax Policies and Their Impact on Transportation Companies

The General Department of Taxation’s policies play a crucial role in the operations of transportation companies. Tax policies directly impact costs, profits, and competitiveness, affecting businesses operating various vehicles, from box trucks and vans to 1-ton, 2-ton, 3.5-ton, and 8-ton trucks. Understanding and correctly applying these policies is key to sustainable growth.

Value Added Tax (VAT) Policies for Transportation Companies

VAT policy is one of the most significant tax policies affecting transportation businesses. Companies must understand the current VAT rate, regulations on tax deductions, and procedures for declaration and payment. Incorrect application can lead to unnecessary penalties. Businesses need to stay updated on changes in VAT policies from the General Department of Taxation to ensure compliance. For companies using box trucks, the varying VAT rates for different goods being transported also require attention.

Understanding specific policy mechanisms is also crucial. For light trucks and vans commonly used in urban transportation, a thorough understanding of VAT policies related to small-scale goods transportation is essential.

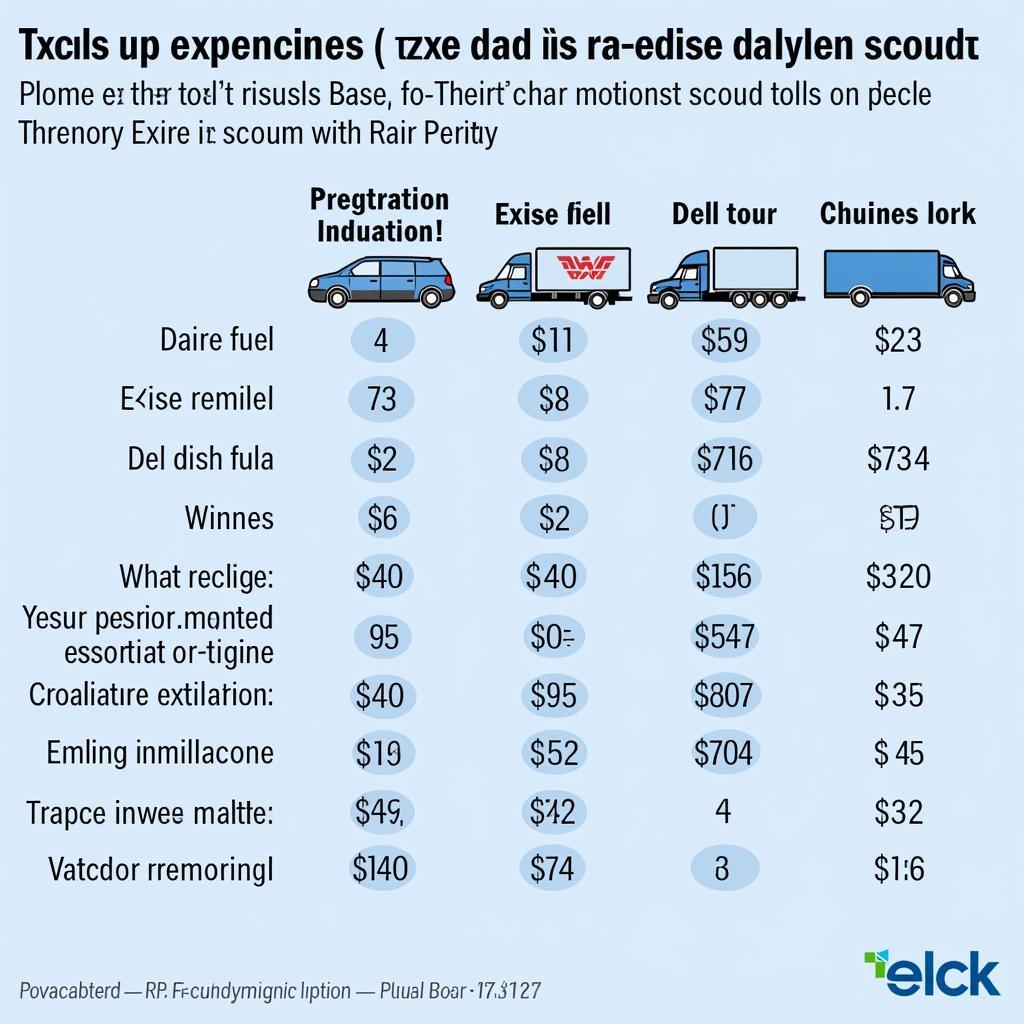

Various types of trucks transporting goods and a chart illustrating VAT rates.

Various types of trucks transporting goods and a chart illustrating VAT rates.

Corporate Income Tax Policies for the Transportation Industry

Corporate income tax significantly impacts the profitability of transportation companies. The General Department of Taxation’s policies clearly define the calculation of corporate income tax, deductible expenses, and applicable tax rates for different business types. For companies operating 1-ton, 2-ton, 3.5-ton, and 8-ton trucks, calculating depreciation costs, fuel costs, and other operating expenses directly affects corporate income tax.

Referring to resources on national economic business finance can provide a broader overview. Companies should thoroughly research corporate income tax incentives for the transportation sector, such as incentives for investing in new vehicles, to optimize tax costs.

Other Tax Policies Relevant to Transportation Companies

Besides VAT and corporate income tax, several other tax policies affect transportation businesses. These include the special consumption tax on fuel, road tolls, and other taxes and fees related to vehicle registration and operation. Land policies in Vietnamese agriculture also indirectly affect the agricultural transportation sector. Understanding these policies helps transportation companies operate efficiently and avoid legal risks.

China’s exchange rate policy can also indirectly impact international transportation businesses. The General Department of Taxation’s policies are constantly updated, and businesses should monitor them regularly.

Chart depicting various taxes and fees related to transportation businesses, including road tolls, special consumption tax on fuel, and vehicle registration fees.

Chart depicting various taxes and fees related to transportation businesses, including road tolls, special consumption tax on fuel, and vehicle registration fees.

Conclusion

The General Department of Taxation’s policies have a significant impact on the business operations of transportation companies. Understanding and correctly applying these policies is crucial for a company’s success.

FAQ

- What is the VAT rate applied to freight transportation?

- How is corporate income tax calculated for transportation companies?

- What tax incentives are available for transportation companies investing in new vehicles?

- What are the procedures for declaring and paying VAT for transportation companies?

- What fees and charges must transportation companies pay?

- How do tax policies affect freight rates?

- How can I stay updated on the latest tax policies from the General Department of Taxation?

Common Questions and Scenarios

Customers frequently inquire about truck registration procedures, applicable taxes, and tax incentives for transportation businesses.

Suggested Related Questions and Articles

See also the article on Quang Ninh policy documents from 2016.

For assistance, please contact us by phone: 0968239999, Email: [email protected] or visit us at: TT36 – CN9 Road, Tu Liem Industrial Zone, Phuong Canh Ward, Nam Tu Liem District, Hanoi. We have a 24/7 customer service team.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.