Monetary Policy in Vietnam: Application and Challenges

Monetary policy in Vietnam plays a crucial role in maintaining macroeconomic stability and promoting economic growth. Its application requires flexibility and timely adjustments to adapt to domestic and international market fluctuations.

The Role of Monetary Policy

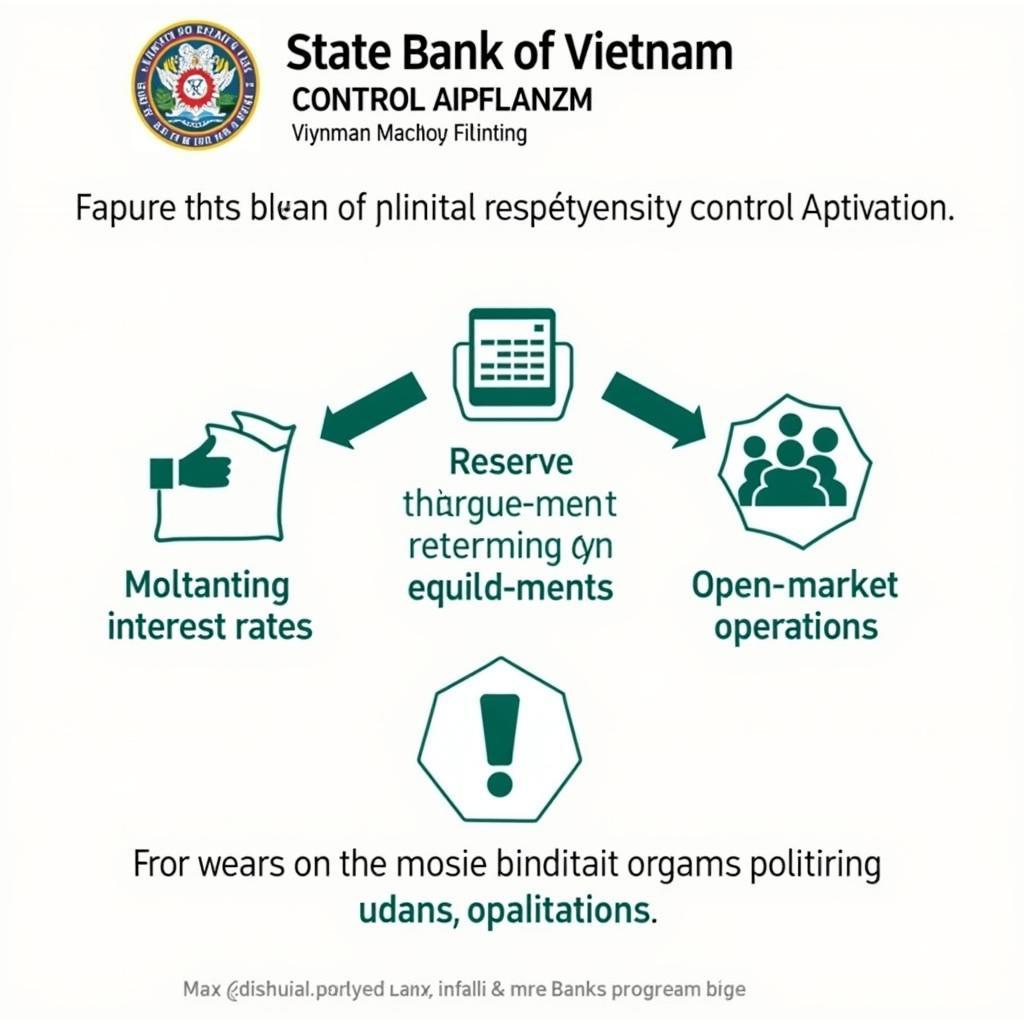

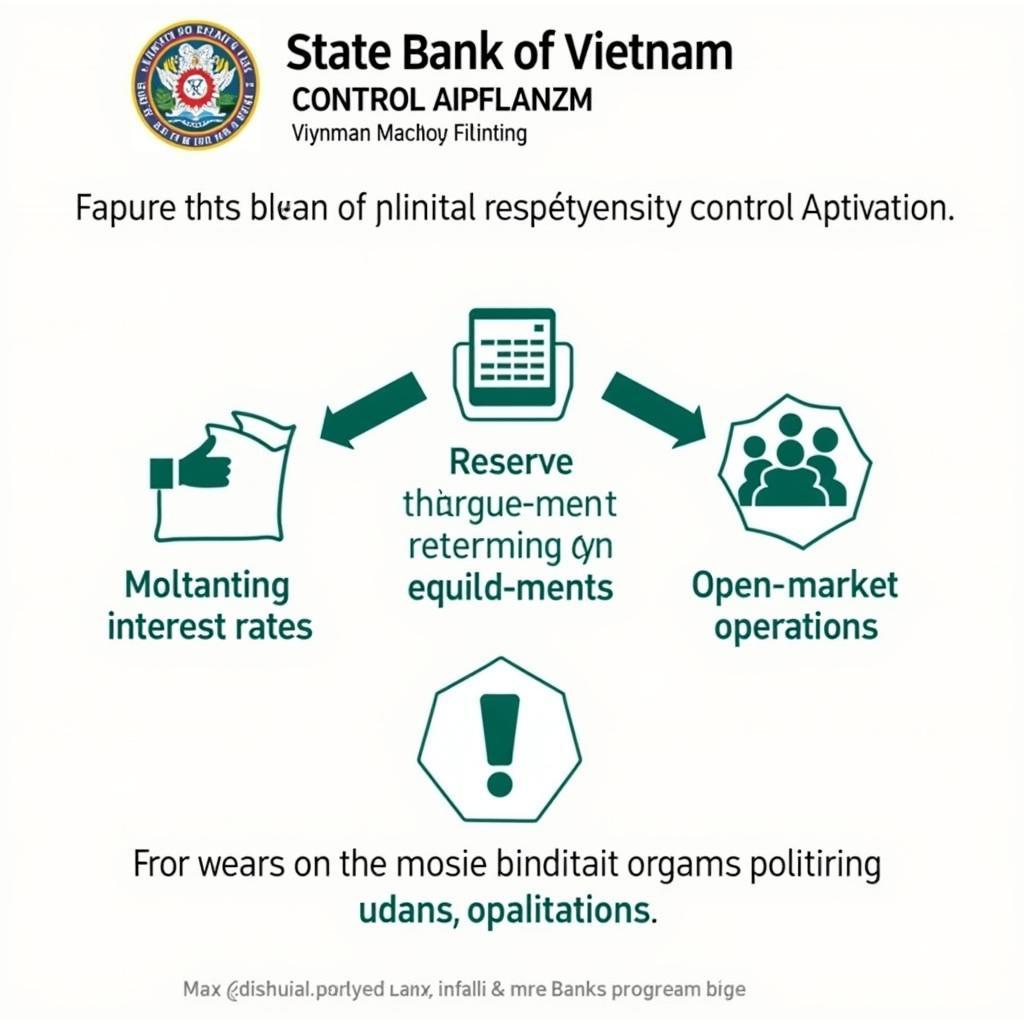

Monetary policy influences the economy by adjusting money supply, interest rates, and exchange rates. The primary objectives of monetary policy in Vietnam are to control inflation, maintain macroeconomic stability, and support sustainable growth. The State Bank of Vietnam (SBV) implements this policy through tools such as adjusting the refinancing rate, reserve requirement ratio, and open market operations.

Inflation control through monetary policy

Inflation control through monetary policy

Tools of Monetary Policy

The SBV utilizes various tools to implement monetary policy. Some key instruments include:

- Interest Rates: Changes in interest rates affect borrowing costs, influencing investment and consumption.

- Reserve Requirement Ratio: This ratio mandates the amount of funds commercial banks must hold at the SBV, impacting their lending capacity.

- Open Market Operations: The SBV buys or sells government bonds to adjust the money supply in the market.

Challenges in Applying Monetary Policy

Applying monetary policy in Vietnam faces several challenges, including:

- Inflationary Pressure: Fluctuations in global and domestic commodity prices can create inflationary pressure.

- Global Economic Conditions: Instability in the global economy can impact exports and foreign investment.

- Non-Performing Loans: Bad debts within the banking system can limit the effectiveness of monetary policy.

Developing public policy, including monetary policy, requires careful consideration and in-depth analysis. You can learn more about the steps of public policy formulation for a deeper understanding of this process. Employee reward policies are also crucial for promoting organizational effectiveness. You can refer to employee reward policies to learn more.

Monetary Policy in the Current Context

In the current context, the application of monetary policy needs to be flexible and adaptable to economic developments. The SBV needs to closely monitor macroeconomic indicators and adjust policies promptly to ensure economic stability and support growth.

Learning about mortgage loans for house construction from policy banks can be beneficial for those interested in real estate investment. If you are interested in publishing, learn more about the main author in a book. Finally, if you are researching public policy, exercises in public policy analysis can provide valuable practical application.

Conclusion

Applying monetary policy in Vietnam is a crucial and complex task, requiring close coordination between the SBV and related agencies. Effective implementation of monetary policy will significantly contribute to macroeconomic stability and sustainable economic growth.

FAQ

- What is monetary policy?

- What are the objectives of monetary policy in Vietnam?

- What tools does the SBV use to implement monetary policy?

- What challenges are posed in applying monetary policy in Vietnam?

- How does monetary policy affect people’s lives?

- How can the effectiveness of monetary policy be evaluated?

- What is the relationship between monetary policy and fiscal policy?

For assistance, please contact us at Phone: 0968239999, Email: [email protected] or visit us at: TT36 – CN9 Road, Tu Liem Industrial Zone, Phuong Canh Ward, Nam Tu Liem District, Hanoi. We have a 24/7 customer service team.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.