Vietnam Bank for Social Policies Secured Loans

Secured loans from the Vietnam Bank for Social Policies (VBSP) offer subsidized financing, helping individuals access vital resources for economic development and improved living standards. This article details what VBSP secured loans are, eligibility requirements, and the application process.

What are VBSP Secured Loans?

VBSP secured loans provide preferential financing to policy beneficiaries, low-income households, near-poor households, newly escaped poverty households, and other eligible groups as defined by the Vietnamese Government. These loans, offered at lower interest rates than commercial loans, are a crucial resource for those in need.

Purpose of VBSP Loans

VBSP secured loans empower individuals with access to subsidized capital for various purposes, including:

- Production and Business Development: Investing in machinery, equipment, raw materials, and business expansion.

- Housing Construction and Repair: Improving living conditions by building new homes or renovating existing ones.

- Consumption: Covering household expenses, education costs, and medical treatment.

Eligibility Requirements for VBSP Secured Loans

To qualify for a VBSP secured loan, applicants must meet the following criteria:

- Target Beneficiary: Be a Vietnamese citizen belonging to a designated policy beneficiary group, such as low-income, near-poor, or newly escaped poverty households.

- Loan Purpose: Align with VBSP’s preferential credit programs.

- Financial Capacity: Demonstrate the ability to repay the loan principal and interest on time.

- Collateral: Possess assets to secure the loan (e.g., land use rights certificate, house ownership certificate).

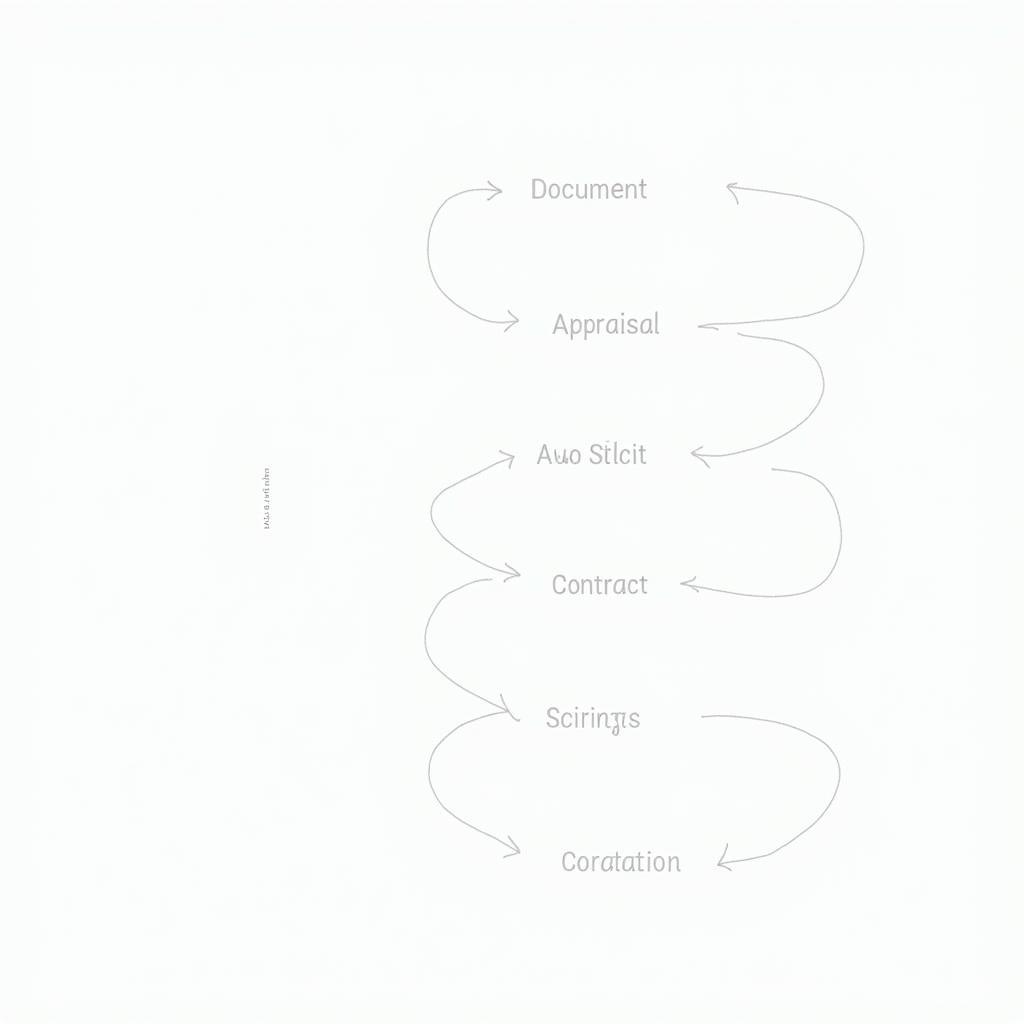

Application Process for VBSP Secured Loans

The application process for a VBSP secured loan involves the following steps:

- Submit Loan Application: Prepare and submit all required documents to the nearest VBSP branch.

- Application Review: VBSP will review the application, assess financial capacity, and appraise the collateral.

- Loan Approval: If the application meets the requirements, VBSP will approve the loan and notify the applicant.

- Loan Agreement Signing: Both parties will sign a loan agreement outlining the terms and conditions.

- Loan Disbursement: Upon completion of the signing process, VBSP will disburse the loan via bank transfer or cash.

VBSP Loan Application Process

VBSP Loan Application Process

VBSP Secured Loan Interest Rates

VBSP secured loan interest rates vary based on the prevailing economic conditions and specific credit programs. Generally, these rates are lower than commercial loan rates, easing the financial burden on borrowers.

Benefits of VBSP Secured Loans

- Preferential Interest Rates: Lower rates compared to commercial loans reduce repayment burdens.

- Simplified Procedures: Quick and convenient application process with less stringent income verification requirements.

- Flexible Loan Terms: Customizable loan durations to suit individual financial capabilities.

- Support for Disadvantaged Individuals: Facilitates access to capital for those in need, improving livelihoods and promoting economic development.

Advantages of VBSP Loans

Advantages of VBSP Loans

Important Considerations for VBSP Secured Loans

- Choose the Right Loan Program: Carefully research available VBSP credit programs to select the one that best suits your needs and circumstances.

- Prepare Accurate Documentation: Ensure all application documents are complete and accurate to avoid processing delays.

- Use Loan Funds for Intended Purpose: Utilize the loan for the stated purpose to avoid misuse and ensure maximum impact.

- Repay on Time: Adhere to the repayment schedule to avoid penalties and maintain a positive credit history.

Frequently Asked Questions about VBSP Secured Loans

1. What is the maximum loan amount I can borrow from VBSP?

The maximum loan amount depends on the chosen program and your financial capacity. Contact VBSP for personalized guidance.

2. What is the maximum loan term?

The maximum loan term varies depending on the chosen program. Generally, it can extend to several years.

3. Can I make early repayments?

Early repayments are allowed. Contact VBSP for details regarding potential prepayment penalties.

Need More Information on VBSP Secured Loans?

VBSP secured loans are an effective financial solution, providing access to subsidized capital for individuals in need. We hope this article has provided valuable insights into this financing option.

For further details on loan programs and application procedures, please visit the Accounting Policy website or contact VBSP directly for personalized assistance.

Contact Information:

Phone: 0968239999

Email: [email protected]

Address: No. TT36 – CN9 Road, Tu Liem Industrial Zone, Phuong Canh Ward, Nam Tu Liem District, Hanoi.

About us

Chúng Tôi luôn muốn trao đến tay khách hàng một sản phẩm tâm đắc nhất, một chiếc XE TẢI tốt nhất mà mọi người luôn muốn sở hữu.